The Yes Bank shares and bonds took a huge hit after the Reserve Bank of India (RBI) imposed a month-long moratorium on the bank on Thursday. Shares of YES Bank tumbled 85% in Friday’s trade after the news of a month-long moratorium. Many mutual fund investors are wondering whether their mutual fund schemes have exposure to the troubled bank’s stocks or bonds.

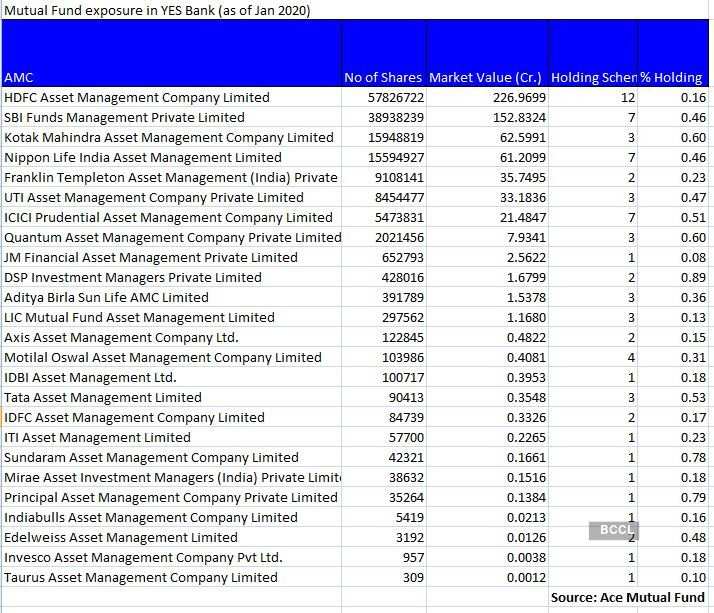

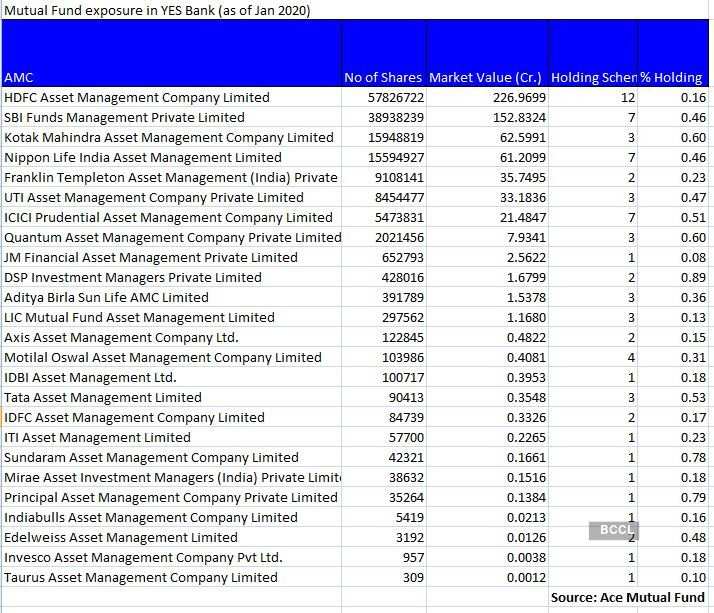

According to data from Value Research, a mutual fund tracking firm, Nippon India has four schemes which have huge exposure to the troubled stocks/bonds. Some schemes from big fund houses like Franklin Templeton, HDFC Mutual Fund and SBI Mutual Fund also had large exposure to stocks/bonds.

“The Reserve Bank assures the depositors of the bank that their interests will be fully protected and there is no need to panic,” RBI said in a statement.Nippon India Equity Hybrid Fund has an exposure of Rs 587.58 crore in the bonds/NCDs of the troubled bank. Next in line is Nippon India Credit Risk Fund with an exposure of Rs 468.45 crore in bonds/NCDs of Yes Bank. Similar exposure can be seen in Nippon India Strategic Debt Fund where Rs 410.8 crore are at stake. Franklin India Short Term Income Plan also has an exposure worth Rs 281.09 crore to Yes Bank bonds. HDFC Balanced Advantage Fund has an exposure of Rs 93.03 crore to Yes Bank stocks. SBI ETF Nifty 50 also has investments worth Rs 116.61 crore to Yes Bank stocks.

No comments:

Post a Comment