Most Adani Group stocks suffered losses in Intraday Trade on June 14 after media reports suggested that the National Securities Depository Ltd (NSDL) has frozen three Foreign Portfolio Investors' (FPIs) accounts that own shares in four of the listed Adani firms.

Shares of Adani Ports (down 8.36 percent), Adani Enterprises (down 6.26 percent), Adani Total Gas (down 5 percent), Adani Transmission (down 5 percent), Adani Power (down 5 percent) and Adani Green Energy (down 4.13 percent) all ended in the red.

Later in the day, Adani Enterprises issued a statement terming the media reports as erroneous.

"We bring to your kind attention, the news headlines published in ET that NSDL has frozen the accounts of 3 foreign funds-Albula Investment Fund, Cresta Fund and APMS Investment Fund holding shares in Adani Group Companies. We regret to mention that these reports are blatantly erroneous and are done to deliberately mislead the investing community. This is causing irreparable loss of economic value to the investors at large and reputation of the group," Adani Enterprises said in a statement.

"Given the seriousness of the article and its consequential adverse impact on minority investors, we requested Registrar and Transfer Agent, with respect to the status of the Demat Account of the aforesaid funds and have their written confirmation vide its e-mail dated 14 June 2021, clarifying that the Demat Account in which the aforesaid funds hold the shares of the Company are not frozen," the company's statement said.

Besides, Sebi is reportedly investigating whether there has been price manipulation in Adani Group stocks, which have gained between 200 and 1,000 percent in the last one year. Moneycontrol could not independently confirm the development.

Overall, the m-cap of Adani group stocks fell nearly Rs 54k crore today. However, Adani group stocks have been on a tear for over a year.

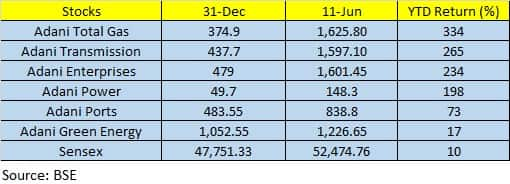

Stocks like Adani Total Gas vaulted 334 percent in the calendar year till June 11. Shares of Adani Transmission, Adani Enterprises and Adani Power have jumped between 200 percent and 265 percent in the same period.

Analysts are now advising staying away from Adani group stocks.

"No fresh trades are advisable for now in Adani group stocks. As these shares are in control of the operators and the news is out, the risks are high. There can be unpredictable movements in either direction. Those who are trapped in long positions should wait patiently for a bounce to exit," said Sanjeev Agarwal, Founder and CEO, Alpha Quantum Capital Management Ltd.

Yash Gupta, Equity Research Associate, Angel Broking pointed out as per the different market news some of the mutual funds are holding very large quantities of Adani groups stocks and some complaints have been filed with Sebi also.

"From today, four Adani group stocks have been shifted to T2T (trade 2 trade) which means that intraday trading will not be permitted and investors need to take or give holding for any trade," said Gupta.

"We suggest investors be cautious on Adani group stocks, trading at very high valuations compared to peers. Buy on dips or averaging the buy position should be avoided for the time being," Gupta said

No comments:

Post a Comment