Despite record-high interest rates, small bank failures in the US, sticky inflation, and a perennially hawkish Federal Reserve, the stock markets have remained resilient in India and advanced economies. Nifty 50 is trading near an all-time high with mid and small caps participating in the recent rally, and the Dow Jones and S&P 500 have recovered much of the ground lost last year. China has started cutting interest rates, while many central banks, including the Reserve Bank of India (RBI), have maintained a pause.

From the lows of 28,666 hit on October 13, 2022, the Dow Jones has rallied nearly 21% now. A rise of more than 20% typically indicates a bull market. Nifty 50 has run up around 24% between the June 2022 low and near 18,900-level it is currently trading at. Analysts are now forecasting growth to exceed expectations in Asia, driven by India, Indonesia, China, and Japan.

However, the questions remain: Are we in a goldilocks scenario, where stocks continue to rise this year despite high rates and sticky inflation? Or are investors ignoring grave risks that lurk below the surface?

This is even more relevant now that the

Fed is expected to raise rates twice more, by at least 50 basis points, going into the year, instead of the earlier expectation of rate cuts during the second half of 2023.

Rate-cut projections have now been pushed beyond March 2024 and after. This would possibly lead to a stronger dollar, a key negative for equities.

Morgan Stanley, the global leader in equity investing and trading, believes much of the over 20% rise in US equities since October last year is actually a bear-market rally, and that the equities could trip to new bear-market lows.

In this view, there are now several warning signs that the bear-market rally may have finally exhausted itself after eight months. And disappointment will emerge slowly from weaker company earnings or some exogenous shocks. This article has been put together by listening to several recent podcasts on Morgan Stanley’s

Thoughts on the Market channel.

Before that, let us delve into Morgan Stanley’s India equity view, which is at variance with its US market view.

The India view

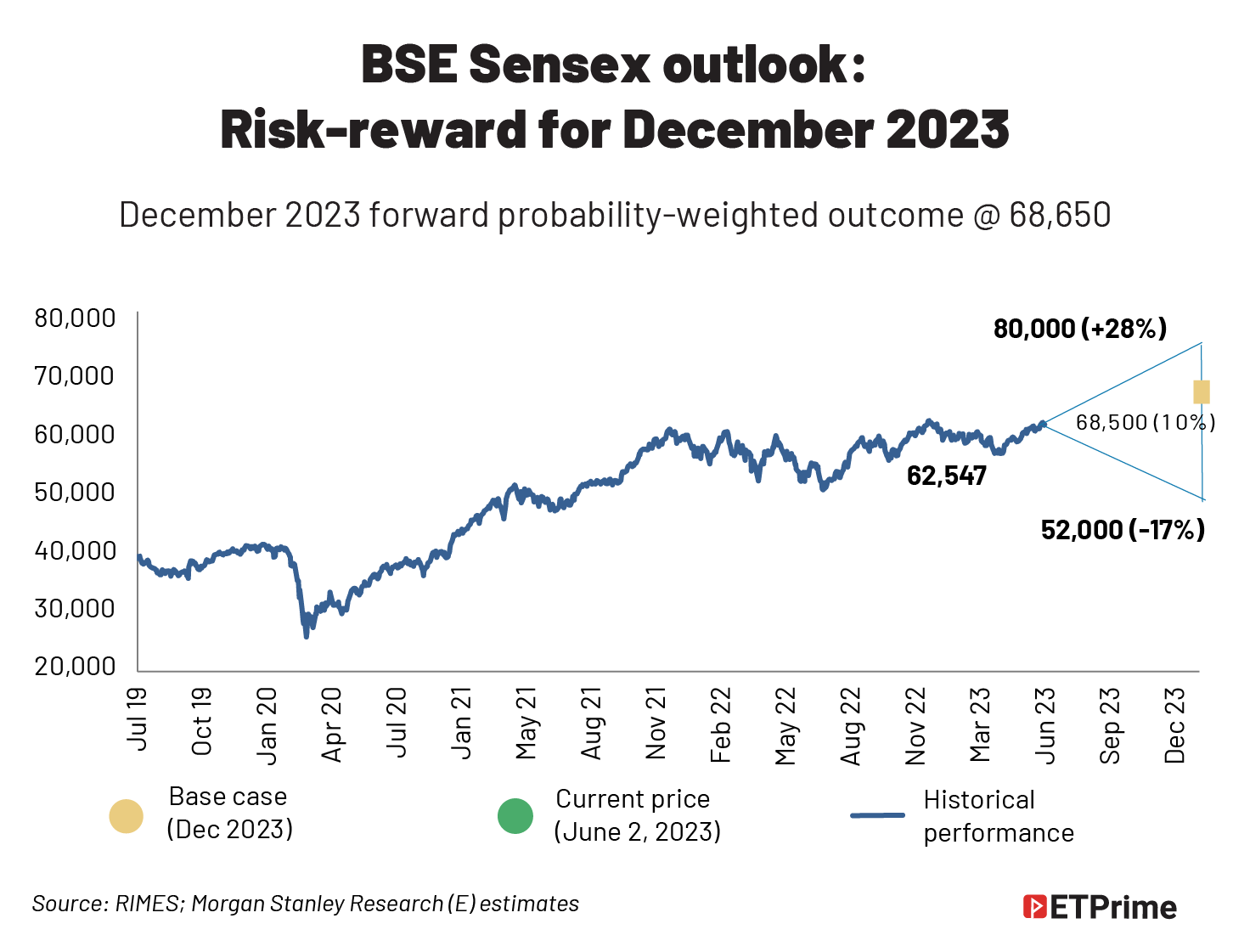

In its June 5, 2023, research report titled ‘India Equity Strategy Playbook: India’s Transformation and Its Implications’, Morgan Stanley has given

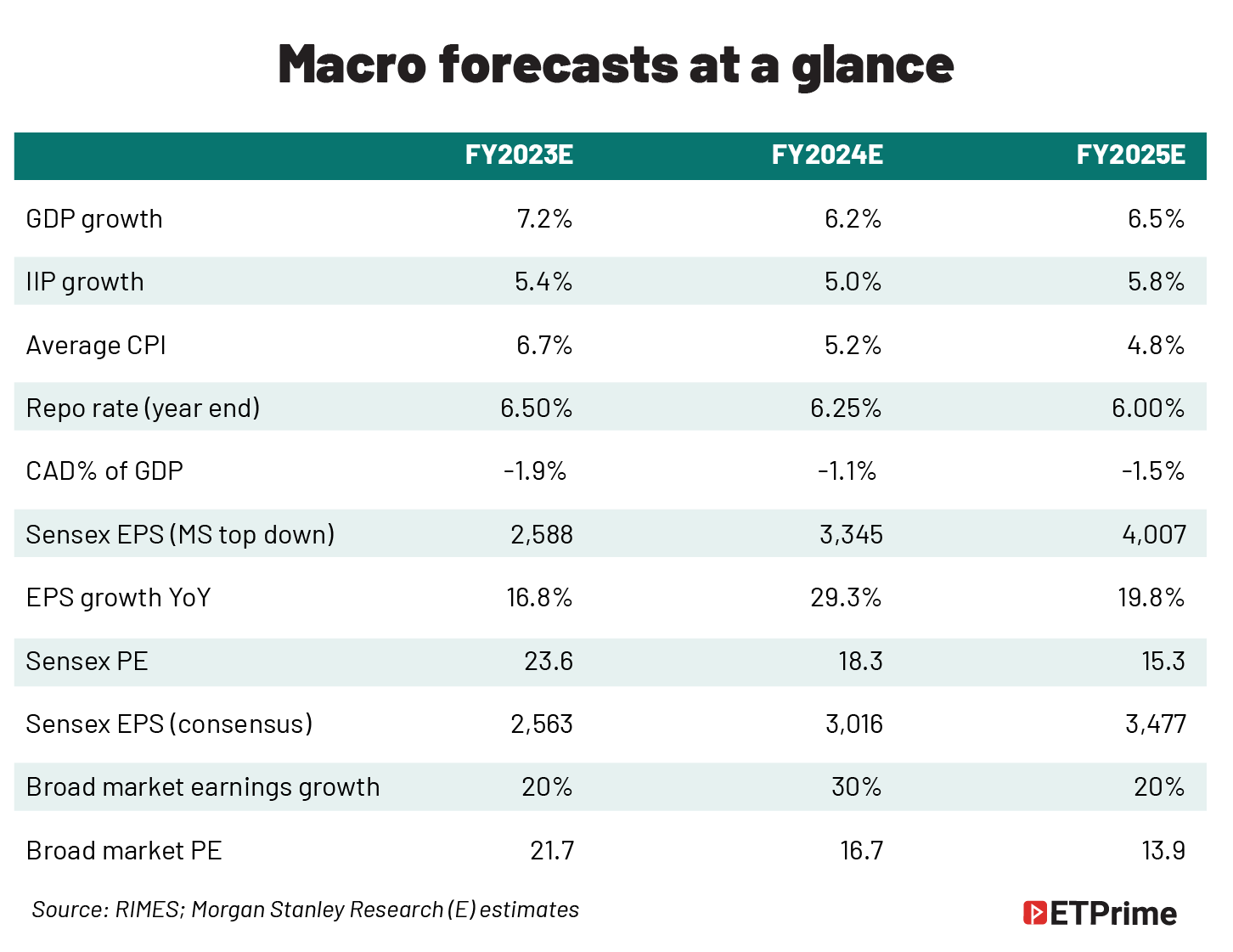

BSE Sensex a target of 68,500, implying a potential upside of 10% to December 2023. This level suggests that the BSE Sensex will trade at a trailing P/E multiple of 20.5x, ahead of the 25-year average of 20x, with the premium over the “historical average reflecting greater confidence in medium-term growth,” it said.

India’s manufacturing and capex are resurgent, exports are rising, the current account is becoming more benign, consumption is undergoing radical shifts and interest-rate cycles are likely to become shallower, the report said.

“The concomitant profit book, lower return correlation of equities with oil and US growth/Fed cycles, and a lower beta to EM (emerging markets) set India up for strong equity markets, albeit relative valuations remain rich, and India’s low-beta status implies it underperforms an EM bull market even as India offers much stronger relative earnings growth and is also likely to benefit from the troughing of the real rate gap with the US,” it said.

Top reasons for a bearish view on the US

Morgan Stanley’s October 2022 call for the start of a bear-market rally was based on two assumptions: the US dollar was peaking, and market concerns around the Fed and terminal rate also had peaked. But it now projects a stronger dollar, and the S&P 500 has become very negatively correlated to the dollar over the last decade.

And the Fed is not yet done with hiking rates.

“Not a single person on the committee (FOMC) wrote down a rate cut this year, nor do I think it is at all likely to be appropriate if you think about it,” Fed chairman Jerome Powell said on June 14, adding that rate cuts are probably a “couple of years out”.

Earnings pessimism and the 1946 parallel

“We don't find much value in the 20% threshold for declaring new bull markets. Instead, our conclusion is driven more by the fundamentals, valuations, and expectations relative to our outlook. In short, our earnings view is much more pessimistic than the current consensus expectation, which is now assuming a second-half reacceleration story,” Mike Wilson, chief investment officer and chief US equity strategist for Morgan Stanley, said on June 12.

The investment bank said there are several historical instances of bear-market rallies that exceeded the 20% threshold, only to eventually give way to new lows.

“After the boom in 1946, following the end of the war, the S&P 500 corrected by 28%, followed by a 24% choppy bear-market rally that lasted almost eighteen months before succumbing to new lows a year later. Thus far, it appears similar to the current bear market, which corrected 27.5% last year and has now rallied 24% from its intraday lows, but is still 10% below the highs,” said Wilson.

Slow drag or exogenous shock

Wilson says that market sentiment and positioning are now 180 degrees from where they were on January 1, and stocks are no longer set up for the disappointment that is coming in the form of much weaker-than-expected earnings this year. This could bring an end to the current bear-market rally.

“This reset can happen either slowly as companies miss expectations one by one, or quickly from another exogenous shock that is just too much for the market to absorb. In that latter case, the equity risk premium is likely to spike, price-earnings multiples are likely to fall sharply, and we may make a new bear market price low before estimates fall in earnest,” he said.

"Not a single person on the committee (FOMC) wrote down a rate cut this year, nor do I think it is at all likely to be appropriate if you think about it"

— Fed Chairman Jerome Powell

According to Matthew Hornbach, Morgan Stanley's global head of macro strategy, a key risk of hard landing in the US and then faster disinflation also in the US, should keep macro markets on the defensive. The rates market volatility at present “under-appreciates the multitude of risks that lie ahead.”

“The lack of negative headlines around regional banks in the US has made investors complacent about bank stresses being behind us. However, key data points on bank balance sheets show that things have worsened on the margin since March,” Hornbach said on June 20.

The US economy grew 1.3% in the first quarter and has added 1.6 million new jobs year-to-date. But it's the coming quarters, specifically the next three to six months, where Morgan Stanley economists see the “weakest stretch of economic activity” as full effects of rate hikes take hold and bank failures lead to tighter lending conditions for an extended period.

Quantitative tightening

A component of tighter monetary policy was the so-called “quantitative tightening” or reduction of central bank balance sheets. This was expected to lead markets lower, as liquidity is sucked out of the system. However, exactly the opposite has happened, as global central banks infused liquidity in one way or the other on a net basis.

“Year-to-date, the aggregate bond holdings of the world's central banks have actually risen, not fallen, thanks to continued easing from the Bank of Japan and support for the US banking sector from the Federal Reserve. That should now change going forward, with these balance sheets shrinking, giving us a better measure of the true impact,” Andrew Sheets, chief cross-asset strategist for Morgan Stanley, said on June 14.

Quantitative tightening involves two steps; one is to let the bonds or securities mature; and two, sell securities in the market and suck out liquidity. The withdrawn liquidity is then cancelled in the books of the US Fed, thereby reducing the size of its balance sheet.

“Markets have been resilient year-to-date, a welcome respite from a poor 2022. We don't think, however, that this resilience is yet proof that markets have successfully answered the question of what the impact of lower growth, tighter policy or tighter bank credit will be. Rather, these questions are still sitting there, waiting to be answered over the next several months,” he said.

Bulls may better be watchful of the central bank hawks and possible bear attacks.

(Graphics by Mohammad Arshad)

No comments:

Post a Comment