These 4 Measures Indicate That HFCL (NSE:HFCL) Is Using Debt Reasonably Well

The external fund manager backed by Berkshire Hathaway’s Charlie Munger, Li Lu, makes no bones about it when he says ‘The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. It’s only natural to consider a company’s balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, HFCL Limited (NSE:HFCL) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company’s use of debt, we first look at cash and debt together.

What Is HFCL’s Net Debt?

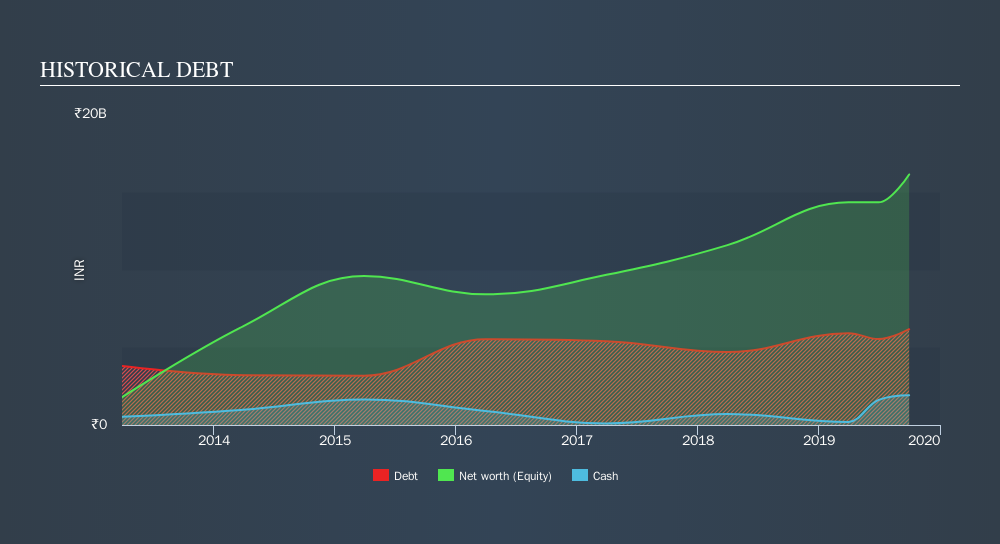

The image below, which you can click on for greater detail, shows that at September 2019 HFCL had debt of ₹6.16b, up from ₹5.90b in one year. However, it also had ₹1.91b in cash, and so its net debt is ₹4.25b.

How Strong Is HFCL’s Balance Sheet?

We can see from the most recent balance sheet that HFCL had liabilities of ₹20.2b falling due within a year, and liabilities of ₹2.27b due beyond that. Offsetting this, it had ₹1.91b in cash and ₹19.0b in receivables that were due within 12 months. So its liabilities total ₹1.50b more than the combination of its cash and short-term receivables.

Since publicly traded HFCL shares are worth a total of ₹21.8b, it seems unlikely that this level of liabilities would be a major threat. Having said that, it’s clear that we should continue to monitor its balance sheet, lest it change for the worse.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

HFCL has net debt of just 0.77 times EBITDA, indicating that it is certainly not a reckless borrower. And this view is supported by the solid interest coverage, with EBIT coming in at 8.8 times the interest expense over the last year. In addition to that, we’re happy to report that HFCL has boosted its EBIT by 62%, thus reducing the spectre of future debt repayments. There’s no doubt that we learn most about debt from the balance sheet. But you can’t view debt in total isolation; since HFCL will need earnings to service that debt. So if you’re keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it’s worth checking how much of that EBIT is backed by free cash flow. In the last three years, HFCL basically broke even on a free cash flow basis. While many companies do operate at break-even, we prefer see substantial free cash flow, especially if a it already has dead.

Our View

The good news is that HFCL’s demonstrated ability to grow its EBIT delights us like a fluffy puppy does a toddler. But the stark truth is that we are concerned by its conversion of EBIT to free cash flow. Looking at all the aforementioned factors together, it strikes us that HFCL can handle its debt fairly comfortably. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it’s worth monitoring the balance sheet.

No comments:

Post a Comment