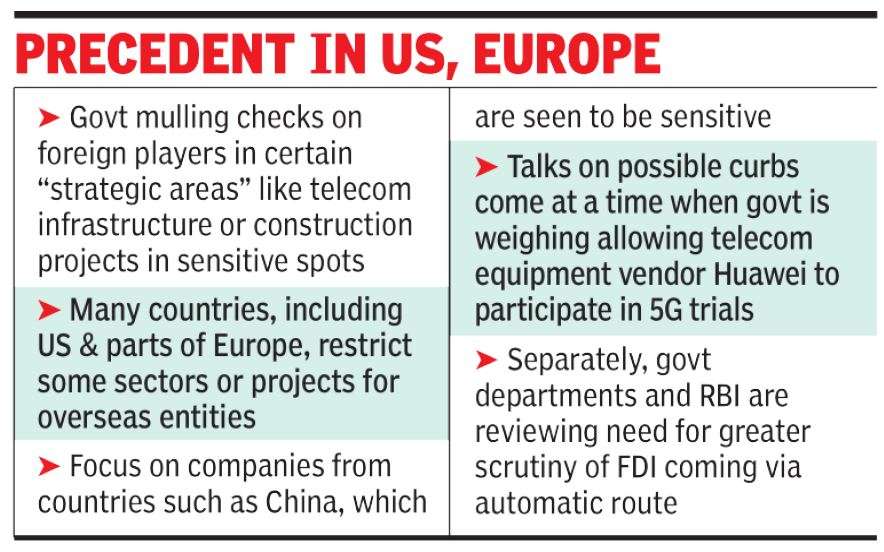

NEW DELHI: Government agencies have begun discussions on possible checks on foreign players participating in certain ‘strategic areas’, such as putting in place telecom infrastructure or construction projects in sensitive parts of the country.

So far, deliberations involving the security set-up and some ministries have been preliminary and no decision on the issue has been taken, including identification of areas which may face restrictions, a government official told TOI. “Several countries, including the US and even parts of Europe, have such curbs where certain sectors or projects are out of bounds for overseas entities given the sensitivities involved,” a source, who did not wish to be identified, said.

While the idea is to look at all overseas players, the focus is on firms from countries such as China, which are seen to be sensitive. The talks for a set of possible restrictions come at a time when the Centre is weighing the option of allowing Chinese telecom major Huawei to participate in 5G trials, amid pressure to keep the the world’s largest 5G equipment maker out of the reckoning due to security concerns.

A section of officials believes that the soon-to-be-launched superfast services are more susceptible to surveillance and the world’s largest 5G equipment maker may be a threat, a charge that Huawei has denied.

The company has already been blocked from selling equipment in the US, which is also exerting pressure on other countries.

Separately, government departments and the Reserve Bank of India( RBI) are also reviewing the need for greater scrutiny of foreign direct investment coming via the automatic route, where companies are only required to inform the regulator about the fund flow within a stipulated time. Barring a handful of sectors, a majority of segments are now under the automatic route for foreign direct investment (FDI) with the government periodically easing norms.

The discussions follow fears that a foreign company may venture into the northeast or other areas, which may be sensitive, and there may be a need to keep closer tabs on such investment.

At the same time, the government is also conscious of the need to keep scrutiny at the bare minimum as it wants to avoid a situation where officials and enforcement agencies misuse the provisions.

The Reserve Bank of India has detailed disclosure requirements on investments via the automatic route and the process has been reviewed in recent months. In the past, the government has resorted to steps such as putting foreign direct investment in pharmaceuticals beyond a certain value out of the ambit of automatic approval.

No comments:

Post a Comment