One year of rising interest rates: How debt funds weathered the storm and came up a winner?

The Reserve Bank of India started raining interest rates (repo rate) in May 2022. Since then, it has hiked the Repo rate 250 basis points. Accrual funds benefitted from the rate hike cycle while, duration funds have been a mixed bag. Here, we analyse how debt funds responded to the rate hikes

MAY 26, 2023 / 08:34 AM IST

2/9

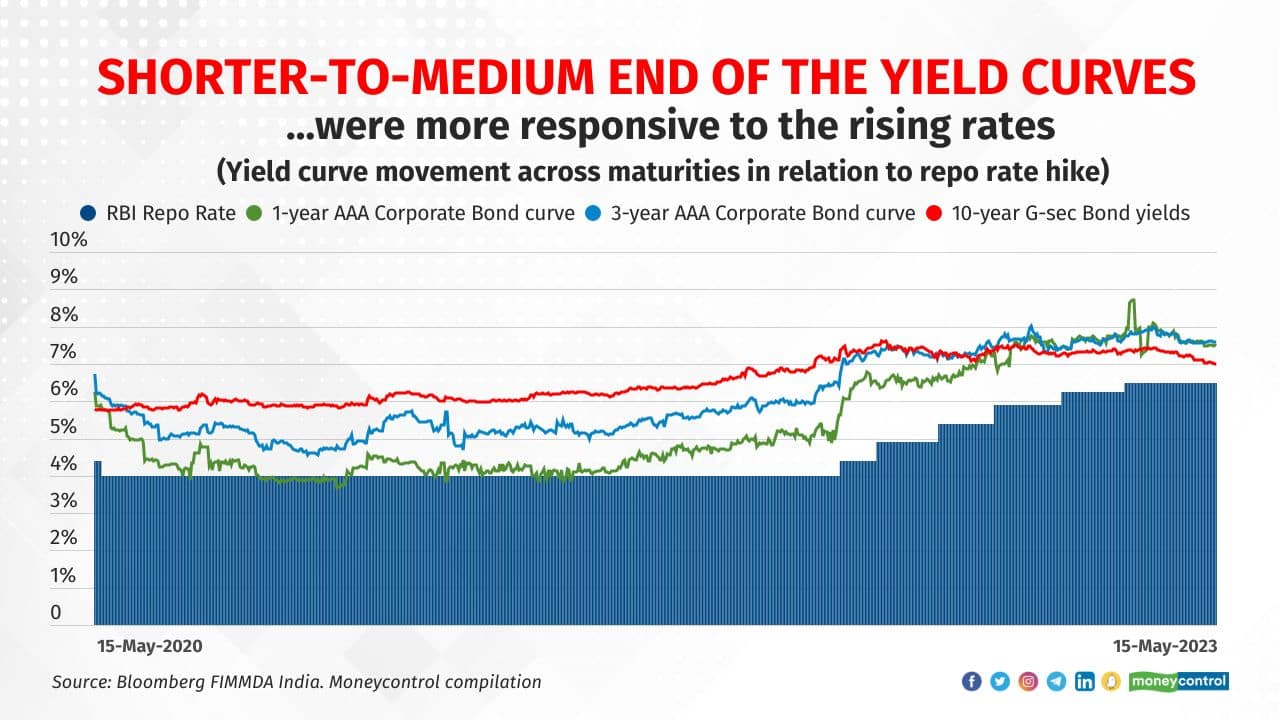

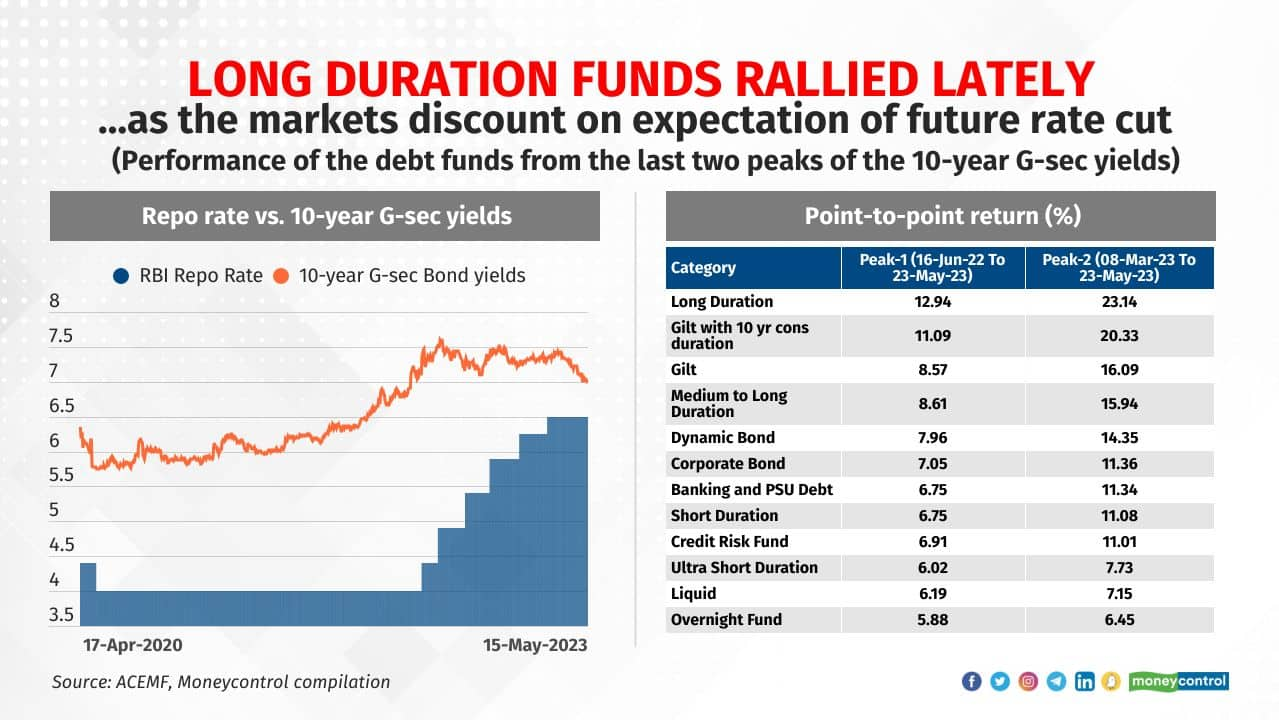

The Reserve Bank of India (RBI) has raised the interest rate by hiking repo rate by 250 basis points since May 2022. (Read here: RBI pauses rate hikes. Time to ride debt funds) The money market rates took cue and started climbing up. The 10 year g-sec bond yield more a market determined benchmark for the financial market was slowly going up through CY2021 anticipating rate hikes by central bank. However, it peaked on June 16, 2022. The markets discounted future by adjusting the yields based on the information flow – be it communication from central banks or the macro-economic indicators such as inflation and economic growth.

3/9

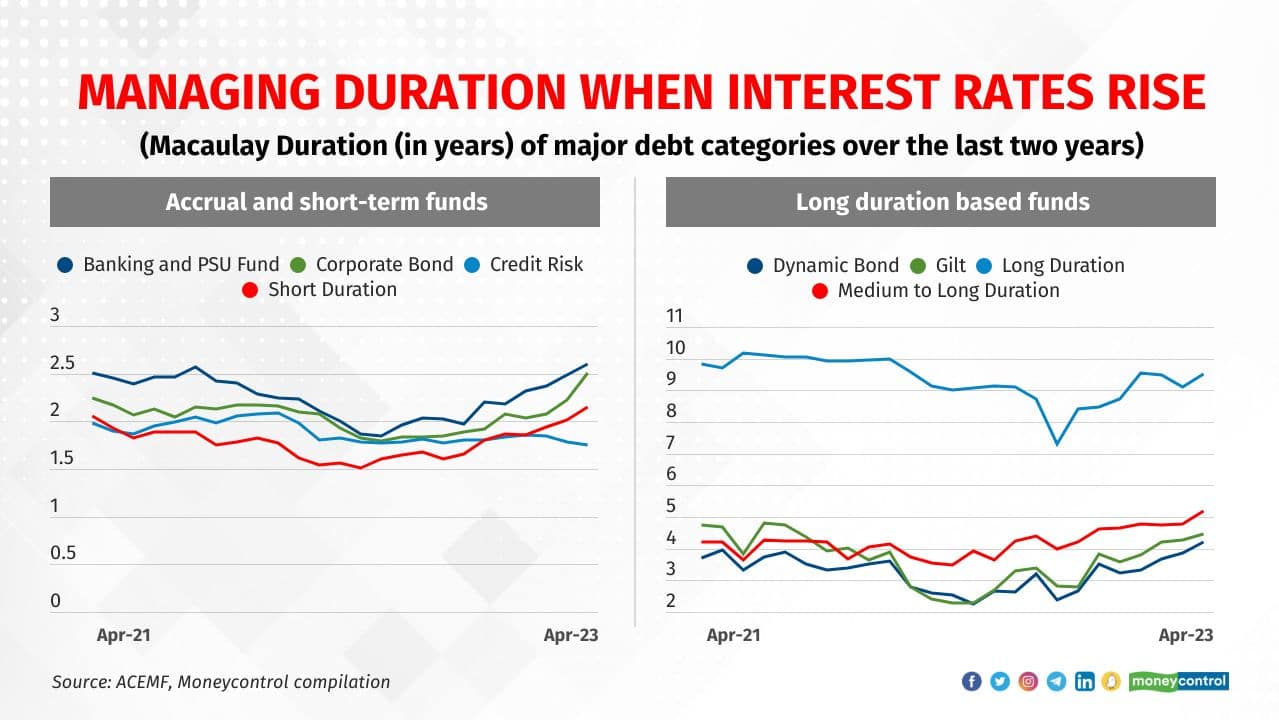

The best way to manage a rising interest rate cycle is to keep the portfolio duration low. Fund managers prefer to remain invested in relatively short term bonds, as these bonds see relatively less price erosion when rates rise. For example, among accrual products like Banking and PSU debt funds as well as Short Duration funds reduced their portfolio duration (Macaulay Duration) to 1.9 years and 1.5 years respectively in May 2022, down from 2.5 years and 1.9 years respectively a year ago. Similarly, gilt funds cut the portfolio duration to 2.3 years in May 2022 compared to 4.7 years in May 2022.

However, as per the latest data as of April 2023, these schemes have raised the portfolio duration to 2.6 years, 2.1 years and 4.5 years respectively.

4/9

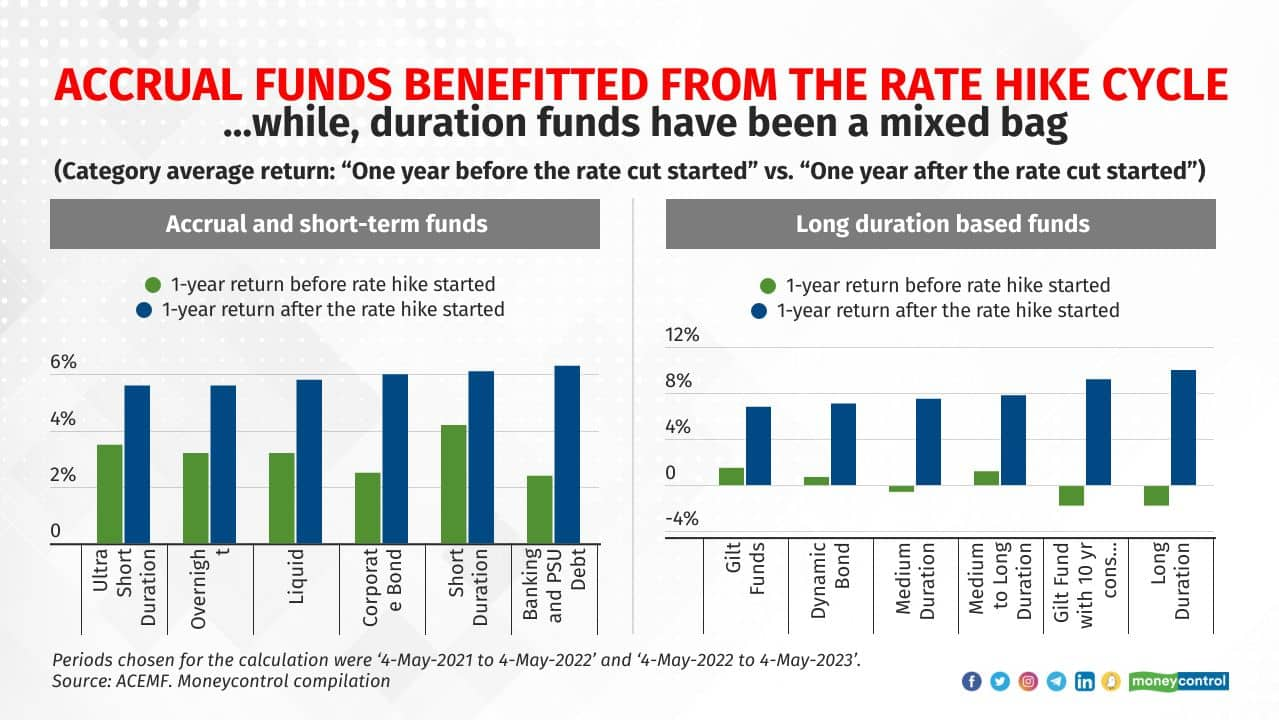

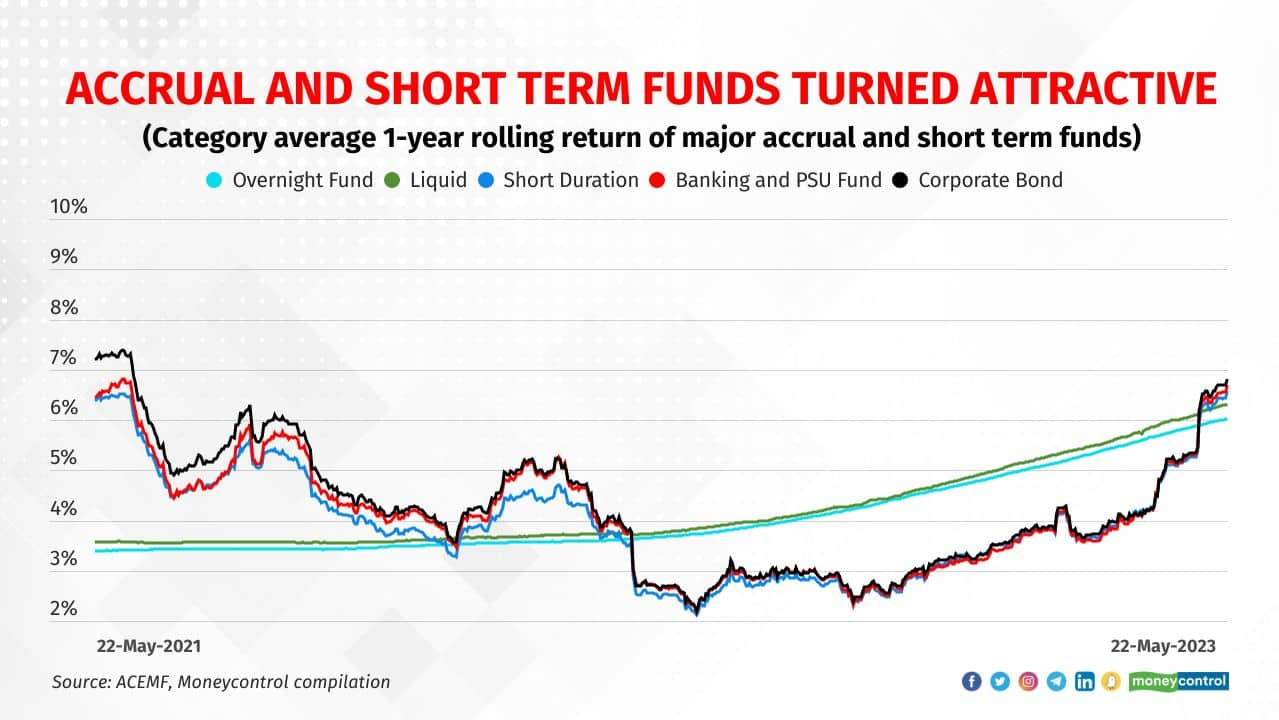

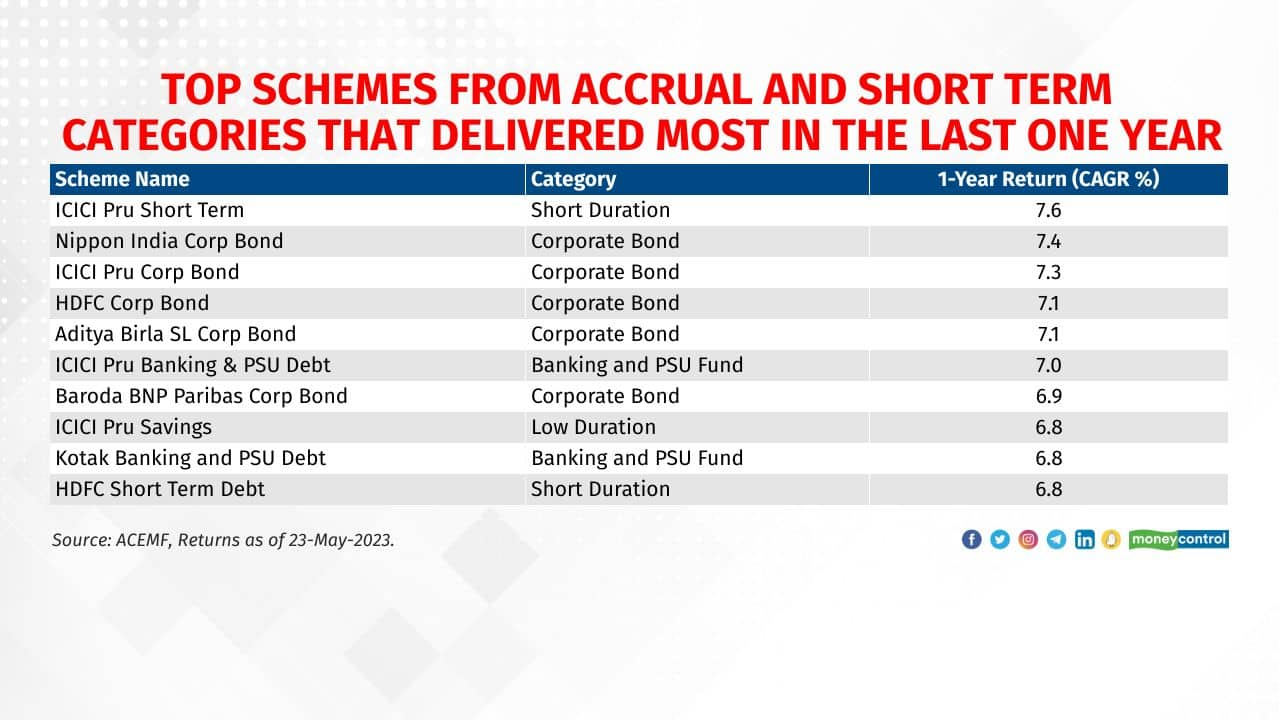

Accrual focused funds benefitted from the rate hike cycle. The returns they generated in the year after the rate hike cycle begun exceeded the returns they generated in a year before the rate hike cycle begun. Debt funds schemes investing in long duration bonds however, have been a mixed bag. The active management of duration and the early peaking of 10 year bond yields in June 2022 influenced the returns they offered.

5/9

Pranay Sinha, Senior Fund Manager- Fixed Income, Nippon India Mutual Fund points out that financial markets tend to discount future. “The 10year yield moved up from 6.25 percent to 7.55 percent between the period Oct 2021 to June 2022 while the actual repo rate hikes happened between May 2022 to Feb 2023.” Similarly the 10year rates have come down in anticipation of RBI going in pause and softening of macro-economic variables like consumer price inflation and current account deficit. The movement in global yields and expectations of pause by global central banks have also played a part, he added.

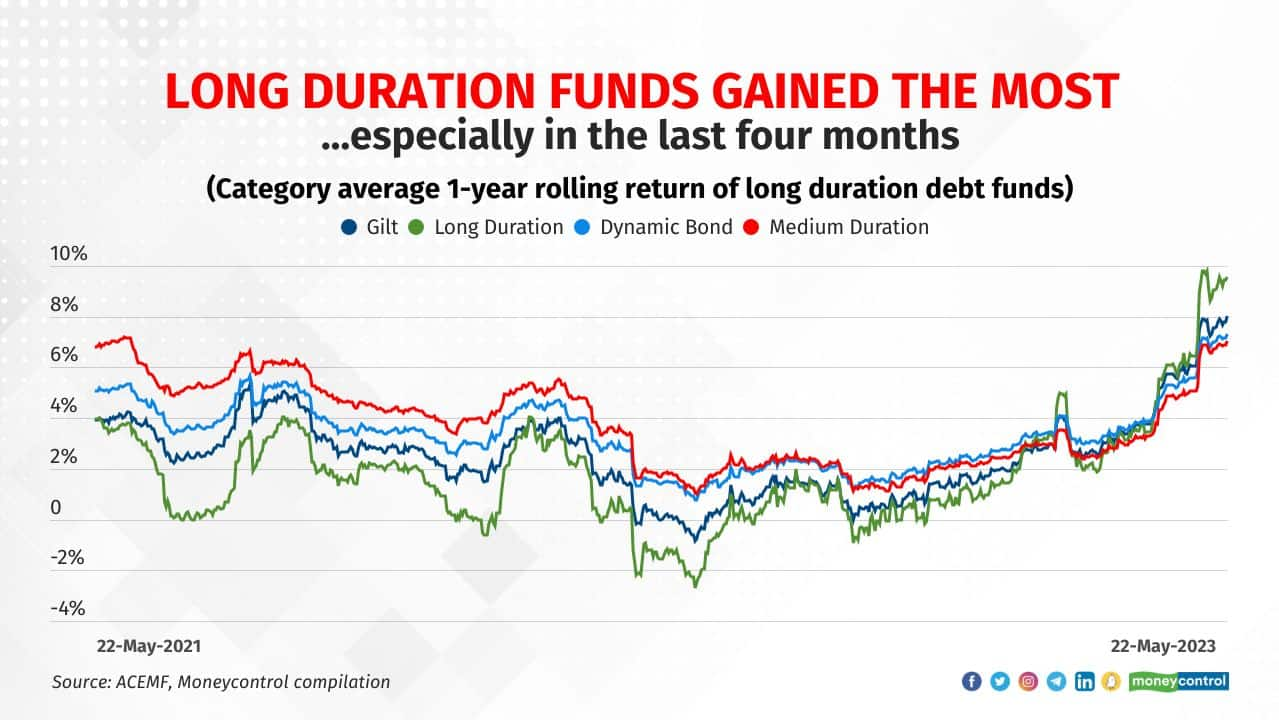

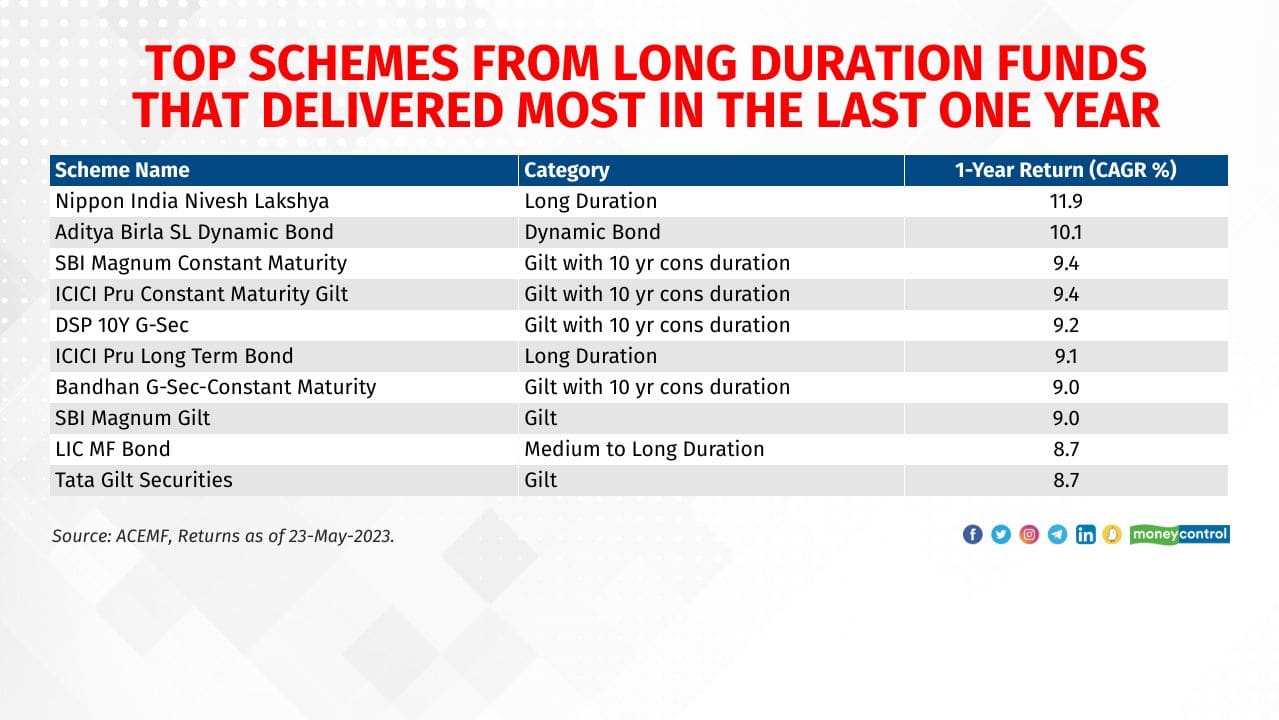

As the long term bond yields came down, despite hike in repo rate, the debt funds investing in long term bonds posted attractive returns, in excess of 8 percent.

6/9

Accrual funds with duration ranging between 2 to 3 years, saw some brunt of expectations of rising interest rates in the year before the repo rates started going up. Average 1-year rolling returns of both banking & PSU debt funds and corporate bond funds categories saw a decline to 1.7 percent in June 2022. The same however climbed up gradually as the markets started building in a case of pause in rate hikes.

Manish Banthia, Deputy CIO - Fixed Income, ICICI Prudential AMC believes that RBI is approaching the fag-end of the rate hike cycle, with an elongated pause expected post peak in interest rates.

Joydeep Sen, corporate trainer -debt, sees slim chance of a cut in repo rate in this year. “However, if a repo rate cut takes place then the yields on money market instruments and bonds with residual maturity of less than one year will also go down,” he adds.

If the short term rates continue to remain elevated at current levels, then accrual funds will benefit.

7/9

Debt schemes investing in relatively long term bonds are more susceptible to changes in interest rates. For example, long duration funds saw the one year rolling returns fall to negative 2.7 percent in June 2022 compared to positive four percent in June 2021. The expectations of rate hike ensured that the bond prices fall and the NAVs are hit. As the expectations of rate hike gave way to expectations of an early pause and possible rate cut in future, the long duration fund bounced back quickly. As on May 23, 2023, the one year rolling returns stand at 10.5 percent.

Sinha sees the 10 year benchmark bond yield pricing in pause in rate hike cycle with a possibility at of the next move being a rate cut. “Any deterioration in growth data locally could put pressure on RBI to cut rates and could lead to fall in 10y benchmark yields,” he says.

8/9

Though liquid and overnight funds tend to benefit from the rising interest rates, the accrual focused schemes with portfolios of two to three years duration did better. After MPC meet held in February 2023, the expectations of possible pause in rate hikes ensured that the yields of the bonds held come down and the NAVs of these schemes got some facelift. Investment demand for these bonds also went up as the investors decided to lock in their money in relatively less risky debt fund offerings after switching out from very short term focused products such as liquid and overnight funds.

Banthia attributes superior returns in the last couple of years to the fund house’s strategy to reduce duration with the thought that rate hike cycle would be steep. “We avoided the short end of the curve as it was riskier than the long end of the curve. Through this cycle, we were overweight floating rate bonds which provided good margin of safety. All of these calls played out well and aided in the fund performance,” he adds.

9/9

As the markets started discounting the expectations of early pause in rate hikes, the long duration funds and 10 years constant maturity funds emerged winners among debt funds that invest in relatively long tenured bonds. Many investors would like to invest in long duration bond funds and gilt funds. However, not all find 10 year benchmark bond yield attractive at current sub-7 percent levels.

“With RBI's inflation target shifting to 6 percent now compared to 4 percent earlier, the 10-year G-Sec would be attractive only at a yield of close to 8 percent,” Banthia says.

Sen advocates matching your time horizon with the duration of the scheme if you are keen to invest in long duration funds. “It helps in riding out interim volatility and you need not unnecessarily worry about timing,” he adds.

No comments:

Post a Comment