The numbers are stark. Nearly Rs 15 lakh crore ($200 billion) of loans in the banking system are distressed loans, unlikely to be recovered in full.

That is a whopping 10 percent of India’s GDP. Investment bank, Credit Suisse pointed out that 10 corporate groups account for nearly one-third of all corporate loans and 20 percent of all distressed loans.

Credit Suisse famously called these corporate groups “House of Debt” (HoD) companies. Public sector banks account for a large share of these distressed loans and have thus borne the brunt of the frontal attacks instigating this crisis. Public sector banks also constitute 70 percent of India’s banking system, so it is expected that they will have the highest exposure to these loans. Over the last year, there have been 26 opinion articles by various experts across all mainstream newspapers on the banking crisis. Of this, 17 have laid the blame for this mess solely and squarely on governance failure in public sector banks. 13 have suggested that privatising these banks may prevent future crises. Conspicuously missing in this whole debate is the role of credit ratings. There has been no article in the last year that has questioned the inadvertent role of such credit rating agencies in instigating and perpetuating the current bank loan crisis.

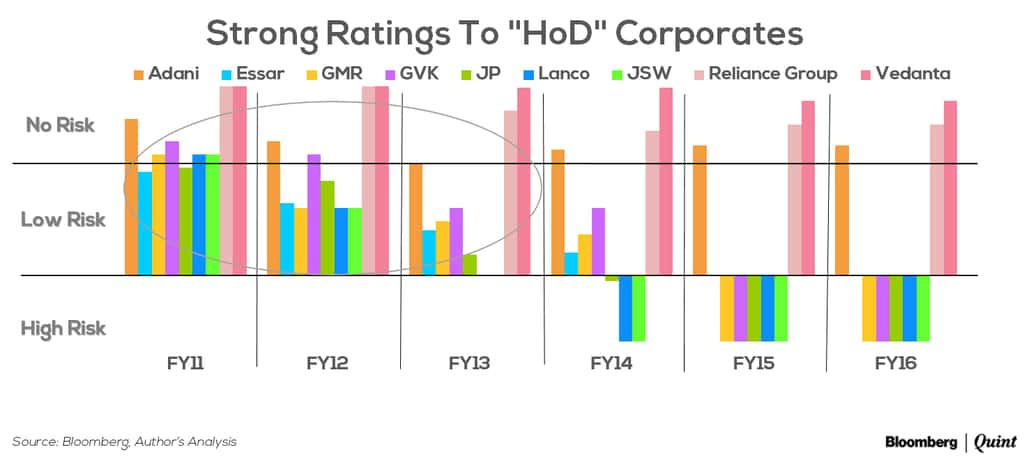

Using the “House of Debt” (HoD) companies as a case study, I undertook a massive data project to objectively analyse if bad loans to these corporate groups were solely a function of crony lending by public sector bankers, as alleged. According to Credit Suisse estimates, these corporate groups had a total debt of nearly Rs 3 lakh crore ($50 billion in today’s value) as of FY10. By FY14, their debt had ballooned to Rs 7 lakh crore ($110 billion). This includes 20 individual companies that belong to these 10 corporate groups. Each of these companies were also given a credit rating for various types of borrowing by independent, licensed, private rating agencies such as Moody’s, Fitch, CARE, CRISIL and ICRA during their period of heavy borrowing. I obtained ratings for each of these companies for each type of borrowing such as long term, short term, foreign loan, structured debt etc from FY11 to FY16. I computed a rating index for each type of borrowing by each rating agency to arrive at a single, standardised credit rating for each company for each year. Using these standardised ratings, a weighted average was computed for each corporate group, based on the borrowing of their individual companies. Broadly, I classified these aggregate ratings in three categories, in line with the definitions provided by these credit rating agencies - No Risk (Rating A and above), Low Risk (Rating BB to A) and High Risk(Rating B and lower).

As the chart shows, in the three years from FY11 to FY13, every single one of these “HoD” corporates were deemed to be in the ‘Low Risk’ or ‘No Risk’ category by these credit rating agencies. Only around FY14, some of these corporates began to be downgraded by these agencies to the “High Risk” category. In other words, all these corporates were deemed perfectly risk-worthy by these credit rating agencies to indulge in the kind of borrowing that they did during those years.

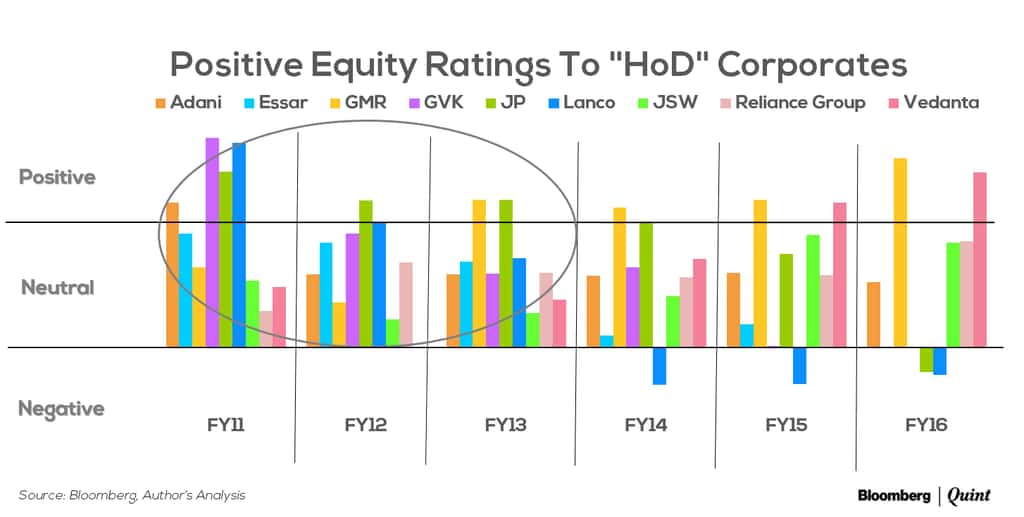

Similarly, the shares of each of these companies were also actively tracked and analysed by research departments of various investment banks. At the minimum, there were at least 20 independent, private research analysts of global and domestic investment banks that provided ratings for each of these companies through financial years FY11 to FY15. Using a similar methodology, I computed an aggregate equity rating for each of these corporate groups in three categories – Positive, Neutral and Negative. Again, not a single one of these corporate groups had been given an aggregate negative rating by any of these analysts between FY11 and FY13. The first group to be rated negative was Lanco in FY14 which, by then, had started defaulting on its loan obligations already. Equity ratings also play an important role in banks’ lending decisions to corporates, albeit indirectly.

Armed with these strong credit and equity ratings, these corporate groups went on a borrowing spree between FY11 and FY14. It is well known that a strong credit rating is almost a mandatory requirement for a large loan from any bank – be it private or public sector bank. An astonishing one-third of all corporate loans by banks went to these ten corporate groups, according to Credit Suisse estimates.

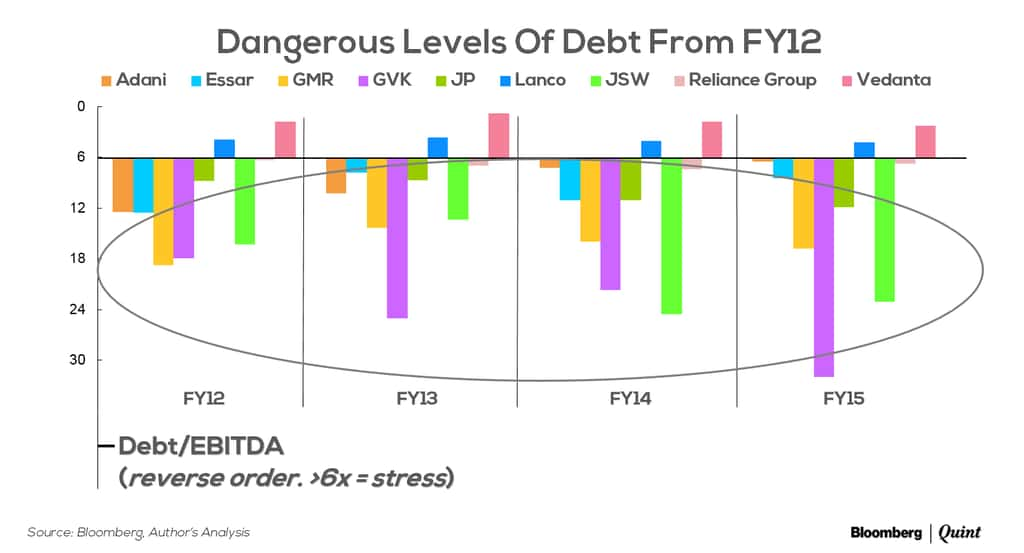

Inevitably, this borrowing binge led to stressed balance sheets. Measured as overall debt to earnings before interest (EBITDA), seven of these corporate groups had dangerously high levels of debt starting FY12, indicating stressed balance sheets. Recall, credit and equity ratings continued to be positive during this time frame even as balance sheets were increasingly getting stretched.

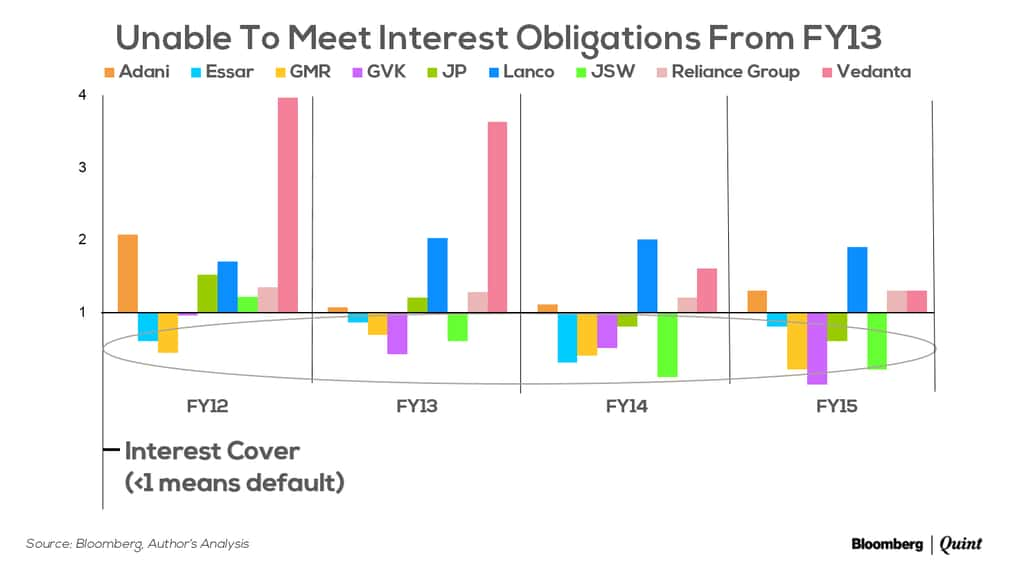

Starting FY13, many of these corporates were not generating enough earnings from their businesses to even meet interest obligations of their borrowings. Measured as the ratio of earnings to interest obligations (interest cover), five of these corporates were in the zone of high risk of default. Nevertheless, the glowing credit and equity ratings for these corporates continued unabated. The net effect of all this is that these “HoD” corporates today account for nearly 20 percent of all distressed loans in the banking system.

It is obvious from the above analysis that credit and equity analysts have been equally culpable of erroneous judgments in leading up to the bad loan crisis. Yet, the entire debate on the cause of the bad loans crisis has been capsuled down to a simplistic narrative of corrupt public sector bankers captured by crony entrepreneurs in lending indiscriminately. This could certainly be the case and this analysis does not disprove any of those theories. But if the sole reason for the crisis is dishonest lending by bankers, then what explains the rosy ratings of these corporates by a large group of independent, experienced, reputed, private sector analysts during the time these corporates indulged in such reckless borrowing? Lending motives can be questioned if bankers lent to companies that had poor ratings. Credit ratings and sometimes equity ratings are very critical inputs to a large loan decision in any bank. If the entire financial system was oblivious to the dangers of such indiscriminate borrowing, how is it that the throats of only the public sector bankers are being choked? It could well be the case that a macroeconomic slowdown was the larger reason for loans going awry. Had the credit rating agencies not been so liberal with their ratings, would banks still have lent such large sums to these corporates? Of course, we won’t know the answer to this counter factual question but the fact remains that this question did not even arise. Ironically, the most popular solution mooted by experts to prevent such future crises is to privatise these public sector banks when an entire swathe of credit and equity analysts from the private sector were equally guilty of bad judgments during the current crisis.

Credit ratings and their inherent conflict of interest are not new. The world witnessed it during the 2008 global financial crisis. Credit rating agencies are paid by the very borrowers they rate. It does not take a behavioral economic expert to tell us that no one bites the hand that feeds. Revenues of equity rating agencies are also impacted by the very corporates they rate, albeit indirectly. A substantial portion of an equity research department’s revenues is received as trading commissions from investors in return for arranging meetings with corporate executives and industry influencers. Corporate executives tend to grant meetings to only those brokers that have a positive rating of them. These conflicts of incentives have been recognized by regulators in developed markets and are increasingly regulating incentive structure for credit and equity ratings.

It may well be a blessing in disguise that India does not have a robust credit market, since it is likely that retail investors would have relied on these dubious credit ratings to invest in corporate debt that could have turned sour later. Yet, we play blind to these more fundamental issues and choose to hang the neck that’s easiest to tie the noose around. The Securities & Exchange Board of India (SEBI) has some basic rules to license credit rating agencies. But there is no accountability pinned on them. And there is no proper regulatory framework for equity research and ratings. India is a unique equity research market where equity analysts write research reports based on rumours they hear, be it of central bank governors or company earnings. In most other markets, this would be reprimanded strongly.

Lest this be misconstrued, this is not to insinuate any mala fide intent by these rating agencies. This is to merely place the bad loans crisis in a larger perspective and argue for a holistic solution. It is indubitable that the public sector banking system needs to be cleaned up. It is also unquestionable that accountability needs to be imposed on private sector ratings agencies – debt and equity. It would be foolhardy to think that merely privatising public sector banks is the panacea to such problems in the future.

Praveen Chakravarty is a Senior Fellow at IDFC Institute, a Mumbai based think/do tank. His work focuses on financial sector legislation & political economy. Noise to Signal will bring you insights from that.

No comments:

Post a Comment