ET Bureau|

Updated: Nov 18, 2017, 12.30 AM IST

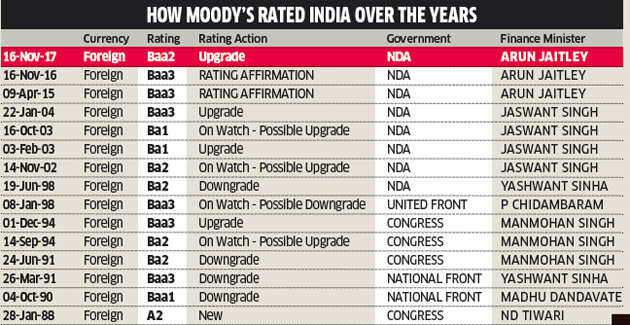

Moody's Investors Service upgraded India's sovereign credit rating a notch for the first time in nearly 14 years on Friday. The US-based agency upped India's rating to Baa2 from Baa3, changing outlook to 'stable' from 'positive', seen as a boost to the Modi government's reform agenda. Moody's morning surprise brought cheers to corporate leaders who hailed the move as reaffirmation of the government's reforms push.

The rating agency has hailed wide-ranging economic and institutional reforms of the BJP government over the last three, citing them as the big reasons for the upgrade of India’s sovereign rating. ET takes a look at the action and its implications:

RATING UPGRADE

Baa2 from Baa3: Government of India’s local and foreign currency issuer ratings

Stable to positive: outlook on rating

Baa2 from Baa3: Local currency senior unsecured rating

P-2 from P-3: Short-term local currency rating

Baa1 from Baa2: Long-term foreign currency bond ceiling

Baa2 from Baa3: Long-term foreign currency bank deposit ceiling

Unchanged at P-2: Short-term foreign currency bond ceiling

P-2 from P-3: Short-term foreign currency bank deposit ceiling

Unchanged at A1: Long-term local currency deposit and bond ceilings

BEHIND CHINA, AHEAD OF OTHER IN BRICS

* India is the largest economy among all Baa2-rated sovereigns

* The Philippines is the only other Baa2-rated country in Asia

* Italy, Spain and Bulgaria are the only Baa2 economies in Europe

* 3 notches — Gap with China’s sovereign ratings (A1 | A2, .A3, Baa1| Baa2)

* India ahead of other BRICS — Russia-Ba1, South Africa-Baa3, Brazil-Ba2

* Among BRICS, only India, China and South Africa are investment grade

* On a PPP basis, India’s GDP per capita has outstripped the Baa-rated median (19 countries)

* Between 2006 and 2016, this grew 108% vs. 74% for Baa-rated median

WHAT COULD CAUSE A DOWNGRADE

* Material deterioration in fiscal metrics

* If the health of the banking system deteriorates significantly

* External vulnerability increases sharply

INVESTMENT GRADE

Aaa: Highest quality, lowest level of credit risk – United States

Aa : High quality, very low credit risk – UK, Belgium

A: Upper-medium grade, low credit risk – China, Ireland, Mexico

Baa: Medium-grade, moderate credit risk – Slovenia, India, South Africa

SPECULATIVE GRADE ..

Ba: Speculative, substantial credit risk - Russia, Costa Rica, Serbia

B: Speculative, high credit risk - Armenia, Cambodia, Argentina

Caa: Speculative of poor standing, very high credit risk - El Salvador, Rep. of Congo, Venezuela

Ca: Highly speculative, very near default

C: Lowest rated, typically in default

No comments:

Post a Comment