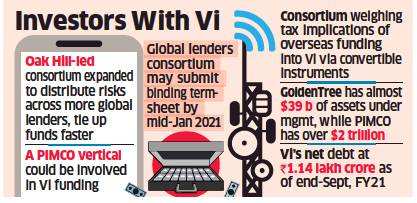

Kolkata | Mumbai | New Delhi: US-based GoldenTree Asset Management and Pacific Investment Management Co (PIMCO) have likely joined a consortium led by investment firm Oak Hill Advisors, which is in discussions to provide a $2 billion (Rs 14,720 crore) credit line to Vodafone Idea, three people aware of the matter said.

The move to expand the global lender consortium is aimed at quickly filling up Vi’s sizeable funding requirement and also distributing the risk exposure across a larger pool of financiers, one of the people told ET.

The proposed funding model is likely to be a blend of convertible instruments, comprising bonds and warrants with a linked equity option that will allow the consortium members to turn a portion of the debt into shares of the company, bankers and industry executives with knowledge of the matter said.

The lossmaking telecom joint venture, co-owned by UK’s Vodafone Group and India’s AV Birla Group, needs funds urgently to ramp up its 4G operations, arrest a steady loss of subscribers to rivals Reliance Jio and Bharti Airtel, and clear its substantial backlog of statutory dues to the government.

The telco had in September announced a Rs25,000 crore fundraising plan via a mix of debt and equity. The $2 billion credit line it is negotiating with the consortium is part of that plan.

The Vodafone Group declined to comment, while GoldenTree, PIMCO, Oak Hill, Vi and the AV Birla Group did not reply to ET’s queries till press time Sunday.

The expanded consortium, it is learnt, is at an advanced stage of wrapping up due-diligence and assessing the tax implications for the overseas lenders, and is on track to formalising the final funding terms that could lead to a binding term-sheet by mid-January. A binding contract, typically, gets drawn up once all parties involved reach an agreement on details laid out in the term sheet.

Last month, ET reported that Sixth Street, Twin Point Capital and Varde Partners were among the global investors in the Oak Hill Advisors-led consortium that had already submitted a non-binding term sheet to Vi.

Vi’s recent rebranding move has concretised its business continuity plans, but industry insiders close to the lenders said this needed to be backed with a much stronger on-ground 4G network and products and services comparable with its rivals.

Vi’s leadership recently said the telco’s stated plans to raise up to Rs 25,000 crore had elicited a strong response from a host of global funds, and was likely to be concluded soon. The telco still has more than Rs 50,000 crore of adjusted gross revenue dues payable to the government over 10 annual instalments through March 31, 2031.

Mumbai-based InCred Capital and its US investment banking partner PJT Partners are known to be helping Vi in its efforts to raise funds.

Industry executives said the funds were likely to be disbursed in tranches linked to the company meeting stiff, periodic business targets on operating income, subscriber growth, average revenue per user and revenue market share fronts.

Vi recently raised prices of two postpaid family plans by about Rs 50 in some circles, with experts saying the telco was testing the waters ahead of a broader price hike, which it desperately needed to shore up finances and underline the industry’s improving fundamentals to potential investors.

Brokerage ICICI Securities expects the next round of tariff hikes to happen latest by March 2021.

No comments:

Post a Comment