With effect from 01 May 2024

Chartered Accountant ( 公認会計士) (공인 회계사 )(CONTABILISTAS) (CONTADORES PÚBLICOS) (ДИПЛОМИРОВАННЫЕ БУХГАЛТЕРЫ СЧЕТОВОДИТЕЛИ) (会计师事务所) (COMPTABLES CHARTERES) (WIRTSCHAFTSPRÜFER) (сметководители) (MUHASEBE MÜTEAHHİTLİĞİ) (محاسبون قانونيون) (CHARTERED AKUNTAN)(Geoktrooieerde Rekenmeesters)(registeraccountants)(RAGIONIERI REGISTRATI)חשבונות רואי חשבון) (This blog is non-commercial and is used here to put important news only for the educational purpose of Students doing CA and CS.

Tuesday, April 30, 2024

RHI Magnesita India appoints Azim Syed as CFO & CIRO :-Business Standard April 29,2014

RHI Magnesita India has appointed Azim Syed as its new Chief Financial Officer (CFO) & Chief Investor Relations Officer (CIRO), effective from 01 May 2024.

Azim brings more than two decades of diverse industry experience to his new role at RHI Magnesita India. He was previously part of the global leadership team at RHI Magnesita NV since 2019, where he steered crucial functions in managing Global Supply Chains and Integrated Business Planning while driving key strategic initiatives.

As the Chief Financial Officer & Chief Investor Relations Officer at RHI Magnesita India Ltd, Azim will work closely with the executive team to drive financial performance and enable operational efficiencies for the India, West Asia and Africa region. His appointment emphasizes RHI Magnesita India's commitment to strengthening its leadership team with top talent to drive growth and innovation in the refractories and industrial solutions segment.

HOW HAS IDFC FIRST BANK PERFORMED IN Q4 & BANKING SECTOR OUTLOOK:-THE INDIAN EXPRESS APRIL 29,2024

IDFC FIRST Bank PAT increases by 21% YOY to Rs. 2,957 crore for FY 24 (PAT increased 28% YoY excluding trading gains).

Core Pre-Provisioning Operating Profit (PPOP excluding trading gains) grew by 31% YOY from Rs. 4,607 crore in FY23 to Rs. 6,030 crore for FY24.Net Interest Income (NII) grew 30% YOY from Rs. 12,635 crore in FY23 to Rs. 16,451 crore in FY24.Net Interest Margin increased from 6.05% in FY23 to 6.36% in FY24, based on AUM.Net Profit for Q4 FY24 stood at Rs. 724 crore as compared Rs. 803 crore in Q4 FY23. The PAT for Q4 FY 23 was Rs. 701 crore excluding one-time items already called out in Q4 FY23.Net Interest Income (NII) grew 24% from Rs. 3,597 crore in Q4 FY23 to Rs. 4,469 crore in Q4 FY24.

Gross NPA improved 63 bps from 2.51% as of March 31, 2023 to 1.88% of March 31, 2024, improved by 16 bps on QOQ basis.Net NPA improved 26 bps from 0.86% as of March 31, 2023 to 0.60% of March 31, 2024, and improved by 8 bps on QOQ basis.

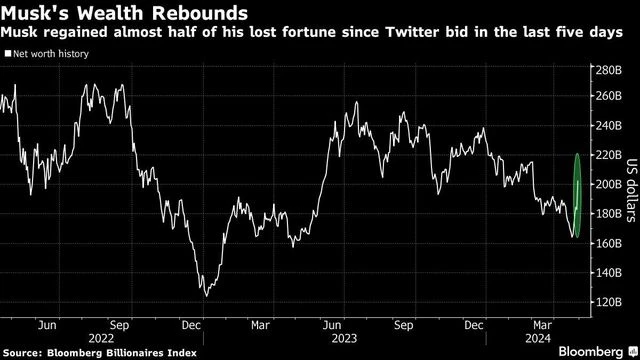

Tesla chief Elon Musk's fortune soars by most since before Twitter purchase :-Business Standard April 29,2024

By Diana Li and Jack Witzig

Elon Musk’s net worth is soaring after it plunged to the lowest level in almost a year.

In the past five days, the world’s third-richest person has gained $37.3 billion in net worth, according to the Bloomberg Billionaires Index. That’s his largest weekly gain since March 2022, just before he agreed to buy Twitter Inc. for $44 billion in one of the biggest leveraged buyout deals in history. Since then, his fortune has tumbled just as often as it has increased after a breathtaking ascent in 2020 and 2021.

Tesla Inc. shares rallied the most in more than three years Monday following reports that it received in-principle approval from Chinese officials to deploy its driver-assistance system in the world’s biggest auto market. That followed news last week that the electric-vehicle maker plans to introduce a less-expensive car as soon as this year, which eased concerns about disappointing earnings.

)

Musk added $18.5 billion to his fortune on Monday alone, the 13th-largest market-driven daily gain for any billionaire on Bloomberg’s wealth index and Musk’s seventh-biggest. With a net worth of $201.5 billion, he’s close to overtaking second-place Jeff Bezos, after he surpassed Mark Zuckerberg last week.

Musk, 52, derives his wealth primarily from his stake in Tesla, as well as his holdings in Space Exploration Technologies Corp. and X, formerly known as Twitter.

Prior to the recent rally, Tesla spent much of the year as the worst-performing stock on the S&P 500 Index amid price cuts and a surprise drop in vehicle deliveries. The value of X, meanwhile, has slumped about 73% since Musk bought it two years ago, according to a March valuation from the Fidelity Blue Chip Growth Fund, which invested alongside him.

One bright spot for Musk’s wealth has been SpaceX, which gained more than 40% in value between mid-2022 and the end of 2023.

The billionaire is also facing pressure domestically. Tesla has asked shareholders to vote again on Musk’s $56 billion compensation package that was voided by a Delware court early this year. If it’s rejected, Musk risks losing stock options that make up nearly a quarter of his net worth, according to Bloomberg’s wealth index.

The US Supreme Court also rejected an appeal Monday from Musk in his “Twitter sitter” case, leaving intact his agreement with the Securities and Exchange Commission to have an in-house lawyer pre-approve his social media posts about Tesla.Follow our WhatsApp chan

India can't become developed nation without making products: Baba Kalyani :-Business standard April 29,2024

Baba Kalyani, Chairman & Managing Director, Bharat Forge

India's defence exports have grown 31 times in the past decade. The private sector accounted for 60 per cent of the record defence exports in 2023-24 (FY24), when they grew 32.5 per cent over a year earlier to Rs 21,083 crore (about $2.63 billion). Against this backdrop, defence major Bharat Forge's chairman & managing director, Baba Kalyani, spoke to Bhaswar Kumar in an interview in Pune, about how India's defence procurement and production policies had evolved over the years and what the new government should focus on in its first 100 days in office to give Make in India in defence a fillip. Edited excerpts:

Large orders for the domestic industry are still missing. Companies are concerned about when they will get the return on their investments. So, what should the new government do in its first 100 days to address these areas of friction?

When Covid-19 hit, things were stuck in limbo. Interactions and meetings, which are a normal part of any business transaction, couldn’t take place between the industry and the armed forces. This led to a problem for the military when it came to procurement. At the same time, the Galwan clash between India and China took place in 2020. The resultant India-China standoff at the northern border was a serious issue at the time. In response, the government and the armed services came up with the process of emergency procurement, where you could only procure what was required for the next 12 months and the items had to be supplied within that period. A cap of Rs 300 crore was set for items being procured under this process, which involved quick decision making. Normally, the decision-making process takes three-four years. Under emergency procurement, this happens in two-three months.

Today, the process has been simplified quite a bit. The Ministry of Defence (MoD) also likes the process for the same reason. Nobody has to make big files for procurement under this simplified process. But, it has also created a different problem altogether — that no long-term or platform orders are given. You can’t make a platform within Rs 300 crore. The armed services were happy because they were getting whatever they wanted in small quantities. For example, we would get an order for 36 Kalyani M4 mine-protected vehicles a year. Making just 36 vehicles a year isn’t feasible.

In its 100-day programme, the new government needs to explore placing platform and long-term orders. Platform orders have to be long-term, like what the Railways has been doing.

The Railways gives a 10-year contract through a bidding process when it orders the Vande Bharat and other trains. That is required in defense too. The government must select its suppliers. Everybody cannot make everything. If Kalyani Strategic Systems Ltd (KSSL) is making artillery guns, there are not more than two-three other firms that can do the same. It is time for the government to choose which are going to be India’s defense manufacturers. It must award long-term orders to companies it thinks will be sustainable players in the sector. For example, you cannot have five submarine manufacturers. You can have only one. Similarly, you can at best have two aircraft makers.

While the reforms of the past five-six years have resulted in greater innovation and indigenisation, I believe industrialisation of these products will mark the next phase of Make in India in defence.

When the government brings in initiatives like the production-linked incentive (PLI) scheme, there's pushback that bureaucrats should not be selecting winners. There’s pushback that the government should not decide which company will be good for what. Is such criticism holding the government back from doing what you suggest?

I don't think the government is deciding which company will do what. It doesn't happen that way. The process starts with a request for information. When the government wants to buy something, it puts it out in the public domain and asks companies that are interested to make that product. Maybe there are 10-12 companies that express an interest in making the product. Then there is a process of technical evaluation and extensive discussions between the industry and the armed services. Half of these companies drop out during this process. They realise it is not their cup of tea or that the investment required is too large. Building just a single artillery gun prototype costs Rs 40-50 crore. How many people will spend that amount and then wait for five years as the prototype is tested across geographies, which also costs money.

There are built-in safeguards in terms of who can do what, and that's how people get shortlisted. At the end of the day, there are always three-four companies that can generate competition in the bidding process, after which the prototypes are built. Then there is the fact that for capital procurements by the MoD, product trials are carried out by the buyer on a no-cost, no-commitment basis. This means that the government neither bears the cost of evaluations nor is committed to buying the product after the trials. The prototypes undergo full testing according to the user’s requirements, which are known upfront. After that, the companies that pass the trials enter the final round and their price bids are opened. Earlier, whichever company was the lowest bidder would get the tender. Now, the lowest bidder (L1) gets 60 per cent of the contract, while the second-lowest bidder (L2) gets 40 per cent if it can match the L1’s price.

What are the positive changes that have taken place in India's defence procurement policy in the past few years and what more needs to be done to carry the momentum forward?

The Narendra Modi government’s first defence procurement policy was announced in 2016. The previous policy had come in 2012 or 2013. But till 2016, the private sector was allowed to play a very limited role in defence manufacturing. It was largely the domain of the State, the defence public sector undertakings (DPSUs), and the ordnance factories — which were a part of the Department of Defence. Then in 2016, a policy paper came out addressing defence procurement. Its fundamental goal was to eliminate the trust deficit that existed between the government and the private sector. That was the big change that happened in 2016.

A number of policy elements were introduced to ensure self-reliance, with the most important one being for products that would be indigenously designed, developed and manufactured (IDDM). These were accorded first priority in terms of procurement. In the following years, a lot of attention was also given to bringing the small and medium enterprises into defence production because ancillary industries were needed to support manufacturing, like in the case of the automobile industry. A different policy was initiated for that in the form of Innovations for Defence Excellence (iDEX) challenges and some other mechanisms that gave priority to the small and medium sector. Support also came in the form of procurement regulations. Any procurement below Rs 200 crore by any government or public-sector agency would have to be procured from an Indian company. Then came the Government-e-Marketplace (GeM) portal, where small and medium enterprises could participate in public procurement through an online system. These small but crucial reforms have gone a long way in realising greater participation of SMEs and MSMEs in the Indian defence sector.

As a result of such accelerated reforms, promulgated in a short period, a lot of red-tape has been eliminated and processes streamlined. Moreover, the Defence Production & Export Promotion Policy (DPEPP) 2020 for the first time articulated targets for domestic production and exports. This is the right thing to do.

If we want to be a developed nation and be counted among the top three or four economies, then we have to be a nation that makes products. We can’t just be a nation that provides services to others. The defence production policy is designed to move the industry towards making products. Along with categorisations like ‘Buy Indian – Indigenously Designed Developed and Manufactured’ (Buy Indian-IDDM) under the Defence Acquisition Procedure 2020, this will create an ecosystem where Indian companies will start designing, developing and manufacturing products, not only for India but also for the world. What has happened in the Indian defence industry in the past seven-eight years is a case study for any other ministry. In that time, we have been able to create a whole ecosystem of industries, both private and public, which have started creating products that are mostly designed in India. While we still have a long way to go, we have certainly made progress.

Some of that reflects in the data as well. For example, India's defence exports touched a record high in FY24, with the private sector accounting for 60 per cent of these exports...

Exports account for 80 per cent of our defence business. We are still waiting for major domestic orders. We have received domestic orders for armoured vehicles and other small products. While we have not received domestic orders for artillery, we have secured a good volume of export orders for our guns. KSSL's revenues last year stood at about Rs 1,200 crore. That figure will see a significant increase this year. KSSL is a subsidiary of Bharat Forge Ltd, set up as a flagship company to drive defence business initiatives.

So, KSSL has received export orders, but not for the Advanced Towed Artillery Gun System (ATAGS)...

Even for the ATAGs.

What will KSSL's next step be?

We have the largest capacity on this planet for making artillery guns. We can make 12 guns per month. The big European manufacturers, which number only four, can make about 20 a year. The ordnance, including the barrel, which is the main part of a gun, uses high-strength steel. The entire manufacturing process is done in-house, including making the steel. The technology involved is also ours. We have installed a capacity to build more than 300 barrels per year.

Our strategy is that artillery, across systems and components, will be the main vertical because India alone requires 4,000 artillery guns to be replaced over the next 15-odd years. We will get our share of that business. Any buyer of an artillery gun will require spare parts for the next 25-30 years, and we have the capacity to supply them worldwide.

Ammunition also has a huge business potential. After the Russia-Ukraine war, every country in Europe, small and big, has started restocking ammunition. They are increasing their war reserves because the earlier concepts of a seven-day or 15-day war are being re-evaluated after the conflict in Ukraine.

Are there any particular geographies you will be focusing on?

We can only focus on those geographies where the government permits us to export. Our immediate focus shall remain on countries in Europe, Southeast Asia, and Africa, but with all of them being non-conflict zones.

Beyond artillery guns, are there any other sectors you will be focusing on?

There is no other gun in the world that has the technology that our gun, the ATAGs, has. It's the world's first completely software-driven gun. When we supplied it to a friendly country in West Asia, they wanted the operations to be in their language. We were able to do that in less than a day. They wanted it connected to their satellite system, which we were able to do in no time. We must also compliment the Defence Research and Development Organisation (DRDO), which has designed the ATAGs.

Beyond artillery, we have the Kalyani M4 in armoured vehicles. When the Indian Army wanted a vehicle in Galwan that could operate at 20,000 feet, the M4 was the only one that could do so.

We also make a vehicle called the TC-20, which we export. It is a 4x4 vehicle on which we mount either a 39 or 45 calibre, 155 mm gun. This is our own design. We are also building a light tank and a Future Infantry Combat Vehicle (FICV). While armoured vehicles will comprise another huge programme for the Indian Army over the next 15 years, we are not only building products that Indians can use, but also building products for world markets.

What are Bharat Forge's future plans beyond defence?

We can't reveal too many details, like numbers, because we have to declare our accounts in a few days. We have engineered this company for growth. We have an industrial products division that is growing very fast. We have a defence division that is also growing extremely fast. We have an electric mobility division, which is still under the product development phase. We have an aerospace division, which is also growing very fast. While it is small right now, it will become a pretty large division of Bharat Forge in the next five-seven years.

Defence aerospace or civil?

Defence and civil both, but largely civil. We supply turbine blades to Rolls-Royce for its engines. We supply the rotating shaft. We supply critical components. We have never been in the commodity space, and the same applies in the aircraft business. For example, we don't supply frames. We supply a titanium blade that goes in the turbine, which runs at 65,000 revolutions per minute (RPM). We supply turbine blades made out of high-temperature alloys like inconel. Metallurgy is our strength. So, we work with metallurgy.

We are making other aircraft engine components, along with landing gears for single-aisle aircraft. We make many other components for a number of companies, all of which are exported.

Coming back to the defence business, what were some of the initial hurdles you had to overcome?

Defence is a natural extension of our business. We developed our first artillery gun, the Bharat 52, in 2012. Everybody wrote it off back then, especially in the MoD, without even looking at it. We could not fire a single shell from it because the government didn't allow the Indian private industry to use any of its ranges back then. In 2017, I got tired of running from pillar to post and we decided to send the gun to the United States (US). I had some friends there, retired military people, who applied to the US Department of Defense. I got an answer in less than 45 days permitting us to test and fire our guns.

They sent us a video and the whole report of the test. It just so happened that there was an Army Conference in Delhi, where I told everybody this entire story and showed the video. Within a month, the then defence minister changed the rule and opened up the firing ranges to the private industry.

I've read this somewhere and wish to confirm. Is it true that when you entered the defence business, you said you would not wait for orders?

Yes, I said so. If you know what you are doing and if you are good at it, risk also generates rewards. Even in our normal automotive and industrial businesses, we have always put capacity ahead of demand.

In top gear: Telecom parts output crosses Rs 45,000-crore milestone Read more at: https://economictimes.indiatimes.com/industry

Telecom equipment manufacturing and exports is emerging as a new success story after smartphone exports. Telecom equipment production for FY24 crossed the ₹45,000 crore milestone with exports of around ₹10,500 crore, backed by the Centre's production linked incentive (PLI) scheme. The scheme has also led to creation of over 19,500 direct jobs, according to government data shared exclusively with ET.

"Telecom equipment manufacturing was a dream for our country and the Make-in-India and PLI programme have really succeeded," telecom minister Ashwini Vaishnaw told ET.

He said India has been a telecom gear importer for decades which changed after the Make-in-India initiative and PLI scheme, driving production of equipment worth more than ₹45,000 crore in the country.Telecom equipment comprises complex products such as radios, routers, network equipment, among others. Further, the government has allowed companies to claim benefits for making 5G fixed wireless access (FWA) equipment. Leading telcos Reliance Jio and Bharti Airtel are betting big on FWA to monetise 5G and all products are made locally.

As per government data, of the total ₹45,988.54 crore worth of sales till February, global firms contributed ₹36,537.68 crore with domestic firms accounting for ₹6,768.74 crore and MSMEs at ₹2,682.12 crore. In terms of employment, domestic companies created 14,525 jobs, followed by MSMEs (2,984 jobs) and global firms at 2041 jobs.

India-made telecom equipment is currently being exported to North America and Europe with top telecom companies globally as customers. "Lots of our Indian manufacturers are getting design inputs into the products. Products are designed in India, made in India and then exported, and the quality of products is good," the minister said.

Department of Telecommunications (DoT) had notified the PLI scheme for telecom and networking products in February 2021 with an outlay of ₹12,195 crore over five years. A total of 31 companies got approval on October 14, 2021, for the scheme, which offers incentives of 4% to 7% for different categories and years. For MSMEs, a 1% higher incentive is proposed in year 1, year 2 and year 3.

The scheme was amended in April 2022 to facilitate design-led manufacturing with an additional incentive rate of 1%, setting aside ₹4,000 crore from the total allocation. The scheme was also extended by a year as most selected firms failed to achieve production targets due to Covid-related supply chain disruptions.

A total of 42 firms, including 28 MSMEs were selected under the revised scheme. These companies had committed to invest a total ₹4,115 crore and were expected to generate additional sales of Rs 2.45 lakh crore and create additional employment of more than 44,000 over the scheme period.

Monday, April 29, 2024

Hamas delegation heads to Egypt for Gaza truce talks, Israel agrees to pause Rafah offensive until... livemint 28 Apr 2024, 11:08 PM IST

Efforts to broker an Israel-Hamas ceasefire deal continued this week against the looming threat of a Rafah offensive. A Hamas delegation will arrive in Egypt on Monday to deliver its response to a new hostage and truce counter-proposal from Tel Aviv. Meanwhile the White House insisted that Israel had agreed to listen to US concerns before making any move towards Rafah. US Secretary of State Antony Blinken also departed for Saudi Arabia on Sunday — seen by many as ‘one last chance’ for negotiations.

More than a million Palestinians had fled to the border city of Rafah as Israeli bombardment reduced much of north and central Gaza to rubble. Tel Aviv is now planning to after Hamas battalions in the southern Gaza city — a prospect that has sparked global alarm.

The Rafah border crossing is the sole entry and exit point to Gaza not directly under the control of Israeli forces. According to the Palestinian ambassador to Cairo, 80,000 to 100,000 people have crossed into Egypt since the Gaza war broke out in October last year.

Here are the latest developments:

- A Hamas delegation is set to visit Cairo on Monday for talks aimed at securing a ceasefire.

- The Israeli military has continued to make preparations for an offensive in Rafah. However Foreign Minister Israel Katz told Channel 12 on Saturday that his country would suspend the operation “if there is a deal".

- Hamas had previously insisted on a permanent ceasefire — a condition that Israel has rejected. An Axios report citing senior Israeli officials however indicate that the latest proposal includes a willingness to discuss the "restoration of sustainable calm" in Gaza after hostages are released.

- The White House said that Israel has agreed to listen to US concerns before launching an invasion of Rafah. Officials indicated that a ceasefire deal at this time would pause fighting for six weeks.“Well, look, I think, again, we have to have a better understanding from the Israelis about what they want to do. As a matter of fact, we've had several staff talks with them. We intend to do that more. They've assured us they won't go into Rafah until we've had a chance to really share our perspectives and concerns with them. So we'll see where that goes," White House national security spokesperson John Kirby told ABC news.

- US Secretary of State Antony Blinken headed to Saudi Arabia for meetings with regional counterparts. Media reports indicate that the top official will make yet another trip to Israel on Tuesday.

- Palestinian president Mahmud Abbas has urged the United States to help prevent “the biggest disaster in the history of the Palestinian people"."We appeal to the United States of America to ask Israel to stop the Rafah operation because America is the only country capable of preventing Israel from committing this crime," Abbas said at a global economic summit in the Saudi capital.

(With inputs from agencies)

Drugs Worth Rs 600 Cr Seized From Pakistani Boat Off Gujarat Coast, 14 Arrested: Coast Guard :-ABP News

New Delhi: The Indian Coast Guard (ICG) has intercepted a Pakistani boat off the Gujarat coast, seizing 86 kg of drugs valued at approximately Rs 600 crore. In an overnight operation conducted in the Arabian Sea, the ICG collaborated with the Gujarat Anti-terrorism Squad (ATS) and the Narcotics Control Bureau (NCB) to apprehend 14 individuals aboard the vessel, the maritime security agency said on Sunday. This marks the 11th successful joint operation conducted over the past three years.

A senior Gujarat police official confirmed that heroin was seized from the intercepted boat. "In a daring overnight operation, the Indian Coast Guard conducted an intelligence-driven anti-narcotics mission at sea on April 28th. Approximately 86 kg of narcotics, valued at Rs 600 crore, was apprehended along with 14 crew members from the Pakistani boat," stated the agency in a release.

— Indian Coast Guard (@IndiaCoastGuard) April 28, 2024

Coast Guard vessels and aircraft were deployed for the operation, with ICG ship Rajratan utilised to locate the suspect boat in collaboration with NCB and ATS officials, as reported by news agency PTI.

“No amount of evasive manoeuvring tactics employed by the drug-laden boat could save it from the swift and strong ICG ship Rajratan. The ship’s specialist team embarked on the suspect boat and, after thorough checks, confirmed the presence of a sizable amount of narcotics,” the Coast Guard said.

Pakistani Boat, Along With 14-Member Crew, Sent To Porbandar

The Pakistani boat, along with its 14-member crew, was apprehended and sent to Porbandar for further investigations, according to the statement. "The collaboration between the Indian Coast Guard and ATS, resulting in eleven successful law enforcement operations over the past three years, underscores the synergy in achieving national objectives," the release added.

Gujarat Director General of Police Vikas Sahay disclosed that a total of 78 packets weighing 86 kg were recovered from the Pakistani fishing boat. Preliminary investigations indicate that the packets contained heroin, a potent recreational opioid.

“Indian Coast Guard and ATS officials approached the Pakistani fishing boat and confronted it with bravery. An ICG official had to shoot, after which the crew members of the boat surrendered and the officials detained them", Sahay told media persons. He said the head of the crew was injured in his right hand in the firing and was undergoing treatment.

Following the seizure of the boat, a second ATS team was dispatched to the location, as stated by Vikas Sahay. "All the crew members originate from Balochistan, Pakistan," he confirmed. Sahay also recalled a previous incident in which the Coast Guard, NCB, and ATS jointly apprehended a boat transporting methamphetamine, a potent psycho-stimulant drug valued at over Rs 400 crore, along with its six Pakistani crew members off the Porbandar coast in Gujarat last month, as per PTI.

In February, officials reported that the Indian Navy and the NCB intercepted a dhow off the Gujarat coast, containing five crew members, and confiscated a staggering 3,300 kg of drugs, marking one of the largest drug seizures in recent history. The seized narcotics comprised 3,089 kilograms of charas, a highly potent form of cannabis resin. Officials estimated the value of charas to be nearly Rs 7 crore per kilogram in international markets, underscoring the magnitude of the interception.

ICAI lens on big four affiliates over their association with global entities :-ET

MUMBAI: The Big Four affiliate firms doing audits are poised for a drawn-out legal clash with The Institute of Chartered Accountants of India (ICAI), centering on association with global entities, resource sharing and control, and referral fees, prompted by the institute's disciplinary committee directive to EY affiliates to cease existing arrangements with multinational entities (EY Global), citing violation of the Chartered Accountants Act 1949.

The committee also ordered the removal of two of the affiliate firms' partners (now both retired) for three years and imposed a fine of ₹5,00,000 on each, requiring a compliance report within 90 days. The EY affiliates in question were SV Ghatalia & Associates, SR Batliboi & Associates LLP, SRBC & Co. LLP, and SR Batliboi & Co. LLP.

On Thursday evening, the institute uploaded the order to its website, causing a stir in the audit fraternity.

Sensing a similar negative order, concerned partners of PwC affiliates had obtained a stay order from Telengana and Punjab & Haryana High Court against ICAI's disciplinary action a couple of weeks back. Similarly, BSR & Co. (a KPMG affiliate) partners under investigation also secured a stay order from a Punjab and Haryana High Court last week. Last year, Deloitte partners had already obtained a stay order from the Delhi High last week. Last year, Deloitte partners had already obtained a stay order from the Delhi High Court against the disciplinary proceedings of the hearing.

The EY affiliate firm, SRBC & Co LLP spokesperson told ET that they will explore all issues raised in the order and explore options under the law including the appeal process. However, the problem is that the appellate tribunal, which is supposed to hear appeals, has not yet been set up by the institute. "The order focused only on procedural matters, not audit quality, and will not affect the future of the audit firms in any way" said a leading lawyer who works closely with Big Four firms on regulatory matters. Deloitte, KPMG, and PwC did not respond to the ET questionnaire on the matter.Though the EY matter is old, the latest clash between ICAI versus multinational networks started in 2016-17 when the institute had sent requests for information/clarification and, in 2018 followed it with a Prima Facie Opinion (PFO) to 171 network firms operating in India asking them to submit documents and statements.

Thereafter, the matter was referred to the disciplinary committee of the institute for further investigation.Several firms had networking arrangements with international networks for several decades and ICAI had issued guidelines for network firms multiple times, most recently in 2011. That set of guidelines was subsequently repealed and, in 2022, the institute issued guidelines for domestic networks but has yet to establish guidelines for international firms.

Experts point out that the issue of whether multinational firms are circumventing the provisions of the Chartered Accountants Act 1949 is an old one which keeps resurfacing and evolving.

In 2009, a high-powered committee of ICAI issued a report against Big four firms and international network firms. In 2016, the MCA convened an expert group chaired by Ashok Chawla to address concerns of domestic audit firms on 'restrictive shareholder covenants'. Their findings classified affiliated firms as Multinational Network Accounting Firms (MNAFs), distinguishing them from MAFs due to Indian nationals' control and management, despite global network affiliation.

Saturday, April 27, 2024

How the success of the INR18,000 crore Vi FPO changes Indian telecom forever:-ET

Vodafone Idea’s successful INR18,000 crore follow-on public offer (FPO) is likely to hasten the follow-up INR25,000 crore debt issue and make its targeted INR45,000 crore a quick reality.

Such a scenario could provide the cash-strapped telco the much-needed financial ammo to ramp up 4G operations, roll out 5G in priority markets and improve overall market competitiveness vs its bigger and more profitable rivals, Bharti Airtel and Reliance Jio, say analysts and industry executives.

More importantly, a stronger and revitalised Vi would diminish the possibility of India becoming a duopolistic telecoms market and help retain its 3-private-players structure.

“The successful FPO by Vi is set to change the telecom sector dynamics for good. With the FPO and proposed debt-raise thereafter, Vi is looking to improve its network quality, which should, in turn, enable it to take tariff hikes, (post-elections). Bharti and Jio are expected to happily corroborate the same, thereby leading to a jump in average revenue per user (ARPU), profitability, cash flows and returns profiles of these operators,” says Nuvama Institutional Equities in a research note.

Analysts, in fact, believe that if Vi can move fast and deploy funds in its network, especially where it lags on 4G population coverage, its revenue streams could look up, setting the stage for a genuine financial turnaround.

Analysts also caution that the current fundraise may not be sufficient as Vi’s big problem - even after its FPO and likely tariff hikes - is a stretched balance sheet, laden with massive liabilities of INR2.5 lakh-crore (of which, INR2.1 lakh-crore are spectrum and AGR liabilities). Matters could easily come to a head after the second half of FY26, when the moratorium ends on spectrum and AGR payments.

“Vi’s cash flows, even on higher tariffs, will be inadequate to meet these obligations, once the payment moratorium ends in September 2025, which is why, it needs some sort of waiver on these liabilities,” says Nuvama.

Since the merger of Vodafone and Idea in 2018, the company has lost 19% of its market share due to its inadequate network spending. Analysts also reckon that Vi’s fortunes hinge on the government's decision to convert more dues into equity going forward.

Ambit Capital, though, is a tad more optimistic. “If Vi uses the funds and improves its competitiveness, and its share price and cash flow generation increase, it can then decide on whether to pay spectrum/AGR dues or give the government an option to convert unpaid dues into equity at the then prevalent share prices,” says the brokerage in a note.

The government currently holds around 32% stake in Vi, which will drop to under 24%, post the FPO.

At present, Vi has earmarked over 70% of targeted INR45,000 crore fundraise proceeds for capex. Of the INR18,000 crore raised via FPO, over INR12,000 crore has been set aside for 4G expansion and 5G rollouts. Of this, INR5,720 crore will go towards 5G rollouts with 4G expansion being a priority for the telco.

The State Bank of India (SBI), Vi’s biggest lender, though, seems gung-ho on the telco’s survival prospects and second coming. On Thursday, SBI chairman Dinesh Kumar Khara said the success of Vi’s FPO puts the telco in “a different trajectory” as it underlines a leap of trust of the larger investor community stemming from Aditya Birla Group (ABG) chairman Kumar Mangalam Birla assuming chairmanship of the telco.

To instill investor confidence, an ABG entity recently infused INR2,075 crore via a preferential share issue as part of the just-concluded equity fundraise.

For a company that is clawing its way back, every bit helps

Friday, April 26, 2024

UK couple order meals worth ₹1 lakh from 5 restaurants, leave child to ‘pay’ the bill; arrested livemint 26 Apr 2024, 07:49 AM IST

A UK couple was arrested by police after they were accused of several ‘dine and dashes’ at restaurants after they ordered free meals worth $1,200 (nearly ₹1 lakh). Despite multiple complaints by restaurant owners, they managed to escape because initially the the police didn't view the scheme as an emergency, reported the New York Post.

Thirty-nine-year-oldher Ann with partner McDonagh used to follow a similar pattern for eating free meals at different restaurants in Great Britain's Wales. After multiple complaints from nearly five eateries within 30 miles of radius, the South Wales Police arrested the duo on charges of fraud and theft.

The couple used to leave their child behind without paying the bill

Several videos of the ravenous diners have gone viral on social media. In most of the cases, the duo was accompanied by other people claimed as their family members. According to a few family restaurants, the two used to follow the same procedure with premeditation and continued to rob multiple restaurants.

According to the New York Post report, the two used to visit targeted restaurants with four more people. Later, they would start ordering their large meals which may cost nearly $ 400. Later, other people accompanying Ann and McDonagh, exit the restaurant. After ordering and eating their meals, they pretend to pay the bill with a card.

After multiple declined requests, the two quickly exited the place saying that they would get another card from the car. The couple used to leave the restaurant in the name of ‘getting another card for payment’ while leaving their kid to ‘stay and wait for them in the restaurant’.

10 seconds after leaving the restaurant, the boy began to run to the car, reported the NY post referring to a restaurant owner. Despite multiple police complaints, the police didn't take action as it wasn’t an emergency and all they could do was report the incident.

Adani Group's Vizhinjam Port gets ministry nod to run India's first transshipment operations :-ET

Synopsis

Adani Group's Vizhinjam Port in Kerala has received approval to operate as India's first transshipment port, facilitating the transfer of cargo between ships. The shipping ministry's nod allows customs to establish an office at the port. The project, started in 2015, aims to tap into India's transshipment cargo, which is currently handled by foreign ports like Colombo. Vizhinjam Port's advanced infrastructure can handle large vessels, with an initial capacity of one million twenty-foot equivalent units (TEUs), set to expand in subsequent phases.

The Adani Group's Vizhinjam Port has received the shipping ministry's approval for operating as India's first transshipment port. The recommendation for declaring it a customs-notified port was made earlier this week, according to people aware of the details.

Current regulations require the shipping ministry's nod to prevent competing projects from being permitted before capacity at operational ports is saturated. "This approval paves the way for customs to set up an office at Vizhinjam port. It will be India's first full-fledged deepwater transshipment port. A final nod from the Central Board of Indirect Taxes and Customs (CBIC) is expected in the coming three months," a senior government official told ET on condition of anonymity.

Current regulations require the shipping ministry's nod to prevent competing projects from being permitted before capacity at operational ports is saturated. "This approval paves the way for customs to set up an office at Vizhinjam port. It will be India's first full-fledged deepwater transshipment port. A final nod from the Central Board of Indirect Taxes and Customs (CBIC) is expected in the coming three months," a senior government official told ET on condition of anonymity.

Subscribe to:

Posts (Atom)