News No.1 Dated Aug 14 2015

NEWS DATED AUG 14 2015 Reliance Jio to partner with Reliance Communications

Reliance Communications (RCOM), too will benefit as it will gain access to Jio’s 4G network in the 10 circles at virtually zero incremental capex costs.

, ET Bureau

KOLKATA: With the Narendra Modi government allowing spectrum sharing, Reliance Communications (RCOM) and Reliance Jio Infocomm are set to ink a pact that will enable the Mukesh Ambani-owned telco to offer fourth generation (4G) services over the 800 MHz band across 10 circles.

The airwaves sharing pact will allow Reliance Jio to access 10 MHz of contiguous 4G bandwidth in Mumbai, UP-East, Orissa, Madhya Pradesh, Bihar, Assam, Northeast, Haryana, Himachal Pradesh and Jammu & Kashmir, a person familiar with the matter told ET.

India’s fourth largest mobile carrier, Reliance Communications (RCOM), too will benefit as it will gain access to Jio’s 4G network in the 10 circles at virtually zero incremental capex costs, another person said. RCOM and Reliance Jio declined to reply to ET’s queries on the upcoming spectrum sharing pact.

News No.2 most important october 4 2019

Here's why 4G spectrum auction is more important for Reliance Jio Infocomm than Airtel and Vodafone Idea

Coming auction crucial for Jio Infocomm as licence to use key 4G band in 18 circles expires in mid 2021.

, ET Bureau

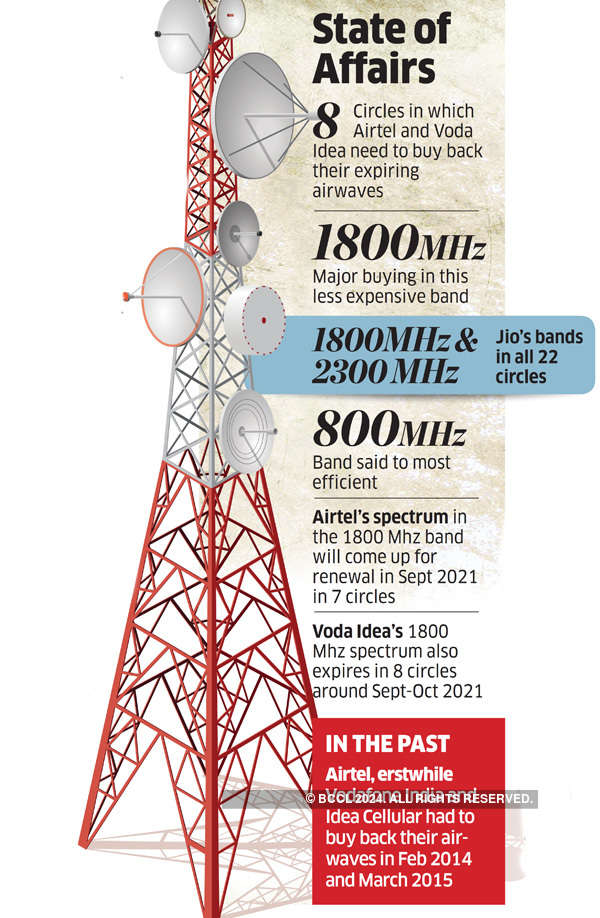

The upcoming 4G spectrum auctions are more critical for Reliance Jio Infocomm than for its nearest rivals, Bharti Airtel and Vodafone Idea. That’s since a sizeable chunk of Reliance Communications 4G airwaves in the coveted 800 Mhz band—that the Mukesh Ambani-led telco uses under a sharing pact—will expire in 18 circles in July-August 2021, analysts said.

They added that Bharti Airtel and Vodafone Idea will also need to buy back their expiring airwaves in eight

circles each, but mostly in the less expensive 1800 MHz band, also used for 4G.

Such a scenario leaves Jio facing a similar situation that Bharti Airtel, erstwhile Vodafone India and Idea Cellular (now merged into Vodafone Idea) had found themselves in during the February 2014 and March 2015 auctions when they had to buy back their own expiring spectrum in the 900 Mhz band in several circles at exorbitant rates, or else risked losing the mobility business, a development that has contributed to their current high debt levels, and financial stress.

“RCom’s 800 Mhz spectrum has played a critical role in Jio’s pan-India 4G launch, and an early auction will help Jio regain these crucial airwaves to ensure business continuity and maintain quality of its countrywide 4G coverage, especially as the ecosystem for other sub-Ghz bands such as 700 Mhz is not developed, besides their exorbitant pricing that makes them unfeasible to buy in an auction," Rajiv Sharma, co-head of research at SBICap Securities, told ET.

Jio uses bankrupt telco RCom’s 800 Mhz spectrum through a 21-circle spectrum sharing pact to deliver countrywide 4G coverage. But those airwaves in 17 circles will expire in July, 2021, and in one, in August, 2021, a person aware told ET. So, nearly 49 units of 800 Mhz spectrum across these circles 18 circles will expire, and around 59 MHz of such spectrum will up for sale in the next sale, as per the regulator’s recommendations.

Jio though has airwaves in the 1800 MHZ and 2300 MHz MHz bands in all 22 circles, but the 800 MHz band is touted to be the most efficient, and hence more expensive, for 4G use, say analysts.

A person close to Jio said “the company is definitely in favour of an early spectrum auction to address the massive demand for 4G services”.

Rohan Dhamija, partner at Analysys Mason, said the financial strength of rivals back in 2014 and 2015 ensured bidding was intensive, making it more expensive for Vodafone Idea and Airtel to buy back their airwaves. But the situation is different now.

“Vodafone Idea and Airtel won’t really be in a position to engage with Jio in an all-out bidding war for sub-Ghz spectrum like in the past auctions of February 2014 and March 2015 since their balance sheets remain stretched,” said Dhamija. He added that the two also need cash to buy back their own 1800 Mhz spectrum that is coming up for renewal in some circles around September-October 2021.

Brokerage Motilal Oswal said Airtel's spectrum in the 1800 Mhz band will come up for renewal in September 2021 in seven circles and also in the 900 Mhz band in Tamil Nadu. Industry sources, added that Vodafone Idea's 1800 Mhz spectrum also expires in eight circles around September-October 2021.

At press time, Jio, RCom, Airtel and Vodafone Idea did not reply to ET's queries.

Another key reason behind Jio’s greater need for 4G airwaves to maintain coverage quality is its modest pan-India market share of liberalised, or auctioned, spectrum at 26%, which is well below Vodafone Idea (40%) and Bharti Airtel (35%).

Matters, they said, could become become more challenging for Jio once both incumbents conclude refarming their 2G and 3G airwave holdings for 4G services.

ICICI Securities, in fact, expects Vodafone Idea and Airtel to be in a stronger position to expand 4G data capacity, especially since they “will have around 33% and 28% more 4G carriers than Jio respectively” after concluding the refarming of their 2G/3G spectrum for 4G services.

News No.3 dated Nov 27 2019

Reliance Jio may have to bear some of RCom’s AGR dues

Jio's dues will need to pay will include those on RCom’s spectrum that was part of the 2016 trading deal.

, ET Bureau|

MUMBAI: The Department of Telecommunications (DoT) has veered around to the view that Reliance Jio needs to shoulder some of Reliance Communications’ (RCom) over Rs 21,140-crore adjusted gross revenues (AGR)-based dues, for the spectrum that the Mukesh Ambani-led telecom operator had bought from the bankrupt telco in 2016.

“The AGR dues that Jio will need to pay will include those on RCom’s spectrum that was part of the 2016 trading deal,” said a senior official in telecom

telecom department, who did not want to be named.

The DoT has sent notices to all telcos to self-assess and pay their dues in three months from the apex court order of October 24. Officials say in case of any discrepancies between the telco and DoT calculations, the department will send fresh notices for the balance.

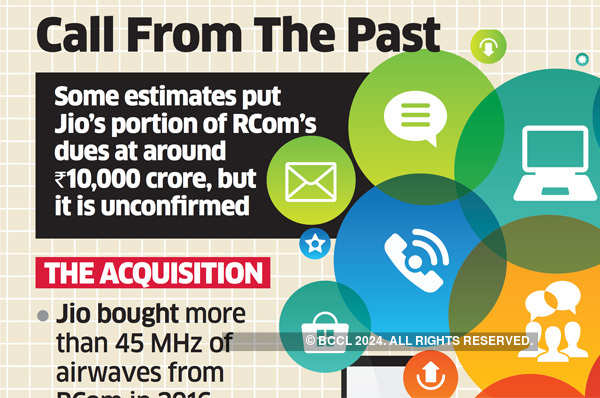

Jio had bought more than 45 MHz of airwaves across 13 circles in 800 MHz band from RCom in 2016, through a spectrum trading pact. Under bandwidth trading rules of 2015, the seller is expected to clear all dues prior to concluding any deal. After that, dues become the buyer’s liability. Further, in case any dues are discovered after the deal takes effect, DoT can recover this from one or both sides.Jio didn’t respond to ET’s emailed queries. But sources at the telco said Jio can’t be held liable for RCom’s past spectrum dues, citing excerpts from a February 2019 telecom tribunal order in a separate spectrum trading case. It ruled that the Mukesh Ambani-owned telco won’t be responsible for RCom’s previous spectrum dues. They added that a subsequent Supreme Court judgement of July dismissed DoT’s challenge of the tribunal order.

But DoT officials say the rules are clear on the liabilities in a trading deal.“The seller shall clear all its dues prior to concluding any spectrum trading. Thereafter, any dues recoverable up to the effective date of trade shall be a liability of the buyer,” according to the rules. “The government shall, at its discretion, be entitled to recover the amount, if any, found recoverable subsequent to the effective date of the trade, which was not known to the parties at the time of the effective date of trade, from the buyer or the seller, jointly or severally.”

Moreover, a May 20, 2016 letter from the DoT to the two telcos – Jio and RCom – clarified the rules further, citing para 11 of the trading rules on the liability of dues in case of trading deals.

Also, the two carriers had written to DoT in January 2016, accepting rules of trading. “...agree that in the event, it is established at any stage that either of the licencees was not in conformance with the terms and conditions of guidelines for spectrum trading or/and of the licence at the the time of giving intimation for trading of right to use the spectrum, the government will have the right to take appropriate action which inter-alia may include annulment of trading arrangement,” their confirmation letter stated.

The development will come as a rude shock to Jio which appeared to have been least affected by the Supreme Court verdict widening the definition of AGR to include non-core items. As per the DoT’s initial calculations, Jio, which started operations in 2016, owed Rs 60.52 crore to the government, compared with over Rs 53,000 crore for Vodafone Idea and over Rs 35,500 crore for Bharti Airtel. In total, some 15 telcos are liable to pay Rs 1.47 lakh crore in AGR dues.RCom’s dues were at Rs 21,140.78 crore, including licence fees, spectrum usage charge (SUC), penalties and interest. The amounts are as per telecom ministry submissions in Parliament. Licence fees and SUC are paid on the basis of AGR. The company is currently undergoing insolvency proceedings in the National Company Law Tribunal (NCLT).

Some estimates have put Jio’s portion of RCom’s dues at around Rs 10,000 crore, but it has not been independently confirmed.

The official added that the department would need to move the National Company Law Tribunal (NCLT) to recover the rest of RCom’s dues, as the telco is in the midst of insolvency proceedings.

No comments:

Post a Comment