(Mahendra Nahata Founder and Managing Director of HFCL)

On October 1, at a packed India Mobile Congress, a digital technology event in New Delhi, Mahendra Nahata, the founder and managing director of HFCL, a telecom enterprise and communications products provider, was seen exhibiting the new Wi-Fi 7 Access Points, built in collaboration with Qualcomm. This product will support peak data rates of over 10 gigabits per second (Gbps)—almost double the speed of current such products—and latency under 2 millisecond (low latency means minimum data transfer delay), compared to 5 Gbps and 10 ms of current Wi-Fi 6 products.

Reliance Industries’ Chairman and Managing Director Mukesh Ambani, whose subsidiary Jio Platforms is India’s largest telecom operator, launched the Wi-Fi 7 AP and an 8T8R radio unit while watching its features. Jio is an important customer of HFCL’s, forming around a fifth of its order book. HFCL has laid the 4G fiber-to-the-home (FTTH) network and also mobile services for Jio in North India.

Unlike previous Mobile Congress events, this year the talk of 5G technology had turned to reality from being a promise or need. In October, India’s 5G technology network was officially launched by Prime Minister Narendra Modi, with two of the largest telecom companies Jio and Bharti Airtel deploying their 5G network in phases.

In this scenario, a Wi-Fi 7 access point compliments the 5G rollout in India, offering extreme speeds and high capacity. It will improve connectivity and speed in high density places like airports, railway stations, shopping malls and factories.

Nahata started HFCL in 1987, once manufacturing transmission equipment in collaboration with Southeast Asian companies. But in the years and decades to follow, when India started to grow and expand its telecom networks, the optical fiber cables (OFC) business became its engine for growth. Since 2015, HFCL has shifted its focus towards exporting telecom equipment and optical fiber cables to over 30 countries at present, from 16 in FY15. Exports form 18 percent share of revenues, HFCL’s June-ended data shows.

On the 5G Pulse

HFCL’s business did mirror the development of India’s telecom expansion in early years, including manufacture of digital microwave radio transmission equipments, radio pagers and satellite video receivers. But as India started to build out its digital transformation journey, its need for OFC increased, being the backbone of digital infrastructure. An OFC network provides the fastest transfer speed and large bandwidth to both corporate businesses and homes.

According to 2021 Feedback Advisory data, the Indian OFC industry was valued at $530 million in FY20 and is expected to grow to reach $700 million in FY24.

Now consider that as of March, India’s total tower fiberisation is at just 33 percent, leaving plenty of room for growth, if it is to achieve 70 percent of tower fiberisation by 2025. And Nahata knew that HFCL has to play a role in that. HFCL has continued to build and expand its manufacturing facilities in Goa, Chennai and Hyderabad. A new facility is being set up to manufacture defence electronic products.

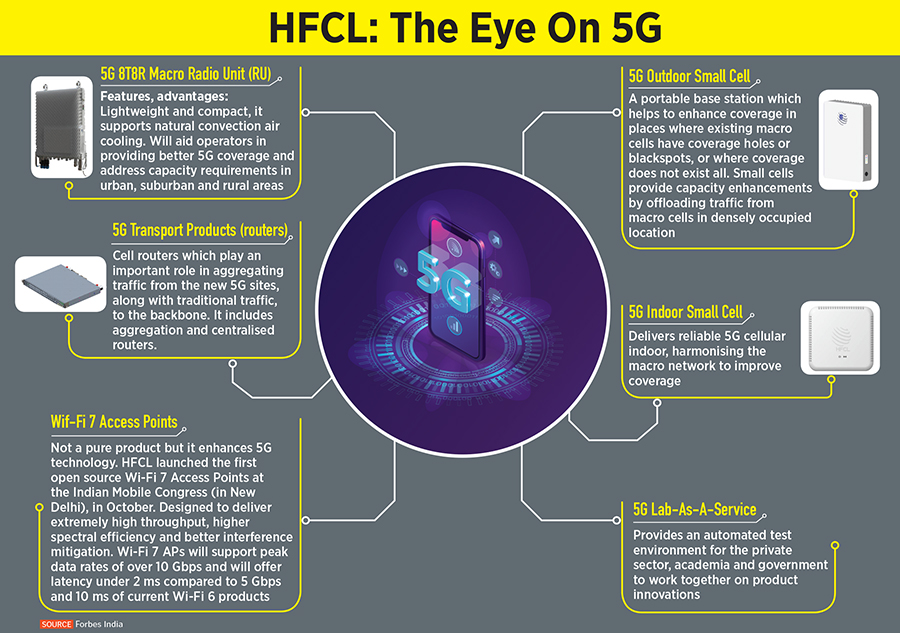

It is the same business acumen which has worked for Nahata and the company to concentrate on manufacturing and sale of 5G-centric products. “We are designing our own equipment and have IPRs for the same,” Nahata tells Forbes India on call. HFCL is designing an entire range of 5G related telecom equipment, including wireless access network 8T8R macro radio unit (see chart). Another product is a 120 Gbps cell site router which helps aggregate traffic from the new 5G sites to the backbone (a high speed line forming the fastest path through the network). The company is also working to develop global system integration services for 5G private networks and integration services.

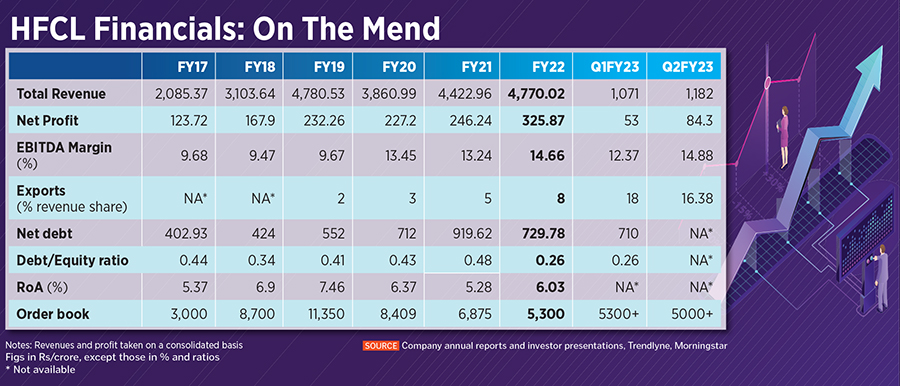

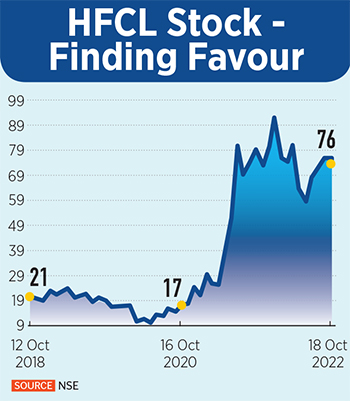

HFCL expects a 15-20 percent year-on-year (y-o-y) revenue growth that will be mainly driven by the growing OFC demand and production of 5G-led equipment. HFCL reported a 10.3 percent jump in total revenues to Rs1,182 crore in the September-ended quarter and net profit rose near 60 percent to Rs84.3 crore, in the earnings announced on October 18. The HFCL stock rose 1.7 percent to an intra-day high of Rs76.8 at the NSE after the earnings data.

Speaking about the Wi-Fi 7 AP, Nahata says: “This device helps achieve an even higher throughput. A Wi-Fi 5 AP could give a throughput of 4 to 5 GB.” This would be useful in areas which have large crowds and help telecom operators deliver better user experience at airports, railway stations or factories. A scaled down version of this product can also be used anywhere, he adds.

Export Thrust, Challenging Sterlite

Nahata claims HCFL to have the highest market share—near 50 percent—in the domestic OFC market, with rival Sterlite Technologies estimated to command the balance. Sterlite predominantly exports its OFCs, with Europe and North America as its focus markets, where it holds a combined 33 percent market share.

Sterlite has a fiber capacity of 37 million fiber kilometers while HFCL has a capacity of 25 million fiber kilometers equivalent fiber optic cable. According to analysts, Sterlite has 50 million fiber kilometers (FKM) of optic fiber capacity for its 37 million FKM of optical fiber cable capacity while HFCL has a 10 million FKM of optic fiber capacity against 25 million FKM of optical fiber cable capacity. Thus, Sterlite is more backward integrated compared to HFCL. HFCL plans to increase this to 22 FKM in FY24.

Sterlite plans to invest Rs800 crore till FY24, to expand capacity to 42 million fiber kilometers. Similarly, HFCL plans to expand its OFC capacity to 35 million fiber kilometers through a funding of Rs 600 crore. HFCL has raised this capital through a qualified institutional placement (QIP) in December 2021.

Both Sterlite and HFCL have adopted the strategy of selling telecom equipment as ancillary sales coupled with its optical fiber business.

“Demand for upgraded hardware required as a result of 5G and next generation Wi-Fi is propelling this growth in equipment business. It hopes to drive growth by expanding manufacturing capabilities in the telecom equipment business in coming years,” says Pratik Singhania, vice-president (research) at SageOne Investment Managers, a portfolio management service fund house for high net worth individuals.

Nahata says with demand for both OFC and 5G equipment business strong from global markets, the plan is to double exports to Rs750 crore in FY23, from around Rs380 crore in FY22. “We expect about 20 percent revenues to come via exports this fiscal year,” he says.

Singhania says Sterlite gets better realisation for its overseas OFC business, due to the R&D capabilities seconded by its 740-plus patents. “Sterlite is estimated to get approximately $1.5 per fiber kilometer more than the average supplier,” the analyst says. Sterlite is also close to commissioning optical fiber cable plant in USA as tax benefits are given to telecom companies who are expanding fibre footprint using made in USA products along with strong China plus One sentiment.

Product-led Revenue, Stock Gains

During and after the pandemic, several corporates, including HFCL, saw delays in both execution of projects, which delayed operating cycles and resultant payments. Hence, the company has over the years focussed on increasing the share of revenues from products, rather than projects. Products form 50 percent of revenues in Q1FY23, compared to 43 percent in FY22. “An increase in product revenue will need less working capital and quick realisation of revenue,” Nahata says.

HFCL has an order book of over Rs5,000 crore, with half of the revenues coming from the OFC business and the balance from the mix of telecom business, defence electronics, railway communication products, BharatNet and Smart City projects. The book is also well diversified with revenues from several states including Punjab, Rajasthan, Uttarakhand, Himachal Pradesh, Uttar Pradesh, Delhi, Andhra Pradesh and Telangana.

HFCL is banking to continue to receive OFC orders towards the government’s ambitious BharatNet project, which aims to digitally connect all the gram panchayats (GPs) and villages of India. In Jharkhand state, it has deployed OFC in 1,789 GPs, the company said in April.

The mix of the 5G rollout and continuing 4G expansion in remote areas, FTTH penetration and BharatNet are expected to be “an Rs3 lakh crore” opportunity in the OFC space,” Ventura Research says in a July 2022 report.

SageOne’s Singhania expects Jio and Airtel to start giving out orders on 5G deployment in November-December this year, where the annual order would be Rs10,000 crores per annum. “This will be followed by BharatNet orders in early 2023 wherein the total order size is expected to be Rs 80,000 crores,” he says. Portions of these orders will come towards HFCL, besides other rivals.

HFCL’s credit ratings have been improving as revenues grown, order book diversified and profitability improved in recent years. Care Ratings in July gave a Single A credit rating with a ‘stable’ outlook towards long-term credit loans and A2+ for short-term bank credit, compared to an earlier ‘negative’ rating in FY20.

HFCL, the Reliance Industries group and Jio are long business associates, which analysts see as a positive. Nahata is a director on the board of Reliance Jio Infocomm. “HFCL shares a long-standing relationship with the Reliance Group and family. This has particularly helped HFCL’s business in the last 2-3 years when Jio was expanding capacity. In the same period, while the HFCL management was stable, Sterlite was going through an internal management rejig,” Singhania says.

The HFCL stock has risen near four times or 265 percent in the past four years (see chart), echoing the improved business performance.

But for 19 years, between April 2003 and March 2022, the HFCL stock traded in a narrow range of Rs7 to Rs30 at the NSE, before moving up April 2022 onwards. The stagnation could have been due to a baggage of the past when Sebi had pulled up HFCL for violating norms governing prohibition of unfair trade practices, relating to a fraud by stock broker Ketan Parekh in 1999 for allegedly rigging stock market prices of 10 firms, including HFCL. HFCL settled the case through a consent order with Sebi in 2010.

The HFCL stock is not widely held by mutual funds (5.99 percent for the top 20 funds), according to data from Morningstar. The largest mutual fund shareholding includes Quant Money Managers (2.33 percent) and Vanguard Group (1.77 percent).

Usually the confidence in the stock improves as its price rises, so the next 2-3 quarters will be closely watched by investors, fund managers and the management. HFCL has been able to battle competition in its EPC business and the telecom equipment space (from Chinese manufacturers and local companies such as D-Link). It has now taken the lead ahead with 5G-centric products.

Ventura Research estimates HFCL’s revenue and net profit to grow at a CAGR of 20 percent and 30.4 percent respectively over the FY22-25E period.

After the envisaged capacity expansion, HFCL will have sizeable capacity in the OFC which will be near to the current capacities of Sterlite. With the telecom sector continuing to grow, a healthy order book indicating continuity, the right business alliances, HFCL and Nahata have ticked off the right boxes. They would now only hope that there are no delays in the 5G technology rollout.

No comments:

Post a Comment