Many think Jaitley is making haste slowly. He can be reminded of the KISS principle.

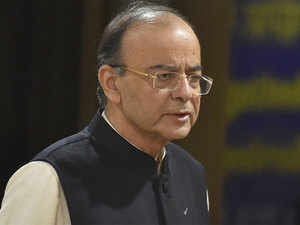

Finance minister Arun Jaitley’s announcement that the sun

will soon set on 28% GST slab except for luxury items and the country can look

forward eventually to only two slabs – 5% and a standard rate between 12% and

18% (apart from exempt items) is welcome. But many think he’s making haste

slowly. He can be reminded of the KISS principle.

Many

think Jaitley is making haste slowly. He can be reminded of the KISS

principle.

KISS – Keep It Simple, Stupid – is a well-known

acronym and an accepted credo in business. Attributed to Lockheed aircraft

engineer Kelly Johnson, it was to urge his engineers to keep aircraft design so

simple that even a stupid person should be able to repair the aircraft with

ordinary tools on the combat field.

Bureaucracy, the world over, is usually

oblivious to the KISS principle. An Amazon ad boasts that it sells more than a

crore different products, besides myriad services, with more categories added

every day. In this context, asking bureaucrats to identify and categorise all

products and services for differential tax slabs in the GST regime is the

surest way to get into a muddle.

Empirical data from across the world on the

benefits of a unified single tax is incontrovertible. So, an unambiguous

directive to the bureaucracy is necessary to come up with just two categories:

goods eligible for zero tax, and all the rest to come under a single rate, say

10% or 12% or even lower. That means everything, except those specifically

exempt, is taxed.

This

needs bold and clear reformist thinking at the political level. Take the

so-called ‘sin’ taxes. They make no sense and are at cross purposes with

government’s overarching policies of generating growth and creating jobs under

the much touted ‘Make In India’.

A typical 300 room five-star hotel generates direct

employment to around 500 people, 90% of whom are waiters, housekeeping staff,

front desk and concierge staff, besides cooks, chefs, managers, financial and

clerical staff. There are a host of others employed in associated services such

as the spa, gift shops and swimming pool.

The hotel also generates indirect employment in

ancillary areas: it buys bed linen, furnishings, rugs and carpets (that are

periodically replaced, generating employment in textiles), air conditioners,

cutlery, electrical fittings, furniture … and consumes enormous quantities of

food produce. All these generate jobs and income for farmers, construction

contractors, artisans and other manufacturers.

Five-star hotels also generate foreign exchange

by attracting rich tourists and visitors and has a direct bearing on FDI. So,

it is unwise to tax these hotels to death. It’s the same warped view that has

high taxes on air conditioners, sanitary and chocolates or luxury cars. They

generate many ancillary jobs downstream.

One must figure out how to rev up the economy by

making the rich spend, and to move more people up the value chain to buy more

chocolates and ACs, instead of designing a tax system that keeps these products

out of the new consumer class’s reach. Similarly, in a roadside bakery for

example, officials have excelled in the art of creating confusion – bread is

zero tax, but the vegetable sandwich is in the 5% tax slab, hitting the

vegetable grower directly. Bun is zero but bun with a few raisins is 5%. And

cakes and chocolates are 18%! It’s the same with taxes on wine, rum and beer,

which generate huge employment and are the backbone of the grapes and sugarcane

farming and cocoa industry.

The low-cost airline model is successful because

of the KISS principle: elimination of all frills – food, water, freebies,

assigned seats, etc – single-class seating, point-to-point travel with no code-sharing,

direct internet booking, no middlemen … It’s an Udupi self-service hotel in the

sky.

Jaitley, instead of moving gingerly as has been

the case till now, should take a cue from the PM who hinted at major reforms in

GST, and do away with all the confusing tax slabs in one fell swoop. He can

then usher in a truly single low tax rate along with a list of exempt items. That

will ensure compliance, widen the tax net, boost the economy, create jobs and

increase tax collection as witnessed in many countries – a move that will be

both populist and well-regarded by economists. And a wonderful new year gift to

the country.

The

writer is an entrepreneur, founder of Air Deccan and a retired Captain Of

Indian Army. Views are personal.

Read more at:

//economictimes.indiatimes.com/articleshow/67266963.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

//economictimes.indiatimes.com/articleshow/67266963.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

No comments:

Post a Comment