Finance Minister Nirmala Sitharaman today announced a big consolidation of public sector banks: 10 public sector banks to be merged into four. Under the scheme of amalgamation, Indian Bank will be merged with Allahabad Bank (anchor bank - Indian Bank); PNB, OBC and United Bank to be merged (PNB will be the anchor bank); Union Bank of India, Andhra Bank and Corporation Bank to be merged (anchor bank - Union Bank of India); and Canara Bank and Syndicate Bank to be merged (anchor bank - Canara Bank). In place of 27 public sector banks in 2017, now there will be 12 public sector banks after the latest round of consolidation of PSU banks. The consolidation of public sector banks will give them scale, the finance minister said.

The government also announced capital infusion totalling over₹55,000 crore into public sector banks: PNB ( ₹16,000 crore), Union Bank of India ( ₹11,700 crore), Bank of Baroda ( ₹7000 crore), Indian Bank ( ₹2500 crore), Indian Overseas Bank ( ₹3800 crore), Central Bank ( ₹3300 crore), UCO Bank ( ₹2100 crore), United Bank ( ₹1,600 crore) and Punjab and Sind Bank ( ₹750 crore).

Last year, the government had approved the merger of Vijaya Bank and Dena Bank with Bank of Baroda (BoB) that become effective from April 1, 2019. In 2017, the State Bank of India absorbed five of its associates and the Bharatiya Mahila Bank.

Here are the highlights of what the finance minister said today:

We want banks with strong national presence and enhanced risk appetite

Indian Bank to be merged with Allahabad Bank (anchor bank - Indian Bank)

Consolidated Indian Bank and Allahabad Bank to be 7th largest public sector bank with cRs 8.08 lakh crore business ((anchor bank - Indian Bank)

PNB, OBC and United Bank to be merged (PNB will be the anchor bank)

Union Bank of India, Andhra Bank and Corporation Bank to be merged (anchor bank - Union Bank of India)

Consolidated Union Bank of India, Andhra Bank and Corporation Bank to be 5th largest public sector banks with₹14.6 lakh crore business

Canara Bank and Syndicate Bank to be merged Consolidated Canara Bank and Syndicate Bank to be 4th largest public sector bank with ₹15.2 lakh crore business

No retrenchment has taken place post merger of Bank of Baroda, Dena Bank and Vijaya Bank; staff has been redeployed and best practices in each bank have been replicated in others 8 PSU banks have so far launched repo rate-linked loans

Loan tracking mechanism in PSU banks is being improved for the benefit of customers

4 NBFCs have found liquidity support through PSU banks since last Friday

For NBFCs, partial credit guarantee mechanism has already been implemented

Govt working on banking reforms

Gross NPAs of PSU banks have come down

Provision coverage ratio highest in 7 years

Best practices of each bank in consolidation of Vijaya Bank, Bank of Borada and Dena Bank have been absorbed

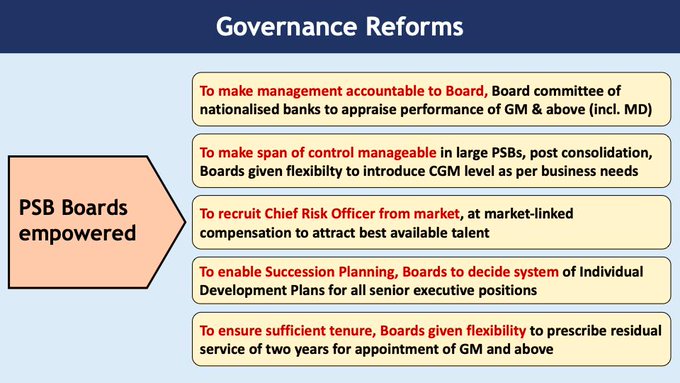

Non-official directors to perform role analogous to independent directors

Public sector banks enabled to do succession planning

Bank boards given flexibility to fix sitting fee of independent directors

Bank of India, Central Bank of India will continue as public sector banks "To make management accountable to board, board committee of nationalised banks to appraise performance of general manager and above including managing director," Sitharaman said.

Post consolidation, boards will be given flexibility to introduce chief general manager level as per business needs. They will also recruit chief risk officer at market-linked compensation to attract best talent.

No comments:

Post a Comment