iShares India MSCI ETF, with a size of USD8.6 billion or INR75,000 crore, is one of the largest India-dedicated funds from the US market. The underlying index for the fund is the MSCI India (USA), which has returned -3.40% YTD. Its largest holding is HDFC Bank at 8% — an outperformer for the past one year.

Similarly, the last year’s performance of Franklin FTSE India ETF, with an asset under management (AUM) of USD1.7 billion, has not been in line (rather negative). Again, the largest holding of the fund is HDFC Bank.

Let’s look at Wisdom Tree, a big ETF house in the US. Its India Earnings ETF has a total AUM size of USD3 billion (INR26,000 crore). In the past 11 months, the fund has given a return of -4% as compared to 10.71% for 2024. In August 2024, when the Indian markets were hot, this fund returned 38.8% at a time when the SPDR S&P 500 ETF had given a return of 27%.

All these funds were massive India bulls till six months ago but today they are facing redemption pressure as investors from global markets do not want to have a position on India. Over the long term, funds that have invested in emerging markets have not made money. In fact, it is the US market that has given the highest returns YoY. These funds prefer to be in the home market where Donald Trump’s victory is playing up the markets, interest rates are high, and the dollar is strong. The 10-year government bond in the US has a yield of 4.45% plus the appreciation of the dollar is attracting FIIs to their home market. Over the last one year, the rupee is down 5.4% against the dollar and presently trades at INR87.06.

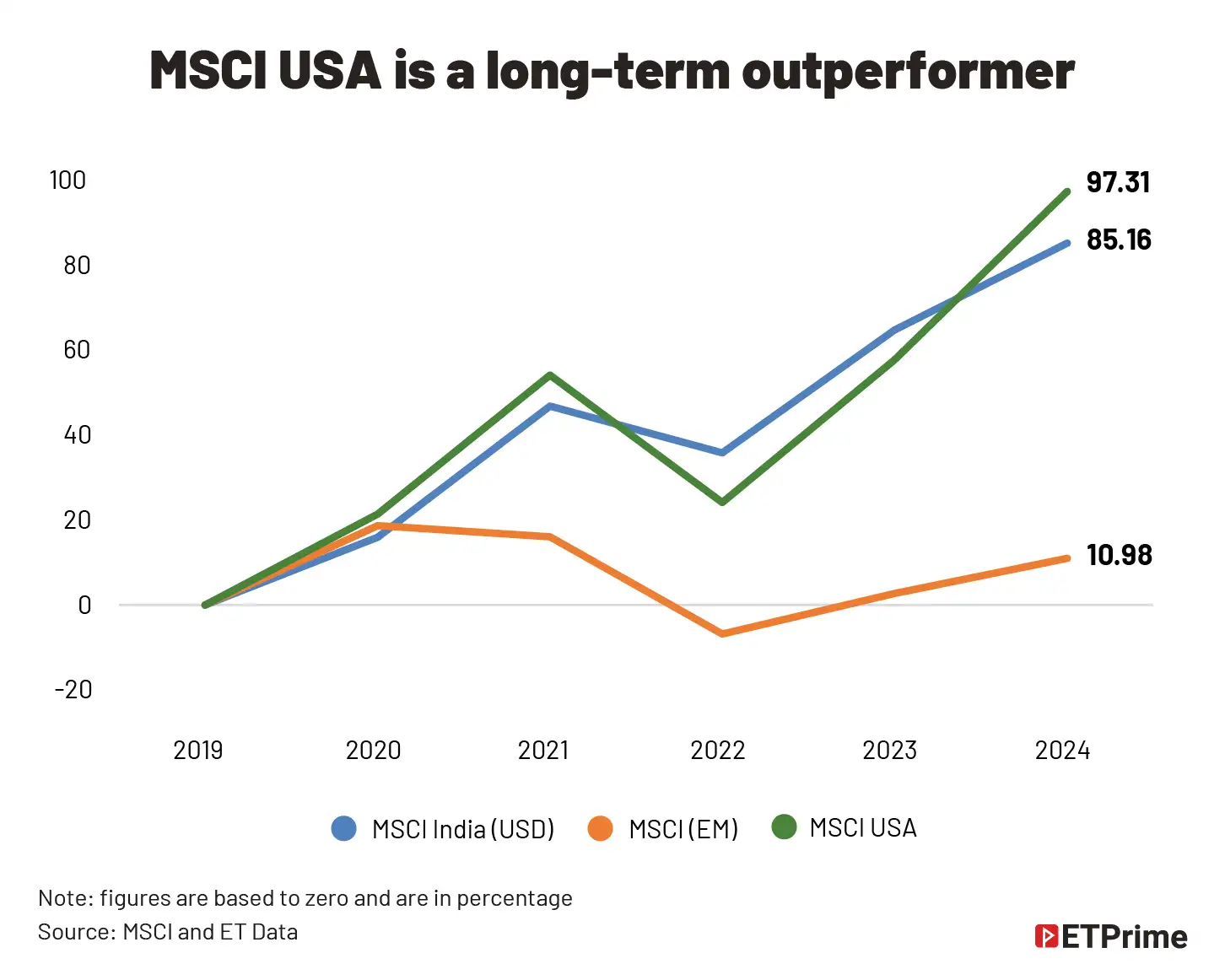

The MSCI USA Index returned 27% in 2023 and 25% in 2024 which was way stronger than the Indian or even the world markets. The MSCI Emerging Market returned 9% for 2024. The MSCI Chinese Index has returned 20% against India which returned 15% for the same period.

India accounts for 1.88% of the MSCI All Country World Investible Market (ACWI) Index. This number was higher in September 2024 at 2.35%. The US accounts for 66.5% of the ACWI Index. In June 2024, the same number was 62.6%.

Institutional investors allocate capital to markets that are bigger in size and show growth and momentum. They are not interested in markets that are down and have a value proposition. Thus, all these investors are increasing their allocation to the US, which has become a strong and resilient economy.

“If I put money in multiple equity markets across the globe, the index which is measured, the weight of US is 60%-70%. Emerging markets all put together is 10%,” said Swanand Kelkar, managing partner, Breakout Capital Partners, in a note to his investors. The last two year’s gains in the US market now gives it an edge, showing an outperformance across timelines. No wonder foreign investors are moving out of India. In 2024, the net foreign investment in the Indian markets was negative at INR4,815 crore. There was some FII buying in the first week of February but that was only for a day. For 2025 so far, FIIs have sold equities worth INR77,721 crore. They started to sell the Indian markets since October 2024, and no one really has any idea when they will start buying India for the long term.

All eyes on US markets

Sanjeev Prasad, managing director, Kotak Institutional Equities, believes the case for investing in the Indian markets by foreign investors remains weak. He recently told a news website that the MSCI Emerging Market has underperformed the MSCI US market over a decade. He is right. In the last 10 years, MSCI Emerging Market Index has returned only 4% annual returns. Against this MSCI USA has returned 13.75%. India has returned 7.8% and MSCI China Index has returned 1.92% annually.

Over the last 14 years (2010-2024) the MSCI India Index (USD) has remained negative six times (based on yearly returns) while the same for MSCI Emerging Market Index stayed has been seven times. The MSCI US Index has remained negative for only two times. Now, all attention is on the US market which is expensive but still attractive.

However, Nilesh Shah, managing director of Kotak Mutual Fund, is optimistic. In an interview in November 2024 with Business Standard he said, “Subah ka bhoola agar sham ko ghar aa jaye to use bhoola nehi kehte.” Basically, he feels FIIs will come back. But he believes that India should focus on double-digit GDP growth rate and foreign investors will come back.

In general, FIIs don’t make money in the Indian market when compared to the US but as apart of some diversification they have always had some holdings here.

They ideally prefer to have positions in a market like China where companies are bigger, and even the market has depth. Also, China is becoming the big tech hub in terms of AI, which is turning out to be a big plus for the country.

Post Covid-19, the Chinese GDP growth has tumbled down, and many foreign investors have looked at India favourably as large-cap banks had cleaned up their balance sheets. In general, Indian corporates were showing good topline growth.

However, for FY25, the Nifty 50 companies are expected to grow only at single-digit rates. Foreign investors do not want to pay a higher PE multiple of 20x for the Nifty 50 at a time when they don’t see any growth. On the other hand, the US tech companies are delivering and despite the S&P 500 being valued at a price-to-book of 5.2x (all-time high) foreign investors are taking comfort. The US dollar is rising, and interest rates are still on the higher side for most investors to even consider investing into emerging markets.

What to expect in 2025?

While 2025 may not be a great year for the return of foreign investors, India is the top emerging market for large investors who want to take a diversified position.

The fiscal deficit, the current account deficit and inflation numbers for India are looking healthy. Global investors are not at all worked up on these numbers. It is just that they find the US a more attractive destination because of its high weightage in global indices.

With the government now focusing on consumption and reducing interest rates, the stock market should ideally benefit from this. But it is going to take time. The only bet that India has, is that the US market is too expensive. Ideally, the next year growth for US markets should be lower but then Indian markets are not exactly cheap.

The US market is expensive, and at some point, it has to rationalise. This is true for India as well. But the good part is that large Indian companies, which are a part of the Nifty 50, are now trading at low valuations. This is especially true for banks. It is a segment that has attracted foreign investors. Even now the top funds have HDFC Bank as their highest holding.

Indian markets will take some time to get FIIs. But the optimism of the retail investor who is investing into the market every month through SIPs will keep it steady. Can we bet on the long-term ability of the retail investor to be in the equity market? There is not enough data to prove it. But there has been enough evidence to show that FIIs will come when they see clear growth, especially when compared to the US market. They will have to diversify, and they can’t ignore India.

(Graphics by Sadhana Saxena)

(Originally published on Feb 10, 2025, 12:30:00 AM IST)

No comments:

Post a Comment