ET CONTRIBUTORS|

Last Updated: Feb 29,

2020, 10.19 AM IST

By Bhogavalli Mallikarjuna Gupta

Ever since the GST came into effect on July 1,

2017, the Indian economy has seen a plethora of regulations implemented by the

GST council. Now the department is using analytics to keep tab on the errant

taxpayers who are claiming excess input tax credit or to track some taxpayers

who are not serious about the matching of their GSTR - 3B with their GSTR - 2A.

The Input Tax Credit (ITC) is one of those regulations that is causing

confusion among the masses. Here is a brief explanation of what ITC means, how

it will affect the masses- especially small business owners, and what are the

necessary steps needed to be taken.

What is ITC?

Input tax credit (aka ITC) is the subtraction of

the tax money you have paid on inputs on the final output bill.

Who can avail of ITC?

ITC is available to an entity only when it is

covered under the GST Act. Any manufacturer, supplier, agent or e-commerce

operator aggregator must be registered under the GST if it is to become

eligible to claim the ITC on their purchases which are used in the course and

furtherance of business

What are the changes in accounting practices?

One of the primary reasons the GST was

implemented was to get rid of old style book-keeping practices and records.

With new ledgers in accounting practices there will be a great deal of transparency

and control. Further mistakes made by suppliers would be readily tracked.

In the case of multiple registrations it is

advised to create ledgers for all - State GST, Central GST, Integrated GST, and

even for tax levied on inter and intra state sales and imports. So in relation

with ITC, the ledgers may be as follows:

·

Interim / Suspense /

Provisional ITC - SGST

·

Interim / Suspense /

Provisional ITC - CGST

·

Interim / Suspense /

Provisional ITC - IGST

·

Interim / Suspense /

Provisional ITC - GST Cess

The entry in accounting records passed at the time of goods

and material received note requires additional entries.

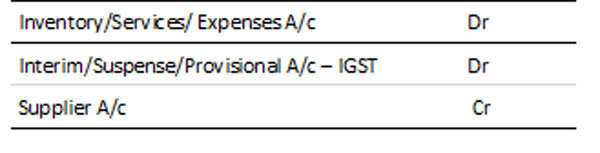

The new accounting entry at the time of purchase

should be

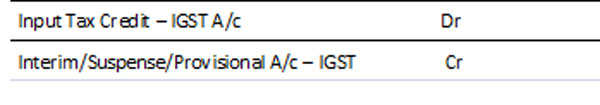

The

new accounting entry at the time of matching

This process will have an option to track at the

supplier invoice level and helps to monitor the suppliers who are not

filing returns on time. This new process also helps to keep track of the

changes which are reflected dynamically in GSTR - 2A from time to time based on

filing of returns by the supplier after the due date.

Did you know?

a) As per rule 69 of the Central Goods and

Services Tax (CGST) Rules, 2017, following details must be matched to the claim

of input tax credit

·

GSTIN of the supplier

·

GSTIN of of the

recipient

·

Invoice or debit note

number

·

Invoice or debit note

date

·

Tax amount

b) There are reasons for the differences between the records

of the seller and the buyer. These could be wrong GSTIN of the supplier, date

related or entry errors while uploading invoice or debit note number, invoice

or debit note date and errors in calculation of the tax amount.

What are the potential errors?

There can be errors at various levels. Let's

examine a few commonly found ones.

·

Errors by the suppliers:

It often happens, especially in absence of a good ERP/Accounting system that

the supplier might end up entering the wrong GSTIN number. Furthermore the

supplier might have not filed tax or uploaded the tax invoice.

·

Invoice related errors:

Again, there could be mismatch due to data entry error of invoice or debit note

number by the end of supplier in their ERP system or the the books of accounts.

The supplier may go errant not just while mentioning invoice number but while

entering the amount of the invoice too. Human errors!

·

Factor of time and luck:

Another important factor is the time gap between receipt of goods and the

generation of invoice. This may cause mismatch and/or errors-for instance, if

the purchase is made on a certain day and the invoice is generated way later,

for some reason. This will create confusion on the day of day of purchase.

Likewise, it may also happen that the supplier has issued invoice and it was

not received by the recipient. Or in some cases in which the purchase has been

made but the goods are still in transit or not yet shipped, then it will be

required to reconcile the entries accordingly.

To avoid the precious working capital the MSMEs have to

change their business process based on the statutory requirements of GST and

also adopt technology so that the entrepreneurs can concentrate on the business

operations rather than the compliance and accounting work. It has to be kept in

mind that GST is not a tax reform but a business process reform and change of

business process and adoption of technology helps the MSMEs to scale to new

heights and they have the potential to become tomorrow's MNCs.

( CMA Bhogavalli

Mallikarjuna Gupta is the Chief Taxologist at Logo Infosoft.)

Read more at:

No comments:

Post a Comment