Synopsis

RHI's parent has committed to supply magnesite, a raw material, from its global mines. This will give RHI an edge over domestic peers such as Vesuvius, IFGL Refractories and Tata Krosaki - none of which are backward-integrated and are dependent on Chinese imports for raw material.

ET Intelligence Group: The stock of RHI Magnesita India, which provides refractory products to the manufacturing industry including steel, non-ferrous metals, cement, and glass, has gained 58% so far in 2022, notwithstanding the broader market volatility.

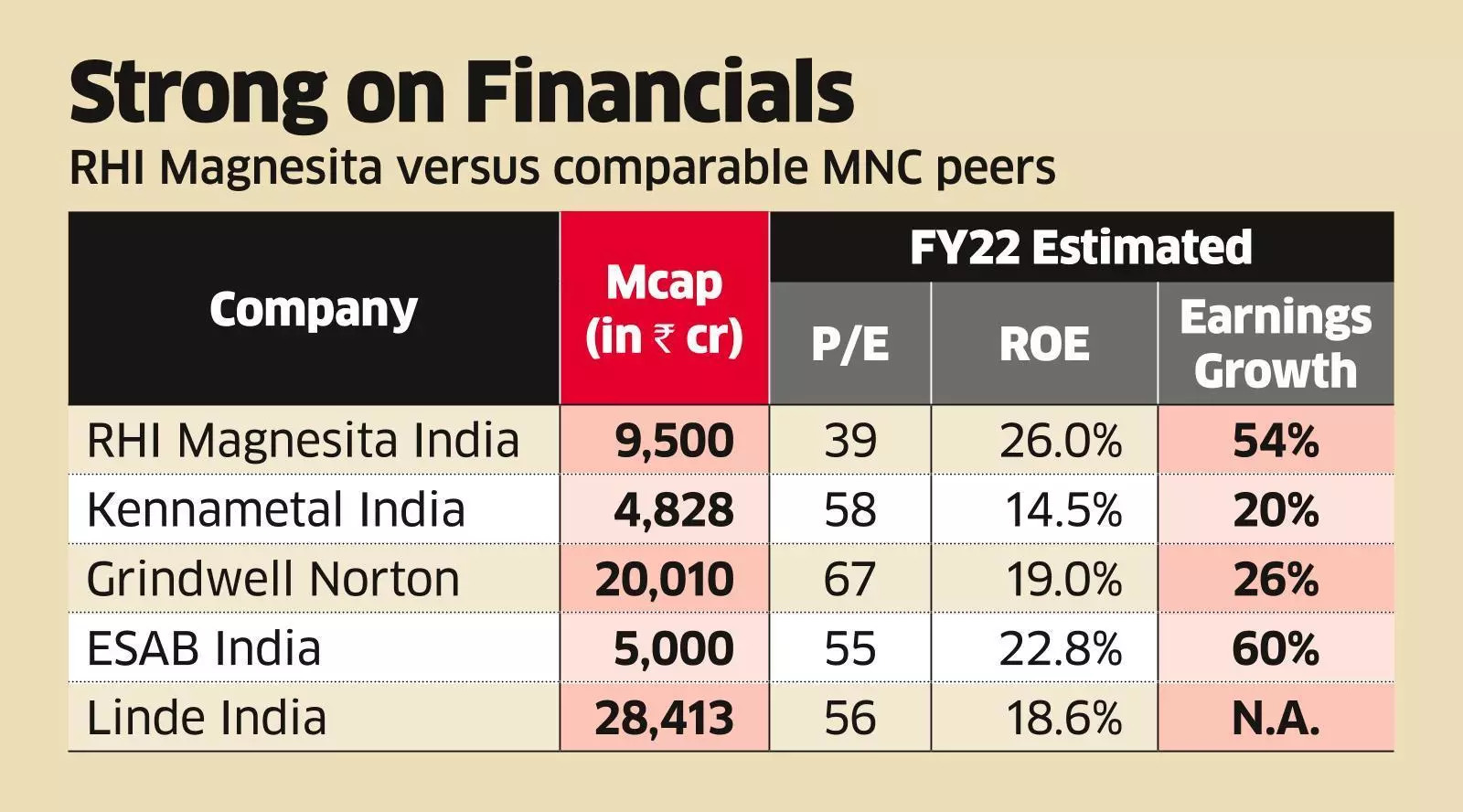

Despite the gain, the stock still trades at a valuation below some of the other multinational manufacturing companies.

The company's multinational parent has plans to make the Indian subsidiary its global manufacturing hub. RHI has a nearly 20% market share in the Indian refractories segment.

The domestic steel sector is expected to grow by 8% annually in the current decade, which bodes well for the company.

The company plans to double the capacity to 280,000 tonnes by FY23 for an investment of ₹450 crore. It is also looking at acquisitions for a speedy expansion.

RHI's parent has committed to supply magnesite, a raw material, from its global mines. This will give RHI an edge over domestic peers such as Vesuvius, IFGL Refractories and Tata Krosaki - none of which are backward-integrated and are dependent on Chinese imports for raw material. Due to higher raw material costs, the profitability of peers suffered in the December quarter.

On the other hand, RHI's sales and operating profit before depreciation and amortisation (Ebitda) for the December quarter grew 41% and 62% year-on-year and 26% and 61% quarter-on-quarter, respectively.

Despite the cyclicity in the steel industry, the refractory segment has shown consistent growth in the past six years. RHI has been the leader in terms of Ebitda margin, which ranged between 16% and 19% and return on equity was in the range of 25% to 30%.

At around ₹590, the stock trades at 39 times FY22 estimated earnings. Other MNCs supplying to the manufacturing industries such as Kennametal, Grindwell Norton and ESAB India trade at 57, 66 and 55 times FY22 estimated earnings, respectively, despite lower growth, margins and return ratios.

(Originally published on Mar 22, 2022, 04:16 PM IST)

No comments:

Post a Comment