Buyer credit is a short term credit available to an importer (buyer) from overseas lenders such as banks and other financial institution for goods they are importing. The overseas banks usually lend the importer (buyer) based on the letter of comfort (a bank guarantee) issued by the importer's bank. For this service the importer's bank or buyer's credit consultant charges a fee called an arrangement fee.

Buyer's credit helps local importers gain access to cheaper foreign funds that may be closer to LIBOR rates as against local sources of funding which are more costly.

The duration of buyer's credit may vary from country to country, as per the local regulations. For example, in India, buyer's credit can be availed for one year in case the import is for tradeable goods and for three years if the import is for capital goods.

Benefits to importer

- The exporter gets paid on due date; whereas importer gets extended date for making an import payment as per the cash flows

- The importer can deal with exporter on sight basis, negotiate a better discount and use the buyers credit route to avail financing.

- The funding currency can be depending on the choice of the customer and availability of LIBOR rates in the exchange market.

- The importer can use this financing for any form of payment mode; open account, collections, or LCs.

- Hedging might be required as foreign currency is involved hence making Buyer's Credit a risky affair at times.

Steps involved

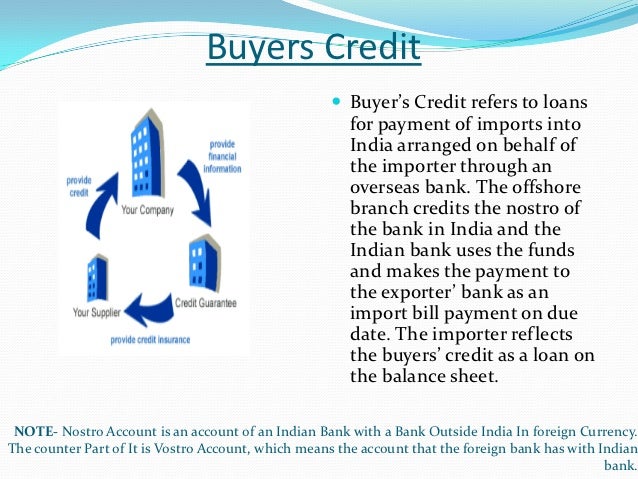

The customer requests the buyer's credit arranger to arrange the credit before the due date of the bill

- Arrange to request overseas bank branches to provide a buyer's credit offer letter in the name of the importer. Best rate of interest is quoted to the importer

- Overseas bank to fund Importer's bank Nostro account for the required amount

- Importer's bank to make import bill payment by utilizing the amount credited (if the borrowing currency is different from the currency of Imports then a cross currency contract is utilized to effect the import payment)

- Importer's bank will recover the required amount from the importer and remit the same to overseas bank on due date.

- It helps importer in working capital management.

Cost involved

Interest cost: is charged by overseas bank as a financing cost

- Letter of Comfort / Undertaking: Your existing bank would charge this cost for issuing letter of comfort / Undertaking

- Forward Booking Cost / Hedging cost

- Arrangement fee: Charged by person who is arranging buyer's credit for buyer.

- WHT (Withholding tax): The customer may have to pay WHT on the interest amount remitted overseas to the local tax authorities depending on local tax regulations. In case of India, the WHT is not applicable where Indian banks arrange for buyer's credit through their offshore offices.

Risk involved

Buyer's credit is associated with Currency Risk

BUYER’S CREDIT FLOW

Steps Involved

- The customer will import the goods either against LC, DA/DP or Documents

- Customer sends the required details to us for arrangement of buyer’s credit quote.

- We approach and negotiates to our network of 125 banks for the best quotation of buyers credit.

- After confirmation of the quotation from client we arrange Quote Letter and LOU (Letter of Undertaking / Comfort)

- Client’s banker needs to send the LOU (LOU Sample) through SWIFT message in the format of the financing bank.

- On the receipt of LOU financing bank will do the funding either in the NOSTRO account of LOU issuing bank or directly in the supplier’s bank.

- Once funds come in the NOSTRO account client’s banker will make import bill payment (if the borrowing currency is different from the currency of Imports then a cross currency contract is utilized to effect the import payment)

- On maturity date Importer’s bank will recover the required amount from the importer and remit the same to overseas bank on due date

No comments:

Post a Comment