Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, RHI Magnesita India Limited (NSE:RHIM) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for RHI Magnesita India

How Much Debt Does RHI Magnesita India Carry?

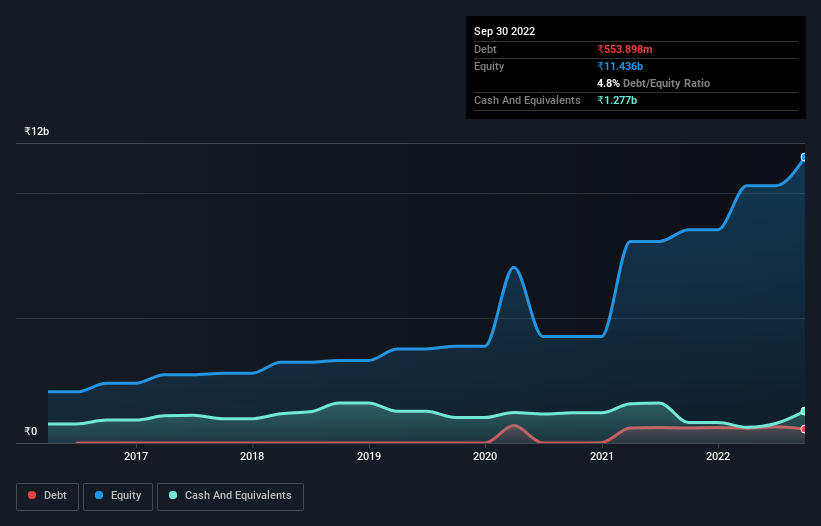

The image below, which you can click on for greater detail, shows that RHI Magnesita India had debt of ₹553.9m at the end of September 2022, a reduction from ₹598.7m over a year. But it also has ₹1.28b in cash to offset that, meaning it has ₹723.6m net cash.

A Look At RHI Magnesita India's Liabilities

The latest balance sheet data shows that RHI Magnesita India had liabilities of ₹7.22b due within a year, and liabilities of ₹428.5m falling due after that. On the other hand, it had cash of ₹1.28b and ₹6.56b worth of receivables due within a year. So it actually has ₹186.3m more liquid assets than total liabilities.

This state of affairs indicates that RHI Magnesita India's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So while it's hard to imagine that the ₹148.2b company is struggling for cash, we still think it's worth monitoring its balance sheet. Succinctly put, RHI Magnesita India boasts net cash, so it's fair to say it does not have a heavy debt load!

On top of that, RHI Magnesita India grew its EBIT by 84% over the last twelve months, and that growth will make it easier to handle its debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if RHI Magnesita India can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. RHI Magnesita India may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, RHI Magnesita India reported free cash flow worth 6.7% of its EBIT, which is really quite low. That limp level of cash conversion undermines its ability to manage and pay down debt.

Summing Up

While it is always sensible to investigate a company's debt, in this case RHI Magnesita India has ₹723.6m in net cash and a decent-looking balance sheet. And we liked the look of last year's 84% year-on-year EBIT growth. So we don't think RHI Magnesita India's use of debt is risky. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example RHI Magnesita India has 2 warning signs (and 1 which is concerning) we think you should know about.

No comments:

Post a Comment