The tax administration's fascination with 'data' collection has been a hallmark of India's tax policy in the recent years. Introduction of technology led GST regime in India paved the way for granular transaction level reporting for indirect tax purposes. This was followed by introduction of Tax Collection at Source (TCS) on sale of goods last year where seller was entrusted with the responsibility to collect Income-tax at 0.1% from buyer, subject to certain conditions.

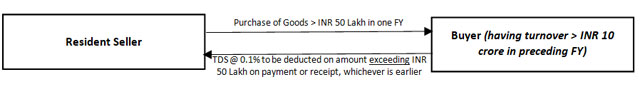

In what is popularly seen as a course correct, the Finance Act, 2021 shifted the compliance burden from seller to buyer by introducing Tax Deduction at Source (TDS) on purchase of goods, subject to similar conditions w.e.f. 1 July 2020.

This means that the IT changes done by India Inc last year to comply with new TCS provisions may no longer be as relevant and new changes would be required to be implemented to gear up the systems to handle TDS on purchase of goods as well as the interplay between TCS and TDS provisions.

This is because introduction of TDS on purchase of goods exponentially expands TDS net and the interplay between TDS and TCS provisions requires validation of buyer's turnover and transaction amount. Where transaction value exceeds Rs 50 lakh and buyer's turnover exceeds Rs 10 crores in the earlier year, TDS would apply over TCS. For sale transactions involving motor vehicle, tendu leaves, scrap, etc., TCS continues to apply. There are also certain interpretational issues (inclusion of GST in consideration, application on new companies in the year of incorporation, transitional issues, etc.) associated with levy of TDS as well as the interplay with TCS.

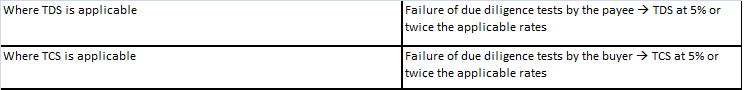

The other new provision coming into effect from 1 July 2021 is the one which requires both sellers and buyers to undertake due diligence w.r.t. tax return filing status of the other party where aggregate TDS/TCS credit is at least Rs 50,000. Where the payee is found to have not satisfied the due diligence tests, the payer is required to deduct tax at higher punitive rates as specified in the law, which could be higher of twice the normal rate or 5%. This due diligence requirement is applicable to most of TDS provisions on resident payments like shareholder dividends, service payments to vendors, rent, etc. but does not apply to salary, winnings from lottery/ crossword puzzle, etc. Similar is the expectation from the seller who needs to collect TCS from the buyer at a higher rate if the buyer does not satisfy the due diligence tests..

While the larger intent behind the above provisions is to push the compliance index, this can easily be a nightmare for India Inc because of the onerous due diligence requirement. But one must laud the tax administration for the recent launch of the compliance functionality " Compliance Check for Section 206AB and 206CC"which allows taxpayers to look up PAN (individual/bulk) of the other party to perform the due diligence tests. CBDT has also issued a guide covering the procedural aspects in detail.

Considering the language of the provisions, India Inc would be required to undertake this due diligence at least twice in a year. However, the recent CBDT Circular provides a welcome relief by restricting the need for second due diligence to only those parties who fail the first one. CBDT has also clarified that even a belated tax return filing will help the taxpayer to escape from such punitive provisions.

( Ashish Jain is Tax Partner, EY India. Rohan Tanwani, senior tax professional, EY also contributed to the article< ..

Used here for Educational Purposes only

No comments:

Post a Comment