Mumbai: Vodafone Idea (Vi) has asked the telecom department to clarify if it can be exempted from stating its net worth when applying to bid for 4G spectrum in the upcoming auction.

“Vi has requested the Department of Telecommunications to state whether mentioning the net worth of the telco is mandatory. If not, then it won’t state it,” said an official aware of the development.

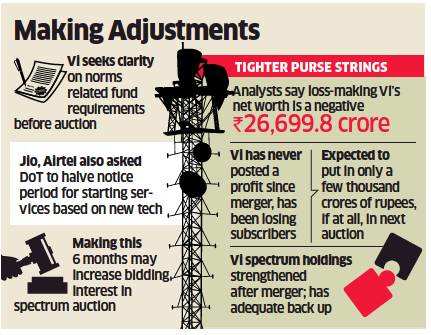

According to analysts, loss-making Vi’s net worth is a negative Rs 26,699.8 crore. The telco has never posted a profit since its formation through the merger of Vodafone India and Idea Cellular in August 2018, and has been rapidly losing subscribers to rivals, mainly as it trails Bharti Airtel and Reliance Jio in 4G coverage.

Bidders are required to show a net worth of Rs 100 crore per service area in which they want to submit bids, although this requirement is not applicable in the case of existing licensees, according to the DoT’s notice inviting applications for the spectrum auction.

This was not the only request from Vi, people aware of the matter said. The telco has also sought clarification on the amount of earnest money to be deposited for the different airwave bands up for bidding. It wasn’t clear why exactly the clarification was sought.

Applicants should deposit sufficient earnest money to enable them to switch among licensed service areas during the course of the auction, the telecom department said in its auction notice.

Vi did not respond to ET’s queries.

Market and industry experts do not expect Vi to be an aggressive bidder in the spectrum auction, scheduled to start on March 1. Vi may pitch in only a few thousand crores of rupees, if at all, by bidding for a limited amount of airwaves. Rivals Reliance Jio and Bharti Airtel are expected to shell out Rs 20,000 crore and Rs 10,000-15,000 crore, respectively.

Vi’s spectrum holdings were strengthened after the merger.

Airtel and Vi, with about 294 million and 272 million users respectively, have less expensive airwaves, mostly in the 1800 MHz band, set to expire across eight circles each from July.

Vi, which has adjusted gross revenue (AGR) dues of Rs 50,400 crore to pay, has adequate back up airwaves. The telco is gearing up to raise Rs 25,000 crore to invest in its network and pay AGR dues. It is not the only telco that has made requests to DoT prior to the 4G auction. Jio and Airtel have asked the DoT to halve the notice period for starting services based on a new technology to six months, a move that may increase bidding interest in the spectrum auction.

DoT aims to sell 2,250 MHz of 4G airwaves across seven bands from March 1, worth Rs 3.92 lakh crore at the base price.

No comments:

Post a Comment