KOLKATA: A potential Vodafone Idea(VIL) shutdown could push opex and capex levels up in the near-term for Bharti Airtel and Reliance Jio Infocomm, but such cost upticks would be more than offset by strong customer gains for both telcos if the sector takes on a private sector duopoly structure, analysts said.

BofA Securities said if VIL, with over 300 million users, is pushed to bankruptcy, and India becomes a two-player telecom market, “opex could increase (for Airtel) by 15-20% due to a reversal of existing tower sharing agreements, and capex could increase too in the near term”.

But Airtel and Jio, it said, would be “big beneficiaries” in terms of market share gains, though adding that the Mukesh Ambani-led telco, which doesn’t face any material (AGR) payment risks (unlike Airtel) is better positioned in the long run and to also invest in 5G with less pressure on its balance sheet”.

Analysts though said it won’t be a cakewalk for either Airtel or Jio as they would need to invest top dollars in fresh spectrum resources to boost their respective network capacities to take on VIL’s customers. But actual size of such investments on network capacity ramp-ups, they said, would hinge on the price at which they buy VIL’s spectrum resources.

Rajiv Sharma, research head at SBICap Securities, estimates the adjusted value of VIL’s spectrum that the company acquired in the previous auctions is estimated at roughly $14 billion.

“In a duopoly scenario, Airtel and Jio might bargain hard and get the government to auction VIL’s spectrum at a significant discount by getting it to slash the reserve price,” Sharma told ET.

Motilal Oswal said a duopoly market seems apparent, and assuming “a 40:60 share of (VIL’s) subscribers for Jio/Airtel, both telcos could see Ebitda addition of Rs 15,000 crore/Rs 10,000 crore with 50% margin, implying a jump of 29%/22% on FY22 Ebitda to Rs 67,100 crore/Rs 54,700 crore”.

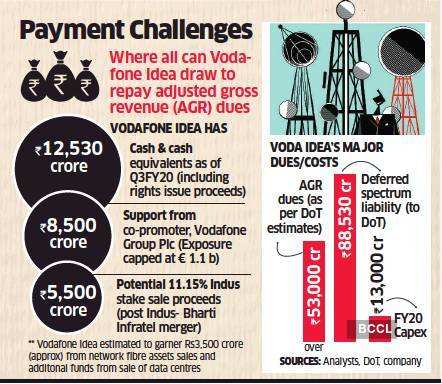

The Supreme Court on Monday dismissed Vodafone Idea’s plea to direct the telecom department not to take any coercive action against the operator, such as invoking bank guarantees. Experts believe this further reduces the struggling telcos’s chances of withstanding its over Rs. 53,000 crore AGR shock.

VIL shares closed 0.6% lower at Rs. 3.42 on BSE on Monday.

Goldman Sachs said Airtel’s stock may currently be pricing in an ARPU (average revenue per user) of Rs181, assuming one-third of Vodafone Idea’s subscribers move to the company over the next couple of years.

Airtel shares were virtually unchanged, closing at Rs. 565 on BSE on Monday.

If VIL indeed shuts down, Jio would need to launch another aggressive 4G featurephone offer to attract Vodafone Idea’s user base, many of which are still on 2G and 3G, who by default would otherwise move to Airtel that offers the legacy technologies, say experts.

Sharma of SBICap Securities said, “Airtel might need to evaluate offering 4G handset subsidy to attract VIL’s 2G/3G users and get them to upgrade to 4G”, especially since it has been “underinvesting in 2G and is also shutting down 3G services nationally by March”.

Experts added that Airtel and Jio have leverage issues, particularly Airtel, which, post a potential Rs. 35,586 crore AGR payout to the government, may not be able to bid aggressively in the next airwaves sale.

Separately, they said if VIL were to shut down soon, and the government is eager to sell the company’s spectrum resources to Jio and Airtel for ensuring tele-density levels don’t crash, it may consider auctioning such airwaves at a sharp discount.

No comments:

Post a Comment