Mcdowell Holdings | Arindam Ash has resigned as Chief Financial Officer of the company.

The assets under management (AUM) for the mutual fund industry surpassed the Rs 30 lakh crore mark in November but outflows from equity MFs continued for the fifth straight month in a row.

Equity funds witnessed the highest ever outflows in November at Rs 12,900 crore after the outflow of Rs 2,725 crore in October. Total outflow in the last five months is now at Rs 23,000 crore. Investors continue to book profit at every higher level, ICICIdirect said in a report.

The S&P BSE Sensex and Nifty50 have rallied more than 11 percent so far in the year 2020, and over 70 percent from March lows recorded on March 24. The risk in equity markets has been swift and that triggered some bit of profit-taking from MF managers.

“UHNI/Family Offices like ourselves are just taking home some profits and rebalancing it between risks & rewards. Liquidity and cash positions are increasing. It is better to at least have 10 to 15 percent correction for the long-term health of the market,” Nitin Shakdher, Professional Investor and Founder & CEO, Green Capital Single Family Office told Moneycontrol.

Flows from Systematic Investment Plan pared slightly, but fund managers are not worried as it could be temporary in nature. SIP inflows came down to Rs 7300 crore in November compared to Rs 7800 crore in October.

“The sharp decline, to a certain extent, could be due to holidays during month-end,” ICICIdirect report added.

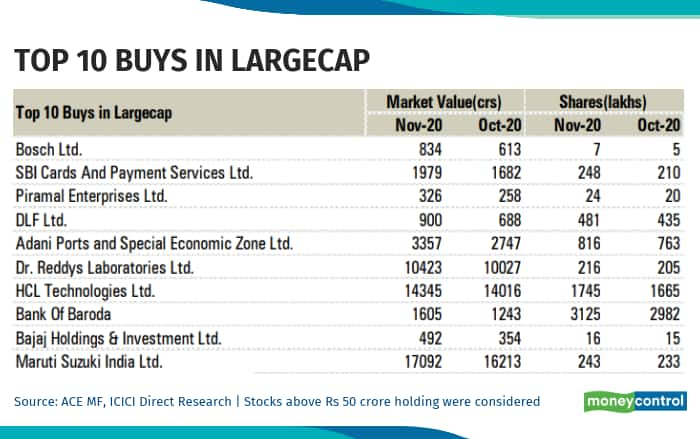

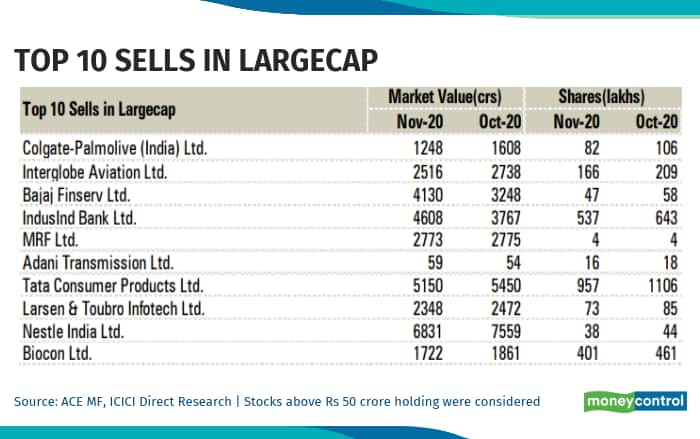

ICICIdirect lists 10 stock each in Large, Mid, and Smallcap space where fund managers bought and sold the most in November:

Top 10 largecap in which fund managers increased stake include names like Bosch, SBI Cards, Piramal Enterprises, DLF, Adani Ports etc. among others.

Top 10 stocks in which fund managers reduced their stake include names like Colgate Palmolive, InterGlobe Aviation, IndusInd Bank, and MRF.

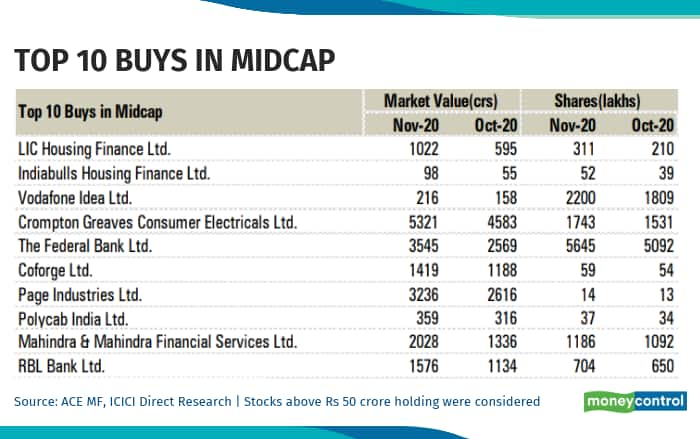

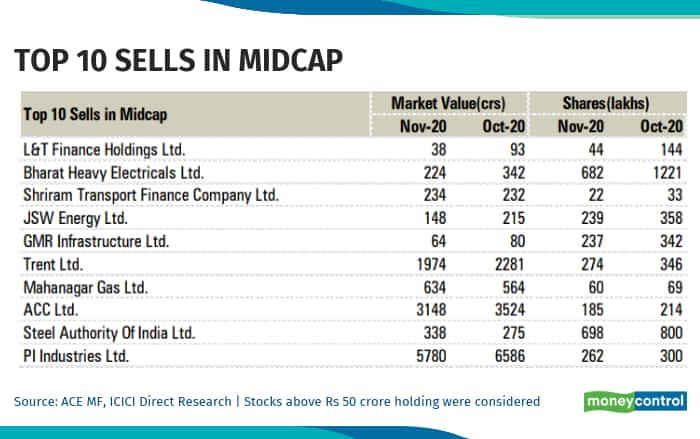

Midcap Theme:

Top 10 Midcaps in which fund managers increased stake include names like LIC Housing Finance, Indiabulls Housing, Vodafon Idea, and The Federal Bank.

Top 10 Midcap in which fund managers reduced stake includes names like L&T Finance, BHEL, Shriram Transport, and GMR Infrastructure.

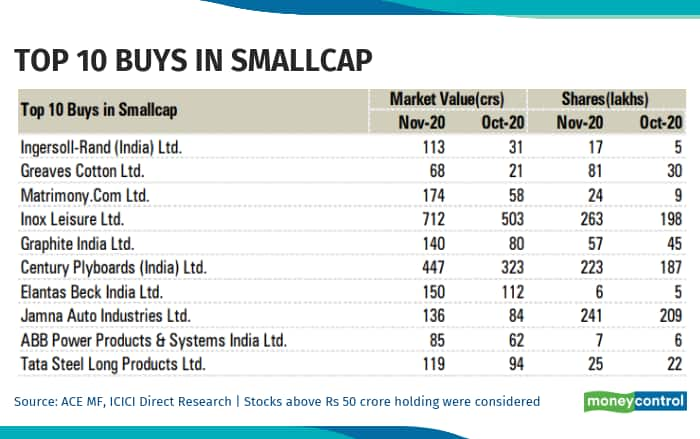

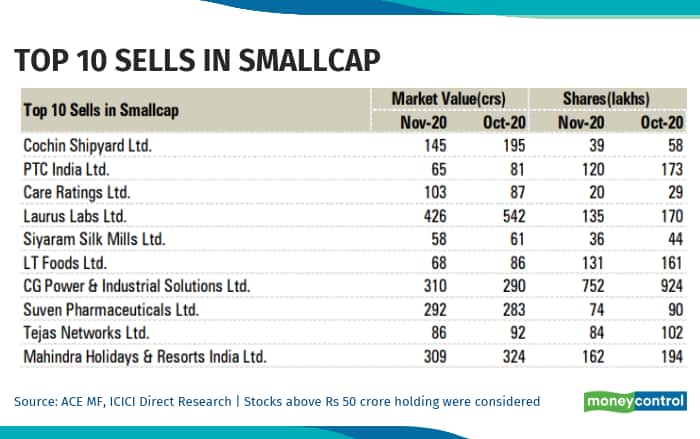

Smallcap Theme:

Top 10 Smallcaps in which fund managers increased stake include names like Ingersoll-Rand (India), Greaves Cotton, Inox Leisure, and Jamna Auto.

Top 10 Smallcaps in which fund managers reduced stake include names like Cochin Shipyard, PTC India, CARE Ratings, and LT Foods.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

No comments:

Post a Comment