On March 19, Bank of Japan ended its era of negative interest rates. This is seen as an essential to bring the consumer price inflation back to the 2% target. It seems a virtuous cycle is now in place in the Japanese landscape where economic expansion is aiding stock market heft, and investors are loving it.

The sun is shining brighter on the Japanese market. In fact, the country’s stock market is poised to rise even higher as it sheds its zero-interest-rate regime and moves towards an inflationary environment.

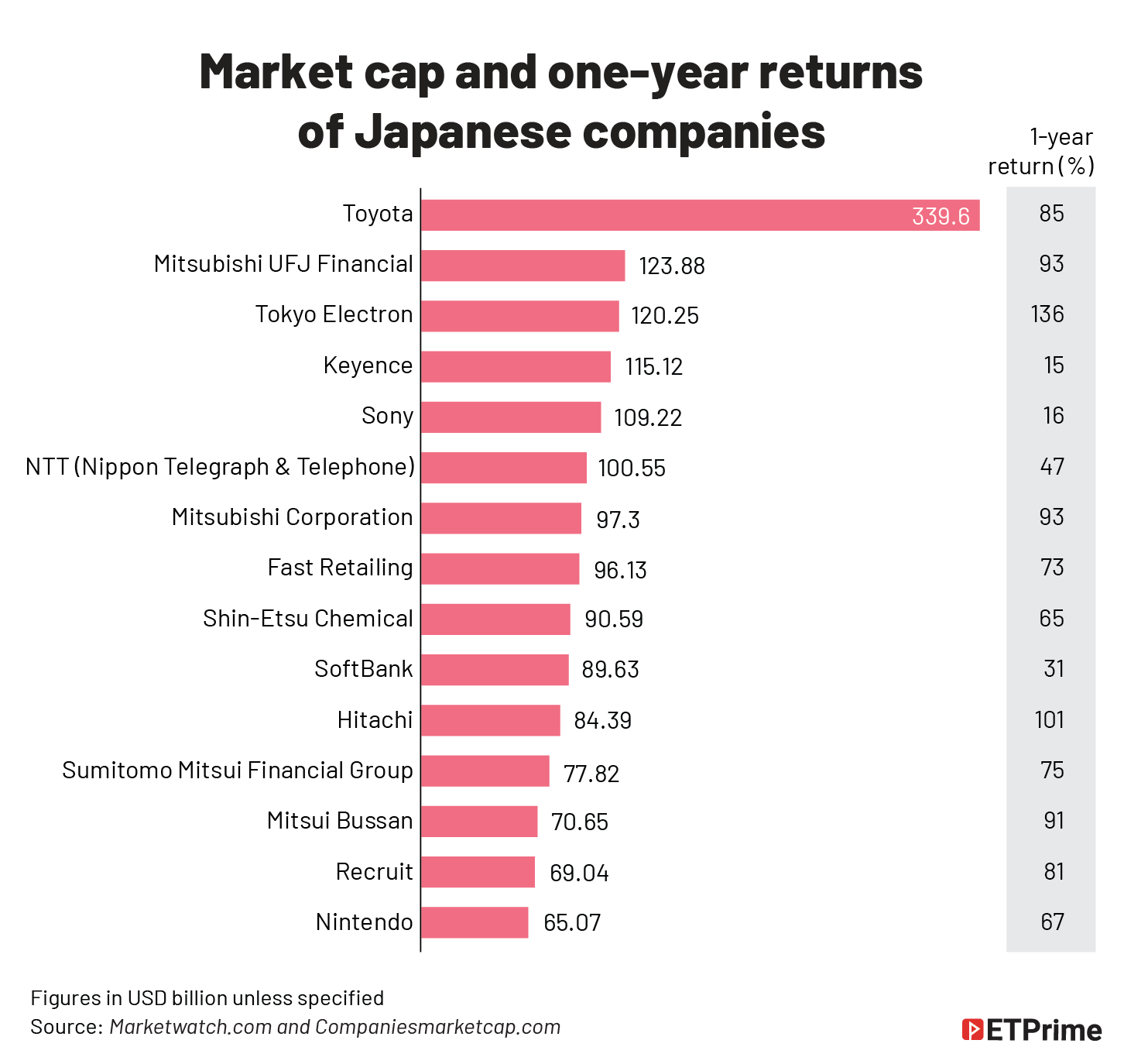

On March 4, 2024, the Japanese Nikki 225 Index closed above 40,000 — a record high after being subdued for 34 years. Over the past year, the index has gained 49%. And there are two specific reasons for this.

- Japan is shedding its zero-interest regime and shifting to an inflationary economy.

- Big corporate reforms are taking place that will help companies to grow at a faster rate.

Goldman Sach’s research expects the TOPIX, the Tokyo Stock Index which also has some semi-conductor stocks, to reach new highs over the next 12 months. Presently, the index is trading at 2,817. Goldman Sachs strategists Kazunori Tatebe and Bruce Kirk in a recent report said that Japanese companies will benefit from a strong US economy and a weaker Yen. They further said that earnings per share will be up 32% over the next three years as the global manufacturing cycle continues to improve. Again, there are talks of wage hikes in Japanese companies, which is expected to boost consumption.

In terms of corporate reforms, the

Tokyo Stock Exchange has requested companies to implement management changes that are conscious of share price and cost of capital.

Japanese companies over the last three decades have not actively looked at equities or their market capitalisation as the market itself was down. It turned into a feedback effect where companies did not concentrate on EPS growth in a low-interest rate regime. Again, a low interest rate regime keeps the cost of capital low but then the ROE (return on equity) of the company also suffers.

Interestingly, Japanese companies themselves are now busy buying non-financial stocks.

So, how can Indian investors take exposure to the Japanese market?

The Japanese economy

At its peak in December 1989, Japan accounted for almost 45% of the world’s total stock market capitalisation. The superior market performance was preceded by years of innovations in sectors like engineering and industrials through the 1970s.

By 1980s, Japan became the world’s second-largest economy. Then China caught up over the years and snatched the second-largest economy tag from it.

After 1990s, Japan got mired into a vicious cycle of stagnation and deflation – crashing its share in world stock market capitalisation to 6% in 2023 – a mighty fall from the heydays of 45%.

Things have now changed almost 180 degrees for the Japanese economy in past couple of years – as growth came back accompanied with inflation. Japan’s share in the world market capitalisation is starting to inch up.

Positive territory

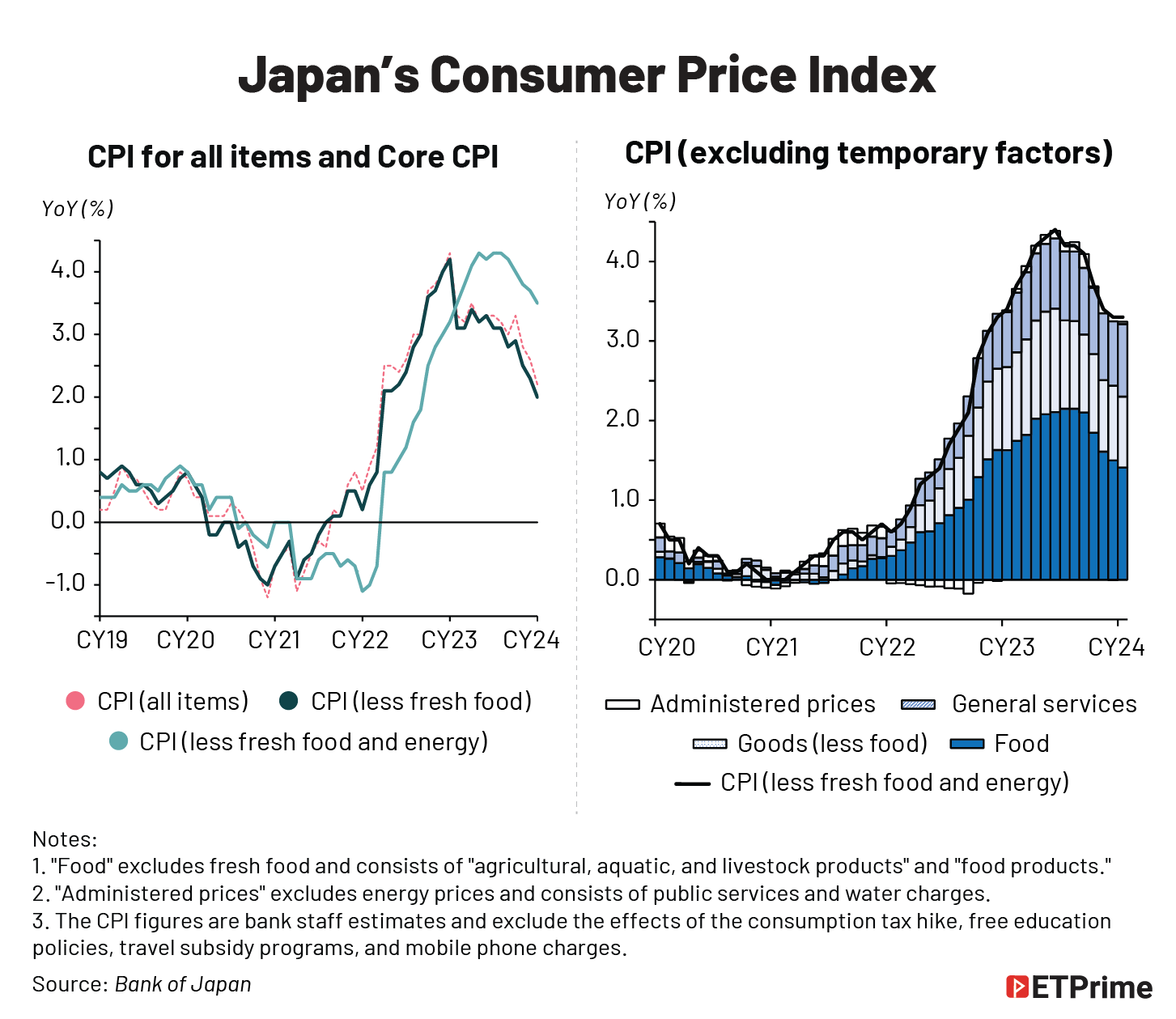

On Tuesday (19 March), the Bank of Japan ended its era of negative interest rates that was in place since 2016. The hike — first in 17 years — brought policy rate into positive territory, with a range of 0% to 0.1%, from negative 0.1%. Higher rates are being seen as essential to bring consumer price inflation back to the 2% target.

A series of recent measures by the country’s financial regulators boosted the investors' confidence. Depressed valuations and lower Yen attracted foreign investors eager to beat index returns.

It seems a virtuous cycle is now in place in the Japanese landscape where economic expansion is aiding stock market heft, and investors are loving it. Foreign investors have their eyes set on Japanese stocks.

Rising company margins

Rising inflation means companies are being able to pass on the price increases, thereby expanding margins. Households need to invest their savings to beat inflation. Decades of deflation in Japan earlier killed any incentive for investment as the purchasing power of cash was being protected. But things have changed now.

Pricing power with companies means profitability is rising.

As per the Bank of Japan data, current profits based on all industries and enterprises have reached the highest level since the April-June quarter of 1985, from when comparable data are available.

Large firms’ profits are supported by a recovery in economic activity and hikes in selling prices. A depreciating Yen also boosted profits via foreign exchange gains and increased dividend income from overseas subsidiaries.

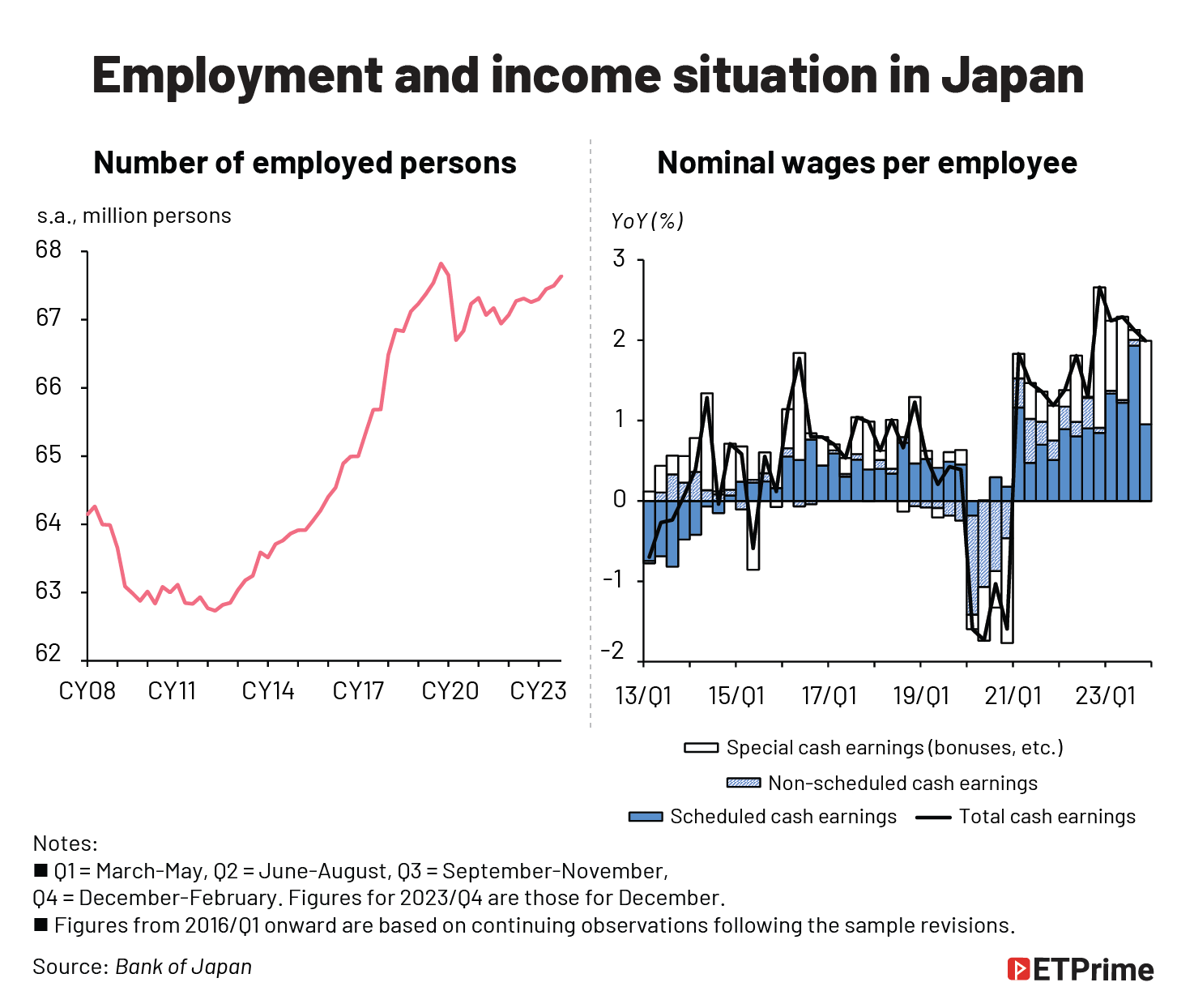

Higher incomes and spending

Rising nominal wages alongside gains in equity markets are leading to higher demand. Full-time employees’ salaries have reflected the results of annual spring labour-management wage negotiations in 2023, which ended up with the highest wage growth rate since 1993, as per the Japanese government official data.

Minimum wages for part-time employees have been raised amid tight labour market conditions. This indicates that economic expansion will be steady and not sporadic.

Consumer inflation has matched or exceeded BOJ’s target of 2% for 22 consecutive months, as per the latest data. It has fallen from the 41-year high levels hit in 2023.

Japan’s real GDP grew at 1.9% in 2023, as compared to 1% in 2022, as per the International Monetary Fund data. Growth in 2024 is projected to moderate to 1%.

Economic growth has been accompanied by rising exports. Exports of goods and services as a percentage of GDP have risen to 21.54% in 2022, up from 16.05% in 2016, as per the World Bank data.

The Bank of Japan expects the economy “to continue growing at a pace above its potential growth rate”, on the back of virtuous cycle from income to spending gradually intensifying.

Indians can take exposure to the Japanese equity market through the Nippon India Japan Equity Fund, which invests into Japanese equity and equity-related securities. Over the past one year, the fund has returned 24.78% against S&P Japan 500 TRI at 22.54%.

(Graphics by Mohammad Arshad)

No comments:

Post a Comment