By Subhadip Sircar and Matthew Burgess

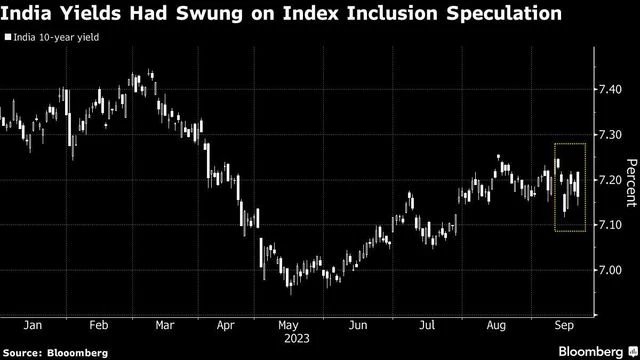

JPMorgan Chase & Co. will add Indian government bonds to its benchmark emerging-market index, a keenly awaited event that could drive billions of foreign inflows to the nation’s debt market.

The index provider will add the securities to the JPMorgan Government Bond Index-Emerging Markets starting June 28, 2024. The South Asian nation will have a maximum weight of 10% on the index, according to a statement Thursday.

Index inclusion follows “the Indian government’s introduction of the FAR program in 2020 and substantive market reforms for aiding foreign portfolio investments,” the team led by the firm’s global head of index research, Gloria Kim, said in a statement. Almost three-quarters of benchmark investors surveyed were in favor of India’s inclusion in to the index, they said.

India’s addition to a major global gauge will give global investors greater access to the world’s fastest-growing large economy that offers some of the highest returns in the region. The inclusion may also prompt flows of as much as $30 billion, according to HSBC Holdings Plc.

)

No comments:

Post a Comment