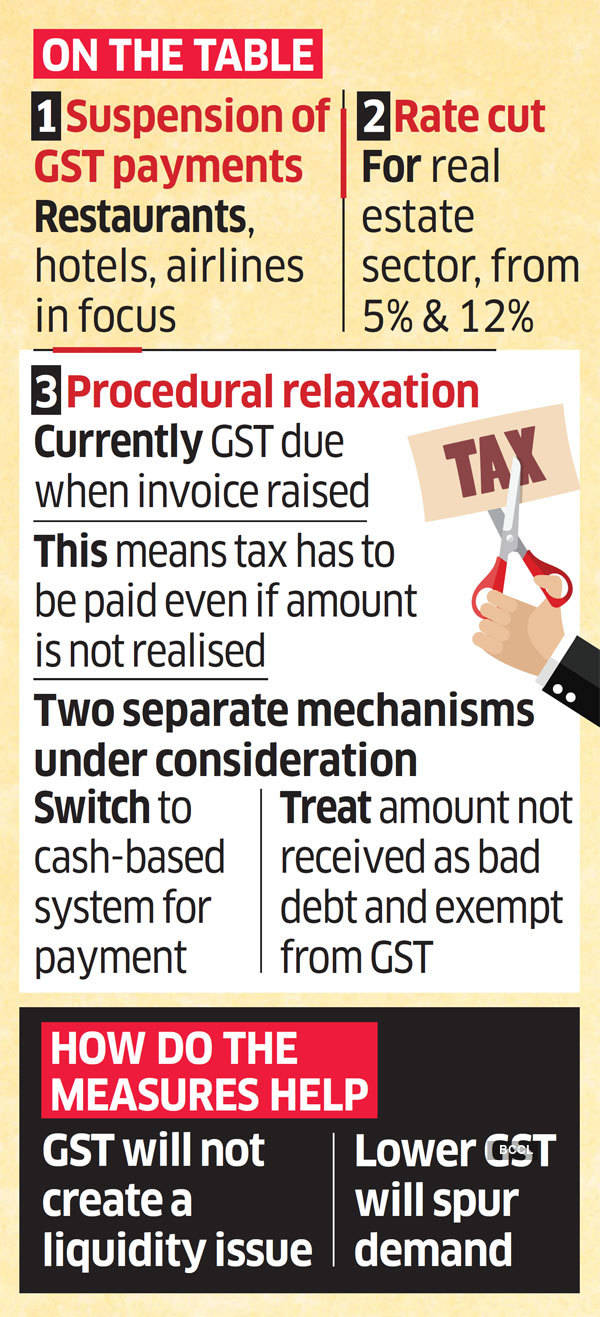

Other proposals include switch to a cash-based

tax system from current invoice-based one.

By Deepshikha Sikarwar

New

Delhi: India is considering a goods and services tax (GST) relief package to

counter the impact of Covid-19 and help prop up the economy, said people with

knowledge of the matter. The package being considered could include a six-month

suspension of GST payments for the worst-hit sectors such as restaurants,

aviation and hospitality as well as a lower rate for the real estate sector.

Other

proposals include a switch to a cash-based principle of levying tax from the

current invoice-based system and providing GST relief on sales for which

payment is not received due to the lockdown by treating those as bad debts.

These measures are expected to ease the

liquidity pressure on businesses that are strapped for cash, said the people

cited above. A final decision on the proposals will be taken by the GST

Council, which is the apex decision-making body for the tax.

“There

is a thinking that for these service sectors, the government should at least

spare its dues,” a government official told ET.

The government could also consider exempting

them from other statutory charges for some time.

Though there has been a demand for complete GST

exemption, the government is veering around to the view that suspending the tax

will work better, the official said. Exempting a sector from tax would mean

breaking the credit chain, leading to further problems down the line.

Need

for Liquidity

A cash-based system will mean businesses pay GST

when they get the money and not when the invoice is raised, ensuring they don’t

have to pay the tax out of their pocket and get squeezed on working capital.

This is most relevant for services where payment is received with a lag after

bills are raised.

Most service providers are facing delays in payments from

clients but are saddled with GST liabilities. Another option is exempting these

from GST, treating them as bad debt.

“The idea is to provide some help to businesses

to sail through this crisis,” a second official said, adding that it is expected

that states will back the move in view of the unprecedented economic situation.

Tax experts said liquidity is among the

immediate needs of industry.

“At this time, industry needs more liquidity and

hence deferment in payment of GST for next few months (without interest) should

be considered,” said Pratik Jain, national leader, indirect tax, PwC.

While providing selective exemption is an

option, it often creates complications as input credit gets blocked, aside from

coping with the rigours of anti- profiteering provisions, he said.

“Since the point of taxation in GST is

effectively the issue of invoice, the suppliers pay the GST to the government

exchequer before they actually collect it from the customers,” said Bipin

Sapra, partner, EY, backing a cash-based system.

No comments:

Post a Comment