NEW DELHI: A Hanging Man pattern on the Nifty chart on Wednesday implied the market may be developing fatigue after a long run. Thursday’s stock action in some way confirmed such a trend. But analysts believe the momentum is intact for the medium term and some of the big names may be poised for another leg of rally.

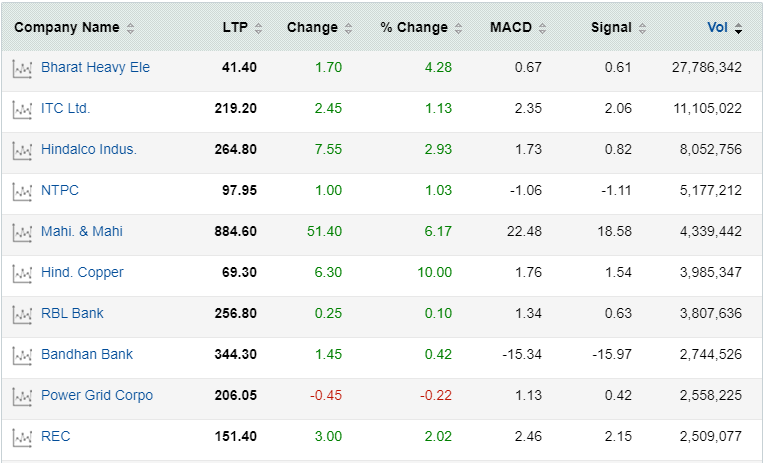

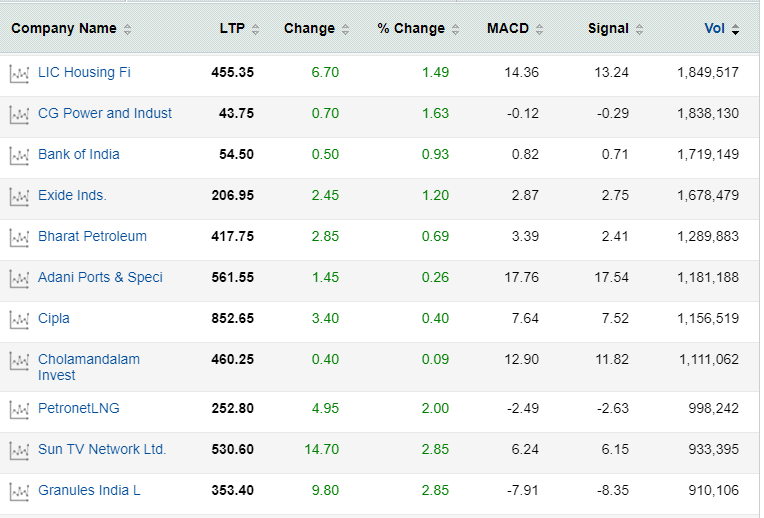

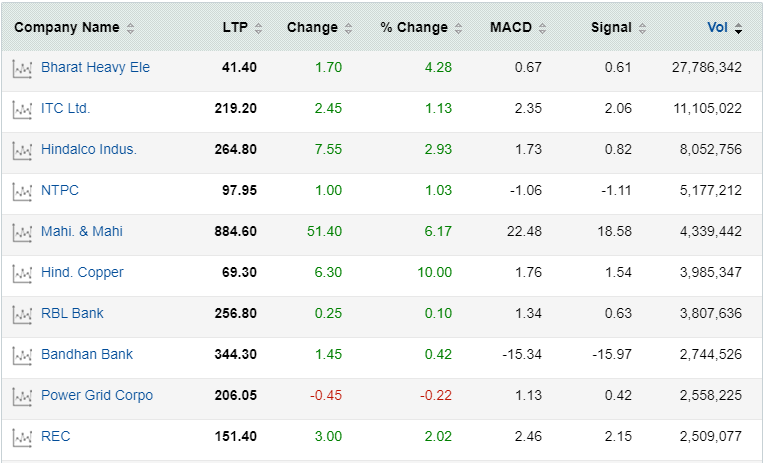

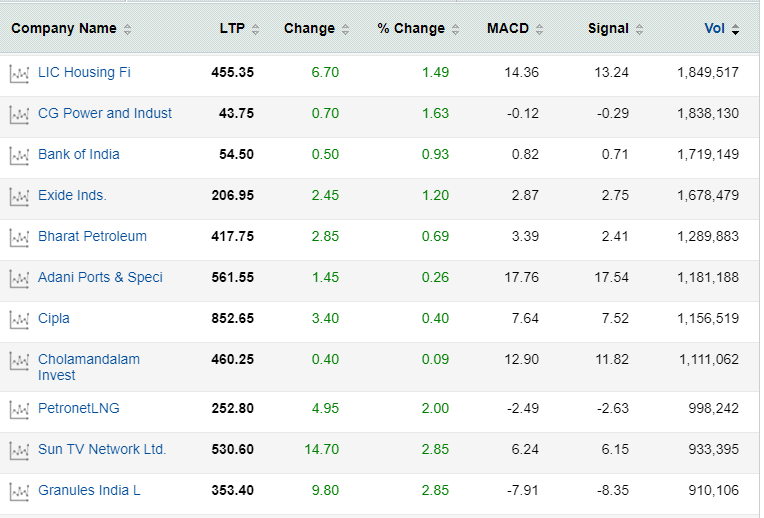

As many as 193 stocks on the Bombay Stock Exchange (BSE) showed clear signs of strength on Thursday on the moving average convergence divergence or MACD, a technical indicator that reflects the ongoing momentum in a security.

The indicator formed bullish crossovers on these counters, hinting at possibility of further upside. Strong trading volumes on many of these counters lent credence to the emerging trend.

The list included BHEL, ITC, Bharti Airtel, Power Grid, Hindustan Copper, NTPC, M&M, RBL Bank, Bank of India, Bandhan Bank, Granules India and HDFC, among others. Some of these stocks have come out with superior earnings performance for December quarter, while others are expected to gain from the government large capex push.  “Markets cheered the Union Budget and scaled new highs. Structurally, Nifty50 is poised for further rise in the medium term, but some consolidation is expected in the short term. We see a base for the index at 13,450, while on the higher side the 16,000 mark looks achievable. In the short term, volatility is expected to be high and any correction should be used as a buying opportunity,” said Sahaj Agrawal, Head of Research- Derivatives at Kotak Securities.

“Markets cheered the Union Budget and scaled new highs. Structurally, Nifty50 is poised for further rise in the medium term, but some consolidation is expected in the short term. We see a base for the index at 13,450, while on the higher side the 16,000 mark looks achievable. In the short term, volatility is expected to be high and any correction should be used as a buying opportunity,” said Sahaj Agrawal, Head of Research- Derivatives at Kotak Securities.

“Metal stocks look attractive at current levels while banking stocks are expected to witness some profit booking after the recent rally,” he said.

The MACD is known for signalling trend reversals in traded securities or indices. It is the difference between the 26-day and 12-day exponential moving averages. A nine-day exponential moving average, called the Signal Line, is plotted on top of the MACD to reflect ‘buy’ or ‘sell’ opportunities.

When the MACD crosses above the Signal Line, it gives a bullish signal, indicating that the price of the security may see an upward movement and vice versa.

When the MACD crosses above the Signal Line, it gives a bullish signal, indicating that the price of the security may see an upward movement and vice versa.

Meanwhile, data showed two stocks are showing clear bearish trends: Tata Motors and Future Retail, both of which have run up significantly in last one month.

“Markets cheered the Union Budget and scaled new highs. Structurally, Nifty50 is poised for further rise in the medium term, but some consolidation is expected in the short term. We see a base for the index at 13,450, while on the higher side the 16,000 mark looks achievable. In the short term, volatility is expected to be high and any correction should be used as a buying opportunity,” said Sahaj Agrawal, Head of Research- Derivatives at Kotak Securities.

“Markets cheered the Union Budget and scaled new highs. Structurally, Nifty50 is poised for further rise in the medium term, but some consolidation is expected in the short term. We see a base for the index at 13,450, while on the higher side the 16,000 mark looks achievable. In the short term, volatility is expected to be high and any correction should be used as a buying opportunity,” said Sahaj Agrawal, Head of Research- Derivatives at Kotak Securities. When the MACD crosses above the Signal Line, it gives a bullish signal, indicating that the price of the security may see an upward movement and vice versa.

When the MACD crosses above the Signal Line, it gives a bullish signal, indicating that the price of the security may see an upward movement and vice versa.

No comments:

Post a Comment