The new, minimal-exemptions tax regime is set to be the favoured choice of most taxpayers in 2025-26, thanks to the raft of announcements in this year's budget.

Know the Budget changes for FY 2025-26

For taxpayers, the new financial year will begin on a positive note as they are set for big savings starting April 1.

Finance Minister Nirmala Sitharaman’s budget announcements for FY25-26 come into effect today, and those who choose the new tax regime will have to pay significantly less this year.

Here’s a look at the income tax slab rejig and other measures that will come into force.

New slabs

The new, minimal-exemptions tax regime is set to be the favoured choice of most taxpayers this fiscal, thanks to the Finance Act, 2025-26, which has raised the basic exemption threshold from Rs 3 to 4 lakh, hiked the rebate limit from Rs 7 to 12 lakh, and widened the tax slabs. For salaried individuals, income of up to Rs 12.75 lakh will attract no tax due to the standard deduction of Rs 75,000 under the new regime.

Old vs new regimes: switch to save

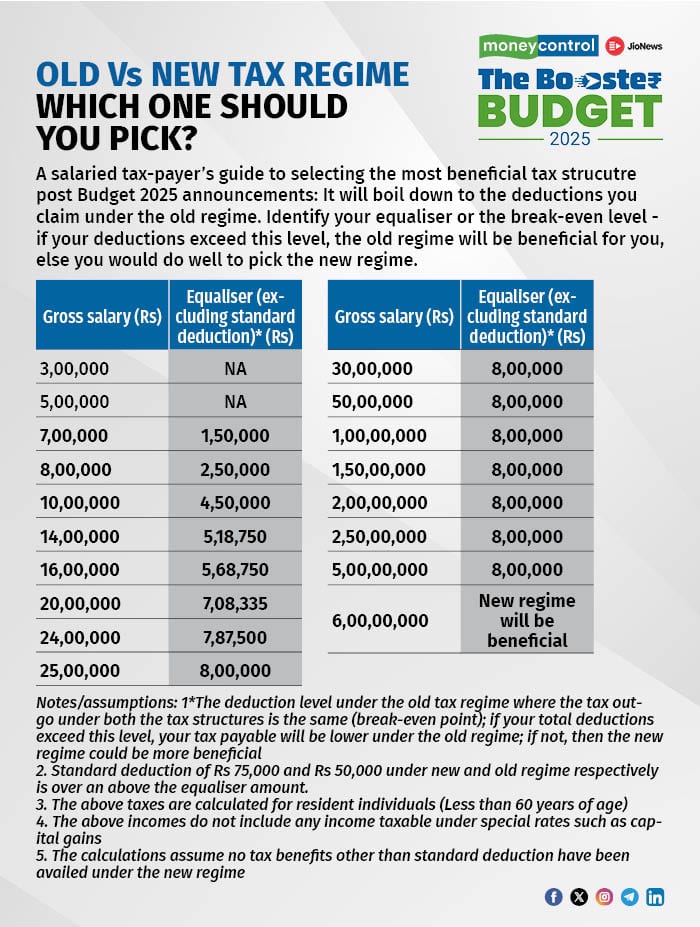

Starting this year, most salaried individuals will save more on their tax outgo under the new regime unless they claim a substantial house rent allowance (HRA) exemption. This is because the minimum deduction amount required for the old tax regime to be more beneficial is now significantly higher.

Per Deloitte's calculations, those earning more than Rs 24 lakh will have to claim deductions of Rs 8 lakh or more for the old tax regime to be beneficial. Put simply, popular deductions under section 80C (tax saving investment of Rs 1.5 lakh), 80D (health insurance premium of Rs 1 lakh), and 24B (Rs 2 lakh in home loan interest) will not be enough to offset the benefits offered under the new regime.

The new tax regime is the default framework, but ensure that you communicate your decision to pick this regime to your employer in April, when you submit your proposed investment declarations.

No comments:

Post a Comment