New Delhi: Setting a floor for mobile phone tariffs is now off the table, with the regulator and the telecom department unable to agree on the matter and private telcos Bharti Airtel, Vodafone Idea and Reliance Jio along with state-run Bharat Sanchar Nigam Ltd. having decided to increase prices from next month, a senior government official said.

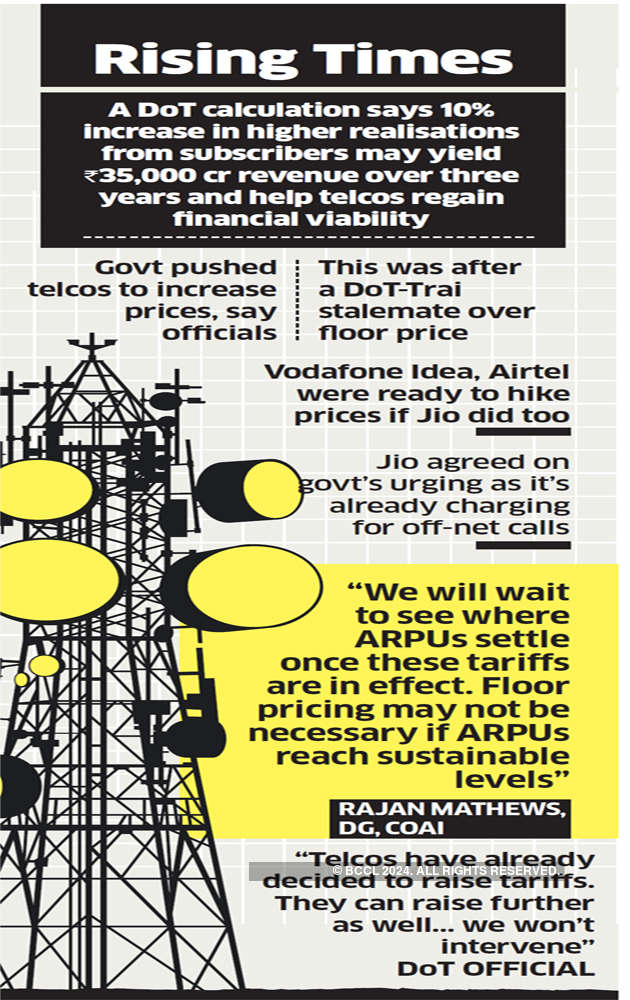

“There’s no more discussion on floor prices,” the telecom department official said. “The telcos have already decided to raise tariffs. They can raise them further as well... we won’t intervene.”

Telcos appear to broadly agree there is no immediate need to set a floor price, given their intention to raise tariffs.

“We will wait to see where ARPUs (average revenue per user) settle once these tariffs are in effect. Floor pricing may not be necessary if the ARPUs reach sustainable levels,” said Rajan Mathews, director general of the Cellular Operators Association of India, which represents private telcos.

“Floor prices are a complex issue and for now our focus is on enhancing ARPUs to sustainable levels, which will lead to recovery of the industry,” Mathews added.

However, at an industry meeting with the Telecom Regulatory Authority of India on Wednesday, Vodafone Idea again raised the issue of a floor price but was opposed by BSNL, a person familiar with the matter said.

A panel of secretaries that looked at ways to ease the financial burden of telcos had nudged the telecom regulator to consider setting a floor price. However, Trai apparently pushed back, with officials saying privately the idea wasn’t workable and had been rejected in 2017.

They said Trai wouldn’t take up the matter suo motu. They called the move anti-consumer and said it would disincentivise investments in future technologies. Trai wanted a reference from the telecom department, backed by written requests from telcos, which didn’t come.

“How could we have sent any reference? Pricing is under Trai,” said another official.

With the matter in a stalemate, the government pushed the telcos to increase prices, industry and government officials said. Initially, while Vodafone Idea and Airtel were willing, they were also wary about losing more subscribers if Jio didn’t follow suit.

“Jio was hesitant to commit to raising prices, having started charging its customers for off-net calls (calls to rival networks), which was an effective price hike of around 14-15%,” said an industry executive.

Jio is said to have finally agreed, at the urging of the government. However, Jio wasn’t as direct as Vodafone Idea and Airtel in announcing increased rates from December – it said prices would be raised “in the next few weeks” under directions from the regulator.

Jio’s tariff increases are not expected to be as much as those by its rivals, government and industry executives said.

The Department of Telecommunications official said the price increases and a two-year moratorium on spectrum payments of Rs 42,000 crore recently approved by the government would provide enough cashflow relief to the telcos and put them on the path to recovery.

However, relief in the matter of Rs 1.47 lakh crore of cumulative adjusted gross revenue-based dues depends on the Supreme Court’s response to review petitions filed by some telcos and the telecom department will act as per the court’s directions, officials said.

Under intense financial pressure, Vodafone Idea and Bharti Airtel had sought the two-year moratorium on spectrum payments, lower licence fees and spectrum usage charges, and a refund of Rs 35,000 crore in input tax credits. They also wanted a mechanism to set a floor for tariffs to ensure prices rise, which they said was key to immediate financial relief.

Their strife was aggravated by the October 24 apex court order widening the definition of AGR to include non-core revenue items, leaving Vodafone Idea and Bharti Airtel as the worst hit, facing dues of over Rs 89,000 crore to be paid in three months.

According to an internal DoT calculation, a 10% increase in realisations from subscribers by increasing phone bills may yield about Rs 35,000 crore in revenue for the sector over three years, without affecting consumer demand, while helping companies regain financial viability.

ET TELECOM

ET TELECOM

No comments:

Post a Comment