By Taruna Nagi ET Dec 26 2016

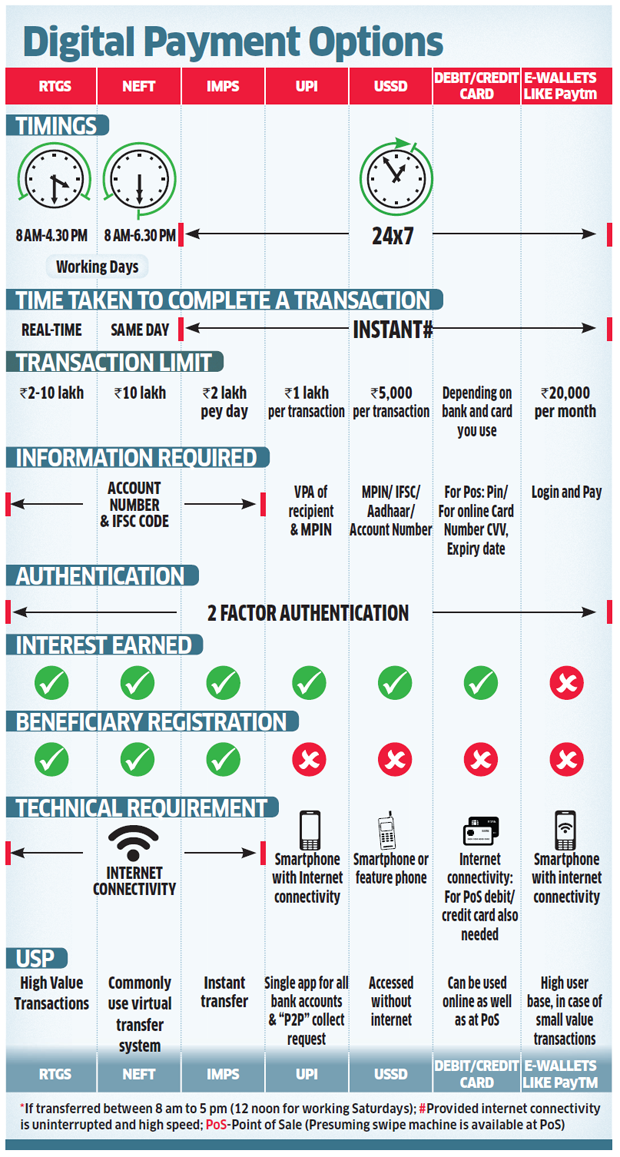

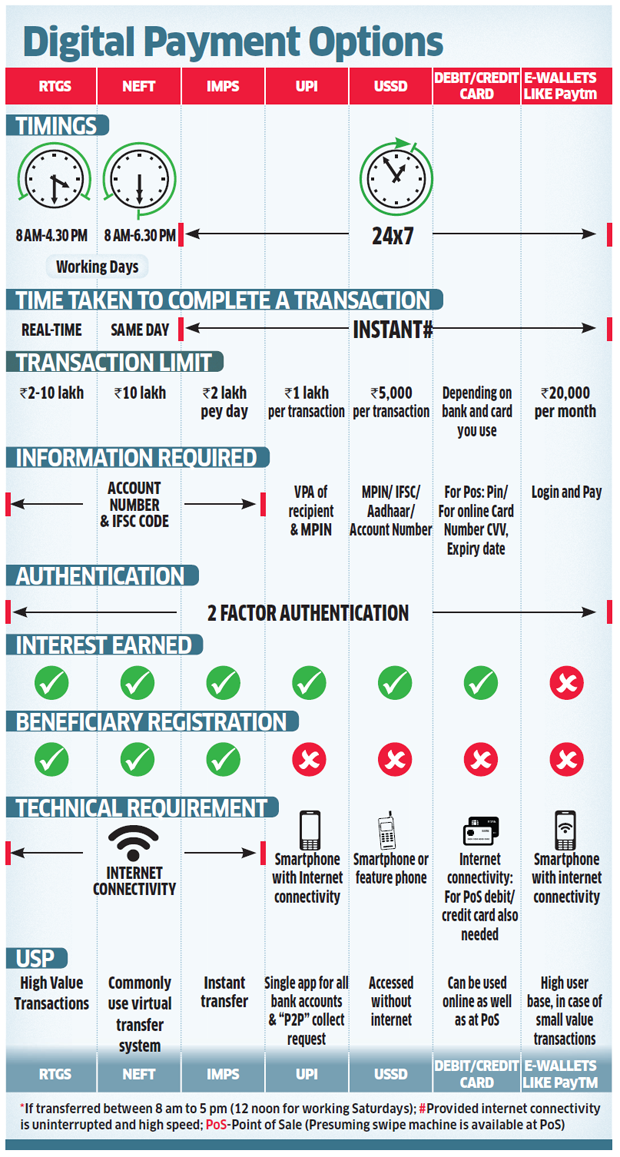

Since November 8, every Indian has only one thing on mind:

the dilemma of choosing a safe, secure, convenient and cashless payment option. Currently available cashless payment

systems include credit/debit cards, e-wallets such as Paytm, Unified Payment Interface (UPI), IMPS, USSD, RTGS, and

NEFT. Which one should you use and for what

kind of transactions? Here’s how you can decide.

We have compared them all on eight different parameters to

help you choose what suits you best:

1. Time taken to complete a transfer/payment;

2. The maximum amount you can transfer;

3. The financial details/information (e.g. account number

etc) that you need to complete the transfer;

4. How is the transaction validated/authenticated;

5. Whether you will earn interest on the money kept in

reserve in the payment system?

6. Whether you need to specify who the money is being

transferred to in advance i.e. register the beneficiary (recipient) of the money (beneficiary registration);

7. What infrastructure/technical support is a must for the

transfer to happen

8. And lastly, what are the costs involved There is no single

‘best’ payment option for everyone and all transactions.

However, you could try to pick a payment option suitable for your purpose. Below is an overview of the comparison analysis.

VALUE OF TRANSACTION

One way of choosing a payment option is to base your decision on the value of the transaction. As opening user accounts, creating passwords for various payment solutions is very cumbersome; a practical way would be to choose at least two of these applications — one for high- value transactions and other for small value transactions. You could divide the payment solutions into two categories and choose from RTGS/NEFT/debit and credit cards for transactions of over, say, Rs 10,000 and from– IMPS/UPI/USSD/e-wallets for payments below Rs 10,000. However, the value of transaction is not the only deciding factor: safety and ease of use are some of the other important parameters.

One way of choosing a payment option is to base your decision on the value of the transaction. As opening user accounts, creating passwords for various payment solutions is very cumbersome; a practical way would be to choose at least two of these applications — one for high- value transactions and other for small value transactions. You could divide the payment solutions into two categories and choose from RTGS/NEFT/debit and credit cards for transactions of over, say, Rs 10,000 and from– IMPS/UPI/USSD/e-wallets for payments below Rs 10,000. However, the value of transaction is not the only deciding factor: safety and ease of use are some of the other important parameters.

AUTHENTICATION

In terms of authentication, standard security procedure,

which is two-factor authentication, is followed in case of all these alternatives. It refers to login ID and password set up

by you coupled with something that only you can provide — a PIN or an OTP (normally sent to your registered mobile

number or email address). In the upcoming versions of UPI, an additional level of authentication i.e. biometric

authentication (using your smartphone scanners) is proposed to be introduced.

NETWORK SAFETY

Apart from this, how safe your transaction is would also

depend upon where and which network (public/private Wi-Fi or mobile data) you are using to make the payment transfer.

Most people have several apps installed on their smartphones and almost all phone apps require access to

various information/data stored on your phone. In such instances, smartphones could be more susceptible to

hacking/internet virus/malware etc depending on the type of firewall installed on

them.

Consequently, it would be wise to restrict using your

smartphone to make money transfers to smaller amounts. The Reserve Bank of India has already limited the maximum amount

that can be transacted via e-wallets and USSD to smaller values – Rs 20,000 per month and Rs 5000 per

transaction, respectively.

Transaction limit for UPI is slightly higher than these but

still limited in comparison to NEFT/RTGS etc.

TECHNICAL REQUIREMENTS FOR MAKING THE DIGITAL TRANSACTION

All the digital and cashless payment alternatives mentioned

above require internet connectivity except for USSD —the only payment system usable on smartphones or feature

phones without internet connection. National Unified USSD Platform (or NUUP) is a mobile banking service based on

USSD technology launched by NPCI. NUUP or*99#, as it is commonly called, is perhaps more suitable for

the population with limited or no internet connection at minimal charges that are capped by TRAI at Rs 0.50 per

transaction.

PRESENCE OF THIRD PARTY OR INTERMEDIARIES

Paying through an e-wallet means presence of a third party

between the payer and the payee. One should keep in mind, that regulations governing e-wallet providers are

different from those governing banks. However, there is an added advantage in case of e-wallets i.e. they provide an

e-commerce platform as well (e-wallets such as Paytm and Freecharge also sell goods and services online just like

Amazon and Flipkart), which is not the

case with any otheralternative discussed here.

The sudden cash crunch due to demonetisation of Rs1000 and Rs

500 notes required a payment platform that was used by all. In our case, ewallets such as Paytm and Mobikwik

were quick to grab this opportunity. Paytm currently has over 160 million users and is accepted by around 15 lakh

merchant locations, as reported on December 13,2016. These figures are huge in comparison to the user base

of similar solutions provided by National Payments Corporation of India (NPCI) such as Unified Payment Interface

and USSD based National Unified USSD Platform (those figures are in lakhs and thousands).

INFORMATION REQUIRED TO MAKE THE PAYMENT

Sharing financial credentials on virtual platforms tends to

always have some inherent risk. Cyber crimes in India have surged around 350% between 2011 and 2014, according to a

joint study by Assocham and PwC released in August 2016. Requirement of the hour is robust and resilient

security protocols coupled with minimum amount of credentials shared on these platforms.

Unified Payment Interface, or UPI, provided by various banks

could be considered safer than other modes in this respect. In case of UPI, one needs to enter only the Virtual

Payment Address, or VPA, of the recipient, which is more secure and easy than sharing credentials such as account

numbers and IFSC codes.

How it Works In UPI, money directly goes to and from your bank

account kicking out the intermediary i.e. e-wallet operators. Money stays in your account until the transaction

is complete, which means you earn interest on it. To make a transaction on this platform, a Virtual Payment

Address, or VPA, is generated, which can be unique for all your linked bank accounts on the interface or only one

account — your choice. In case you want to have a different VPA for every account, be ready to remember all of

them. All you are sharing with other people/merchants is your

virtual ID, instead of important credentials. Launched with a

bang, this e-payment tool is yet to gain popularity in the

already congested digital payments market. One reason may be that it has been taken as just another app for digital

payments by users. Once the flexibility of this application is better understood, its user base is expected to go through

the roof, beating e-wallets.

Costs Due to demonetisation, the government has been

frequently slashing fees or commissions charged by various e-payment solution providers to encourage a cashless economy.

As of date, these are the maximum fees/commission your bank/intermediary could charge to

transact virtually. However, charges are leviable on use of debit card: charges for online payments of up to Rs 2,000 are

capped at 0.75% and for payments above Rs 2,000 charges are capped at 1%. Transaction charges on credit cards

average around 2.5%.

As for e-wallets, currently there are no charges for

transactions. However, fees could be charged if you transfer money back from your wallet to your bank account. As of now,

there are no such charges. The objective of having no charges in case of UPI and ewallets such Paytm is capturing

user base. Once a substantial chunk of the market is captured and sustained by them, these payment systems could

increase their fees gradually, although such an an increase is unlikely before this cash crunch is over.

In terms of cost, for instant digital payments up to Rs 1

lakh, UPI and e-wallets seem like better option and above Rs 5 lakh, NEFT is cheaper, but there is a trade off with the

time taken to complete the transaction.

No comments:

Post a Comment