Prashant Singhal Source EY.Com October 1,2020 -Used here only for Educational purposes

EY Emerging Markets Technology, Media & Entertainment and Telecommunications (TMT) Sector Leader

With innovation at the core, Indian telecom tower industry has carved a global niche in infrastructure sharing. By focusing on the right mix of competencies and business opportunities, the tower industry can drive the next infrastructure revolution and realise the vision of ‘broadband for all’.

In the past decade, India has emerged as one of the fastest growing digital economies and the largest consumers of data globally. The telecom tower industry has been a pivotal force in steering the connectivity revolution. Between 2007 and 2020, number of towers have grown over two-fold at a CAGR of 7.1% to reach 606,300.

The latest EY and Tower and Infrastructure Providers Association (TAIPA) joint study – ‘From evolution to revolution: Advancing a decade of innovation in the Indian towerco industry ,' reflects on the evolution of the Indian tower industry over the last decade and highlights the new opportunity landscape and way forward for the industry.

India – a pioneer in passive infrastructure sharing

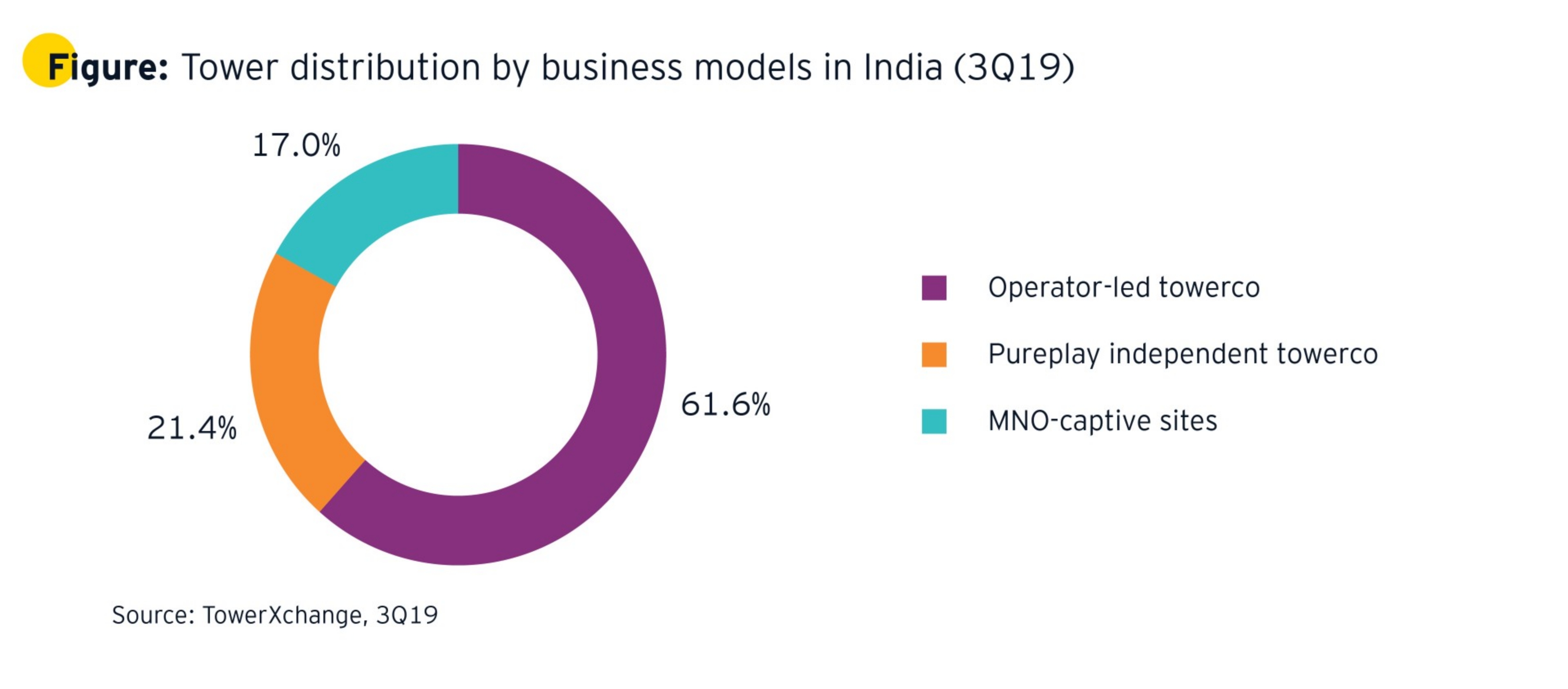

With innovation at the core, India has been one of the pioneers in passive infrastructure sharing, which is now a global hallmark. The “towerco” business model unlocked significant gains – from rapid market expansion and faster time to market, to opex and capex efficiencies, and offloading capex burden from telecom operators. Today, India has 83% of its tower sites owned by towercos, only second to China (100%).

Changing demands in the telecom sector present new opportunities for growth

Today, with data growth and the imminent launch of next gen 5G technology taking center stage, the next decade holds exciting new prospects for towercos. Plenty of new opportunities are arising for tower companies to shift their attention from a macro tower focused business, towards new business models hinged on fiber, small cells, data centers, Wi-Fi, smart cities and beyond.

With strong fundamentals, Indian towercos are well positioned to expand their infrastructure portfolio and tap into adjacencies. Fiber exhibits potential as deployment curve is expected to increase 1.9x and touch 2.8 million cable kilometers in 2023. Small cell deployment is another exciting opportunity, with outdoor small cell deployment slated to reach ~250,000 by 2023.

Advancing the capex to opex model, infracos can venture into data centers and edge computing (micro data centers) play. As the economy grows, low hanging revenue opportunities can come from capitalizing the real estate rights with the infrastructure providers – opening growth avenues in advertisements, electric vehicles infrastructure, security solutions and traffic control among others.

Collectively, these new business avenues present towercos a combined market opportunity size of ~INR215-310 billion in 2023. To tap on these emerging business models to full potential, it would require an investment of ~INR660-930 billion in the five-year timeframe up to 2023.

Shared digital infrastructure provider - a potential future opportunity for towercos

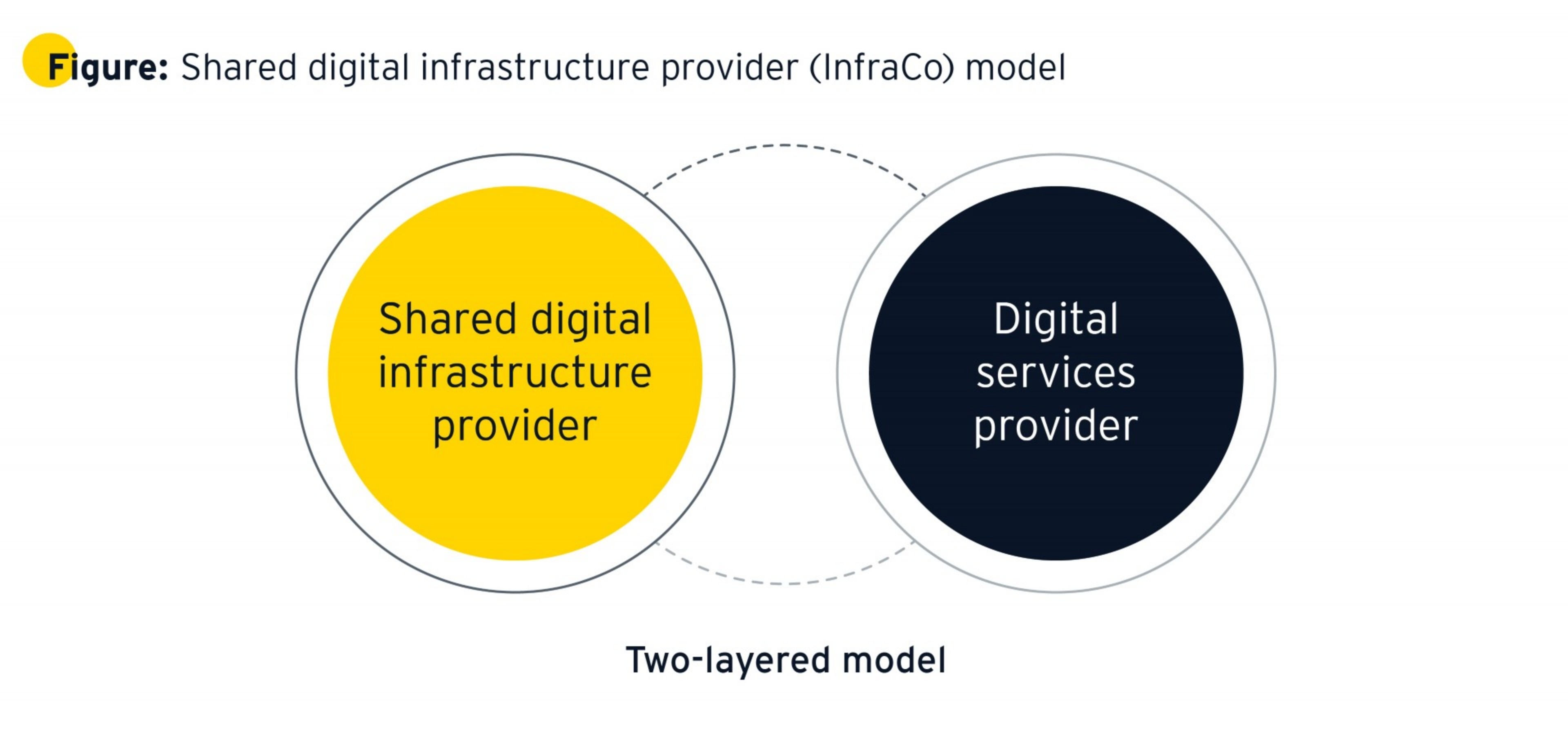

The vision of providing ‘broadband for all’ and fiber connectivity across the country can be realized by enabling the shift from towercos to ‘shared digital infrastructure providers’. This shift would entail a structural separation of an integrated telco operator into two businesses, one that operates the network (a shared infrastructure provider), and a customer-facing entity (telco core business).

With the right mix of accelerators and an enabling regulatory environment, the future of telecom towers looks promising. As these multiple opportunities come to life, they will help in fulfilling the Vision 2030.A carrier neutral shared digital infrastructure provider can grow its wholesale business with multiple operators, since aggregating demand from all customers increases household conversion rates for fiber and, hence, can provide return on investment for new buildouts. By operating independently, financing options for the shared digital infrastructure provider improve considerably. Since it primarily invests in infrastructure, the digital infrastructure provider can attract long-term investors who are interested in buying a physical asset.

There is also a broad consensus that 5G will drive up the total cost of network ownership, given the massively increased densification of urban areas and the resulting heightened requirements for fiber deployment. A strong, independent shared digital infrastructure provider is better positioned to support the industry’s need for fiber rollout and small cell densification.

Incumbents across the globe have already begin to embrace or at least consider structural separation of active network elements to a shared digital infrastructure provider to address deepening financial and market pressures.

Way forward

Ease of doing business remains a prime concern for all infrastructure projects in the country. Delays in getting approvals from municipalities, lack of uniform charges and clearances for RoW, and multi-body approvals are key concerns that needs to be addressed for faster infrastructure rollouts. To expedite the creation of robust telecom infrastructure and to fulfil the agendas of ‘Digital India’, it is pertinent that ease of doing business is treated as a priority.

No comments:

Post a Comment