Kolkata | New Delhi: Promoters of Vodafone Idea Ltd (VIL)—UK’s Vodafone Group Plc and Aditya Birla Group—may infuse around $1.5 billion (about Rs 11,060 crore) into the telco if the government cuts the carrier’s adjusted gross revenue (AGR) dues based on the self-assessment, and also allows repayment over several years, analysts and executives said.

A combination of reduced AGR dues and easier repayment terms on the back of recent tariff hikes, brokerage CLSA said, could send growth revival signals and encourage VIL’s promoters to reassess their stance of ‘no equity infusion’ to bolster the struggling telco’s financial position for competing more effectively with Bharti Airtel and Reliance Jio Infocomm.

“VIL’s promoters may consider an additional capital infusion of at least $1-1.5 billion (Rs 7,376-11,060 crore) over the next 6-to-9 months if the government approves a sharp reduction in VIL’s AGR dues, allows repayment of such statutory liabilities over a minimum 10-year tenure and signals an early floor tariff for data services,” Rajiv Sharma, research head at SBICaps Securities, told ET.

A Vodafone Group Plc spokesman said the British telecom carrier “does not recognise speculation about a potential capital infusion” in a written response to ET’s queries. He though added that “critical steps to ensure sustainability of a three-player market in India are measures that could be introduced by the government and a floor on pricing, which is a regulatory decision”.

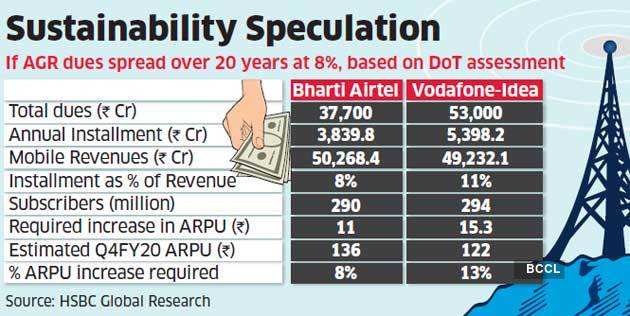

The comments come even as the government on Monday requested the Supreme Court to allow telcos to stagger their AGR payments over a maximum 20 years, at a reduced interest rate of 8%. Vodafone Idea had said it would shut shop unless it gets relief on these dues.

VIL recently computed its AGR dues at Rs 21,533 crore, way below the over Rs 58,000 crore pegged by the Department of Telecommunications (DoT). Of this, the principal sum is pegged at Rs 6,854 crore, which has been paid in full by the telco.

Despite the expected government relief, VIL’s long-term survival hinges on fresh equity infusion by its promoters as the company doesn’t have cash to clear its AGR dues, say analysts.

Brokerage Credit Suisse, in a note, said the telco may be able to sustain over the next two years with the spectrum and AGR payment deferments.

But its “cash flow analysis suggests that business viability is under cloud even at Rs 200 ARPU (and subs base of 280 million) once the deferred spectrum payment resumes in FY23E,” Credit Suisse said in the note. It added that the telco will need strong operational improvement along with “meaningful” equity infusion to sustain in the long term.

“Our analysis further suggests that VIL would need ARPU levels of around Rs 145 to meet interest obligation on its debt and ARPU levels of Rs 230 to achieve cash flow breakeven (post FY23),” Credit Suisse said. The telco’s ARPU was Rs 109 in the fiscal third quarter.

Rohan Dhamija, partner & head of India & Middle East at Analysys Mason, added that a 20% tariff hike from current rates along with the setting of a price floor is crucial for Vodafone Idea to run business sustainably.

The telco’s shares lost 15.36% to close at Rs 4.85 a piece on BSE Tuesday. The exchange's benchmark index, the Sensex, lost 2.58% or 810.98 points.

The Supreme Court was scheduled to hear modification pleas by the phone companies, seeking to negotiate AGR dues payment timelines with DoT, on March 17. But that hearing has been postponed amid precautions to counter the outbreak of Covid-19. The next hearing will also consider the government’s relief proposal made on Monday.

The top court had on October 24 accepted the government’s wider definition of AGR that includes all revenue items including non-telco streams, which left 15 companies—many of whom are defunct—with Rs 1.43 lakh crore in related dues.

No comments:

Post a Comment