While the differential TCS puts credit cards at an advantage, many forex cards offer a cheaper way to spend abroad.

Come July 1, and forex cards will attract a flat 20 percent tax collected at source, or TCS. That is, you will have to shell out an extra 20 percent at the time of buying or loading your forex card — irrespective of the amount of foreign exchange that you buy. Currently, purchase of foreign exchange (currency and forex cards) only in excess of Rs 7 lakh a year attracts TCS at 5 percent.

International spends via credit cards when abroad, too were brought under the TCS net from May 16, 2023. However, the government later offered relief by allowing international spends of up to Rs 7 lakh per year via debit and credit cards to be exempted from TCS. That is, TCS (5 percent until June 30 and 20 percent thereafter) would apply only beyond the Rs 7 lakh threshold. Forex cards have, however, been offered no such relief.

You can adjust the TCS against your tax liability or claim refund for it at the time of filing your tax returns. Until then, this money remains blocked. The question is: should you carry a forex card when travelling or is a credit card good enough?

Pros and cons

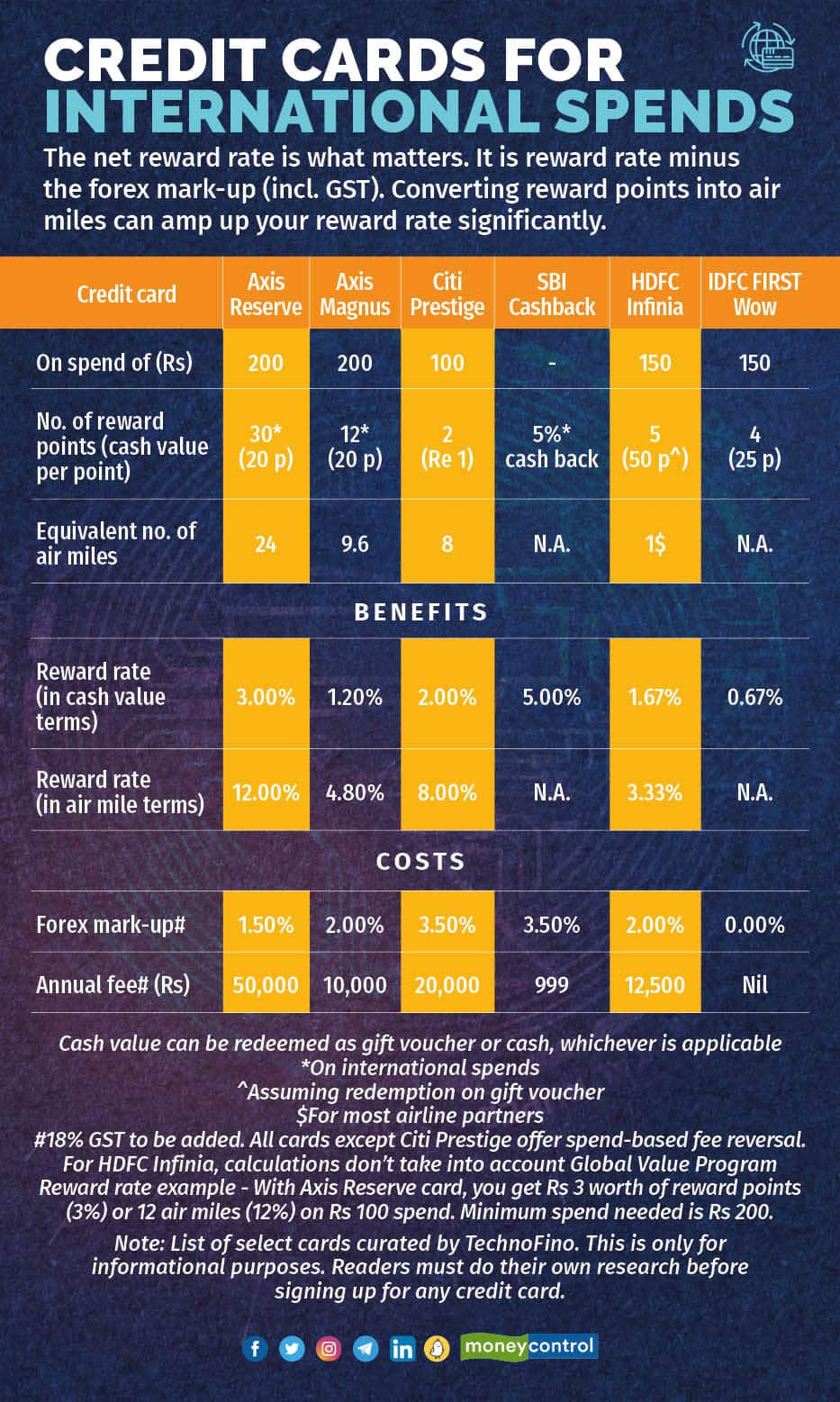

While the differential TCS puts credit cards at an advantage, many forex cards offer a cheaper way to spend abroad. For those who like certainty, forex cards also help them lock into a foreign exchange rate in advance. That said, certain credit cards (see table) can offer you a better deal than forex cards for international spending.

One, there are credit cards that charge zero or a low forex mark-up fee. When combined with the reward points they offer, they can be as good as forex cards in terms of cost. Two, there are credit cards that charge a higher forex mark-up fee (than forex cards) but also offer good reward points and other benefits. Net-net, they can offer you a better deal. If you have one of these credit cards, you may not really need a forex card.

In fact, to get even better return on your credit card, Sumanta Mandal, founder of TechnoFino, a platform that reviews debit and credit cards, suggests that you convert your reward points into air miles for use during your next foreign trip.

There are other advantages that credit cards bring. If you plan to use your credit card, you can avoid the hassle of buying a forex card and later unloading it (or letting your money lie idle). You must encash your forex card before its expiry date to avoid the currency from getting blocked.

In case of a fraudulent transaction, you can file a chargeback claim for a credit card. Ashwin, a credit card enthusiast who tweets at @drgrudge says, “If you lose your credit card and there is a fraudulent transaction, then you can easily file a chargeback claim to reverse it. With a forex card, while you can stop further fraud by blocking your card, getting a fraudulent transaction reversed could be much more difficult.”

Forex cards: what’s on offer

But, when it comes to forex mark-up charges, many forex cards will beat most credit cards. In fact, even within forex cards, buying it from an online forex card provider will fetch you a better deal than buying it from a bank.

BookMyForex and Thomas Cook offer forex cards at zero issuance fee and zero loading fee (when you add forex into an existing card). There is also no forex mark-up fee which is typically levied as a percentage of the transaction amount / amount spent on foreign currency.

But if you buy a forex card from a bank, all these charges are likely to apply. For example, many banks charge a forex mark-up fee of up to 3.5 per cent plus GST — that is, you pay this much more in Rupee terms at the time of loading foreign exchange in the card. Also, unlike online forex websites that show you the exchange rate they will apply, bank websites do not display this on their websites. You will have to contact the bank to get this information.

“We are able to offer forex at very close to interbank rates, which are the live rates at which banks transact. These are the best rates that you can get. Usually banks and money changers charge you a rate higher than the interbank rate. And on this, card issuance and other charges may also be levied,” says Sudarshan Motwani, Founder & CEO, BookMyForex.com.

Note that many forex cards are also marketed as zero mark-up cards even though they may not be so. The exchange rate they offer itself may have an in-built mark-up.

“When getting a forex card, you must read the terms and conditions. For instance, the bank may offer zero markup fees but may include this fee in its conversion rate. Some card issuers may have prerequisites such as maintaining a high TRV (total relationship value) or opening a fixed deposit with the bank to issue a forex card.” says Adhil Shetty, CEO, BankBazaar.com.

The simplest way, therefore, is to compare how much Rupees you are being charged for every unit of foreign currency. This can vary slightly across different websites.

Credit cards for international spends

If you look beyond forex mark-up alone, there are credit cards (see table for more details) that you can consider for your international spending.

Take for example, the IDFC FIRST Wow credit card that does not charge any forex mark-up fee on international spends. There is also no joining or annual fee, and you can collect 4 reward point for every Rs 150 spent on the card. But you need to maintain a fixed deposit with the bank — you get a credit limit of at least 100 percent of your fixed deposit value. “Unless someone has a bad credit history, it is easy to get this card as it is a secured card,” says Mandal.

Others may find RBL Bank’s World Safari credit card useful. The card comes with zero mark-up fee and an annual fee of Rs 3,000. While you earn no reward points on international purchases, you earn travel points on your domestic spends that can be redeemed for air travel and hotel stays. The card also provides you complimentary travel insurance.

At the other end, there are high-end credit cards that can fetch you reward points on international spends at an accelerated rate. Take for example, the Axis Reserve credit card and Citi Prestige credit card, both of which offer 2X the reward points on international spends than on domestic spends. These cards charge an annual fee of Rs 50,000 and Rs 20,000 (plus GST), respectively. The Axis card waives the annual fee if you spend at least Rs 25 lakh in the preceding year. Mandal points out that Axis Bank’s Magnus credit card can turn out to be even better than the Reserve card as it offers 25,000 bonus points (worth Rs 5,000 or 20,000 air miles) to those who spend Rs 1 lakh a month on the card. This is in addition to the 12 reward points per Rs 200 of spend that you can earn on the card.

And then, there are cards such as HDFC Infinia and HDFC Diners Club Black that fit somewhere in the middle – relatively lower annual fee for some benefits.

So, if you are a frequent traveller, it may be worth your while to evaluate some credit cards that are good for international spending. But do a cost-benefit analysis as some of these credit cards come with very high annual charges. On the other hand, if you are unlikely to take frequent foreign trips, you can simply buy a forex card online for your one-time trip.

No comments:

Post a Comment