“You can’t live with it, or without it.”

Chirag Taneja, co-founder and CEO of GoKwik neatly summed up a big problem Internet commerce is facing in India — failed deliveries. Known in e-commerce jargon as RTO (return to origin), this is increasingly becoming a big headache for the industry.

The reasons behind RTOs can be many. Non-availability of the customer to receive the shipment, customer cannot be contacted at the time of delivery, incorrect address, order being cancelled because the customer changed his mind while the shipment was in transit. Many times, the shipment reaches the address, but the customer refuses to accept the delivery as he doesn’t want the product anymore.

To be sure, RTO is not a new problem for e-commerce in India, but as the market has expanded multifold beyond established online marketplaces to vertical commerce, D2C (direct-to-consumer) and social commerce brands, it has become a much bigger problem.

“It is a necessary evil to be tackled if you have to do e-commerce in India,” Taneja adds. GoKwik, like other tech startups such as Pragma and LimeChat, is in the business of providing RTO-reduction tools to D2C brands.

So, how can companies fix this problem? Before we get there, let’s understand the genesis of the problem.

Bought it, but don’t want it

In industry parlance, when an item is either returned or not delivered, the process is called reverse logistics. There are two parts to it. One, when the customer receives the delivery and then places a request for return. The other is RTO when the customer doesn’t receive the delivery and hence the product has to be shipped back to the warehouse or the seller’s location. In e-commerce jargon, the former is called reverse pick-up (RPU). In the e-commerce industry, RPU is estimated at up to 5% of overall shipments, while RTOs are much higher at 40% to 50%.

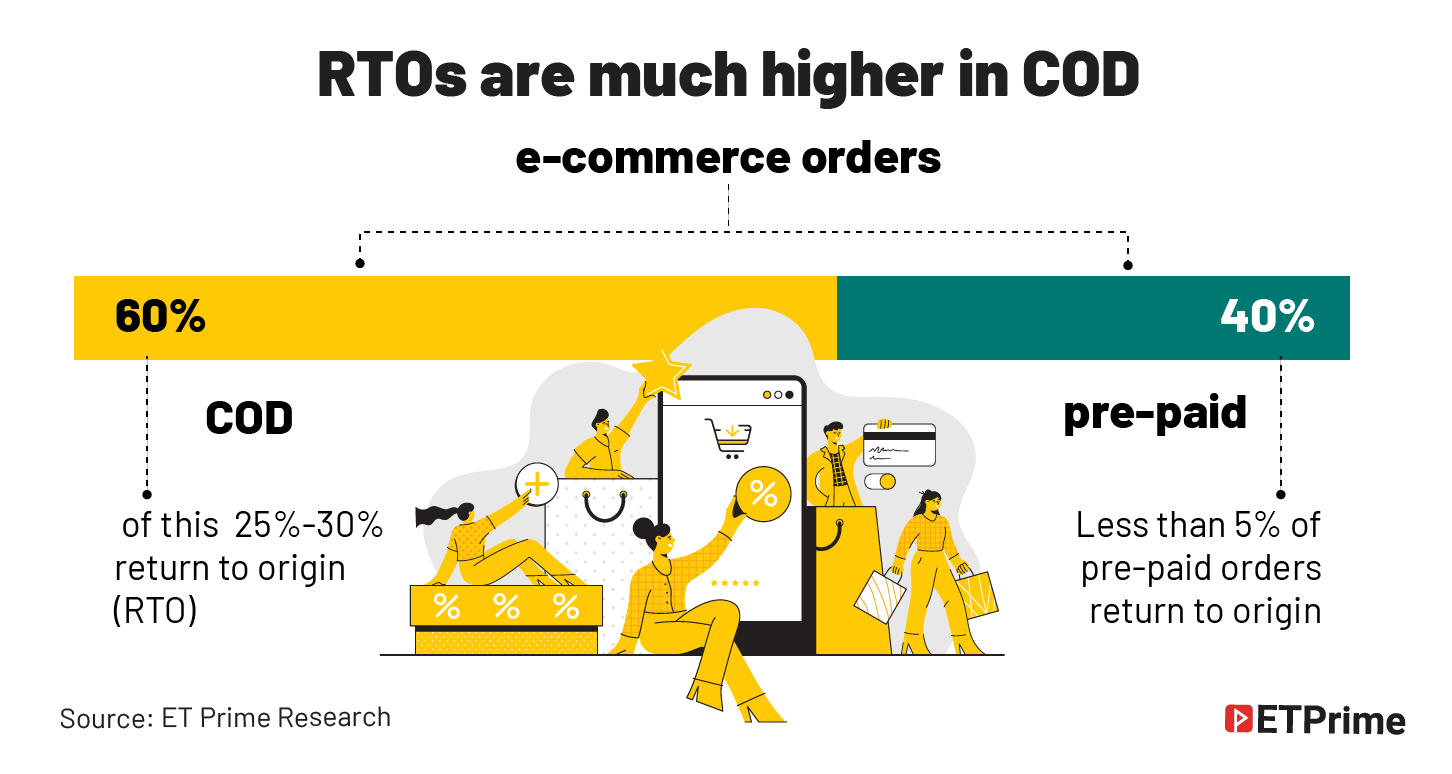

In India, close to 60%-65% of e-commerce orders are COD. Of this, about 25% to 30% turn RTOs. In contrast, unsuccessful deliveries in the pre-paid order category range from 2% to 3 %. That’s because the customer’s intent to actually buy the product may be fickle when placing the order under COD, leading to higher rate of order cancellations.

“COD dominates e-commerce even with the big push for digital payments like UPI. Even though e-COD or payment via digital means at the customer’s doorstep has become very prevalent, it still classifies as COD” says Vishwachetan Nadamani, chief operating officer at Ecom Express.

Developed economies that don’t have COD and only work on pre-paid transactions face other problems but not RTOs. Besides India, some other markets do have cash on delivery like Saudi Arabia, the UAE, Indonesia, and Philippines. In countries like the UAE and Indonesia, RTOs are 15%-20% of COD orders.

RTOs are a much more complicated problem in India with COD still being the biggest payment method for e-commerce.

In developed economies, the customer’s natural behaviour is around placing the order only if they want it. But in India, the intent is to save as much as possible and keep exploring for the best product. “Customers know if they place a COD order, they don’t have to worry. Even if they have placed an order, they keep searching for a price discount and cancel an existing order if they find a better deal on another platform,” says Ankush Jindal, associate director at Shiprocket, an e-commerce logistics aggregator.

A pain point for new D2C brands

RTO impacts all e-commerce platforms, but the problem is acute for new D2C brands, and it makes a significant dent on their books if 25% to 30% of COD orders become RTO. Social commerce as a broad category is very high on RTOs, going up to 35% to 40%.

Sellers need to bear the additional cost for the return journey of the shipment, besides the freight for the forward journey of the item. “If a seller pays, say, INR100 for the forward freight, then the least RTO freight would be INR45-INR50. Bigger brands that have larger volumes of orders can negotiate for lower rates with the logistics company,” says Jindal. Also, since the return shipment takes much longer than the forward journey, products get stuck for days or get damaged. So, the seller may lose inventory, and in many cases, customers too.

Order cancellations to a certain extent depend on at what stage the brand is. For large D2C brands like BoAT, Mamaearth, mCaffeine or gadget brand Noise, RTOs are low because they have gone through the learning curve on what causes failed deliveries — is it to do with their product pricing or their choice of courier partners. Also, customer intent for established brands has matured to a certain extent. These are not the brands that people would want to merely try and see. Jindal of Shiprocket gives one example. “In the last six months, Adivasi Hair Oil has grown so big that we have seen their RTOs reducing gradually. Also, the brand is investing towards improving its last-mile services and delivery timelines.”

On the other hand, for big brands, even a 5% RTO rate is significant. Since their volumes are much higher, their total RTO costs are also huge. So, if they are making INR100 crore, their logistics costs would be INR8 crore to INR10 crore. Saving 5% of this on a monthly basis is a huge saving.

There is a category nuance to it as well. While the value-fashion category has 18%-20% returns, it is lower for the discounted branded fashion category (5% or less). Beauty and personal care items also see around 5% cancellations since they are considered borderline essential.

The e-commerce industry has gone through a learning curve to tackle RTOs. Earlier, RTOs were believed to be a logistics problem to the extent of 80%. But actually it is a 50:50 problem from both the logistics side and the consumer side.

Profiling the customer: Opportunities and challenges

When it comes to solving customer-related issues, brands follow a three-pronged strategy: pre-purchase, purchase, and post purchase.

“We need to tackle it from the top of the funnel. You must figure out if you are really selling to a customer with the right intent and how do you lock them in,” says Taneja of GoKwik.

But how does one get a clue about a customer’s real intent?

Use of technology can come in handy here.

Creating a customer’s profile based on historical data on the numbers of orders accepted and cancelled has been the core strategy. This information can be used to predict the probability of a customer cancelling a particular purchase on a real-time basis. If it turns out to be a very high-risk transaction, there are various interventions that can be done.

Also, correcting wrong or incomplete addresses at the source can also go a long way in keeping RTOs under check. Logistics companies like Ecom Express and Delhivery have developed their AI-based address-correction tools to correct wrong addresses.

An important part of locking customer intent is to add safeguards to the ‘COD option.’ The safest intervention is the ‘no-COD’ option to the very high-risk customers. A popular solution is part-pay, asking the customer to pay a small percentage of the order digitally while the remaining can be paid on COD. This can work to retain orders from very high-risk to medium- or low-risk customers.

Some brands ‘lock the intent to buy’ by placing a fee on COD order and offer a discount on the prepaid consumer so that risky consumers shift to prepaid. In the case of COD orders, some brands, especially the small ones, manually call the customer to confirm the order or confirm the order via an OTP.

Amazon and Flipkart already have a lot of analytics based on PIN codes and customer’s behavioural history using which customers are tagged as ‘very high risk.’ In several such cases the platforms will accept only prepaid orders.

However, using historical data of customers for predicting RTOs has a catch. Experts say using tech tools can lead to brands losing a certain number of orders though their number of successful deliveries may increase.

Nadamani of Ecom Express brings up another challenge for effectively profiling customers. “Both logistics companies as well as e-commerce platforms maintain consignee profiles based on historical data. But so far, we have not seen a good amount of coordination between these two. If these two players can coordinate, it can become a powerful tool to predict an RTO.”

Also, using the buying behaviour of a customer on an existing brand to predict his intent for a new brand would be very different. Similarly, prediction tools will have challenges for new users of e-commerce.

Each RTO-saving tool is trying to solve a small piece from different aspects of the order journey, thus saving RTOs by a very small percentage.

For logistics companies, low RTO rates are a key value proposition for D2C brands. Logistics companies are contractually obligated to make three attempts for making a delivery. In case of customers refusing to accept a delivery, companies use an OTP-based mechanism allowing customers to refuse a delivery and thereafter the delivery boy returns the shipment back to the dispatch centre.

All logistics companies are going through their learning curve. Many RTOs happen because of pure inefficiencies, say speed of delivery gone wrong as opposed to what was promised to the customer. If a shipment gets delayed beyond the promised timeline, the chances of an RTO happening keep increasing.

Companies are also pushing the pedal on improving contact with customers. Ecom Express is working on a ‘contactability suite’, likely to be launched by June this year wherein the company will have a direct communication channel with the customer, parallel to what the delivery boy has with the customer communication channel to aid successful deliveries.

The final cut

The twin conveniences of COD and ‘easy returns’ have led to the explosive growth of the e-commerce industry in India. But Nadamani of Ecom Express stresses that companies need to strike a fine balance between going maniacal over reducing RTOs versus customer convenience. For a good customer with a genuine reason, there should be no problem in cancelling an order.

While different brands have their own appetite for reducing RTOs, depending on how much GMV (gross merchandise value) they want to lose, the problem will exist as long as COD thrives in India and companies don’t find a balanced tool that will alert them about a customer’s real intent to buy.

(Graphics by Sadhana Saxena)

No comments:

Post a Comment