NEW DELHI: There may be noise over heavy tax burden on small businesses but initial data does not support the complaint. It turns out that over 40% of the 54 lakh businesses which filed GST returns in July claimed 'nil' tax liability and paid no tax. This means that around 22 lakh did not pay even one rupee GST.

Of the remaining 60% or 32 lakh businesses that filed returns on the GST Network (GSTN), the IT backbone for the indirect tax, many did not have a cash liability as they opted to use the credits available for service tax or excise that they had paid before GST kicked in on July 1.

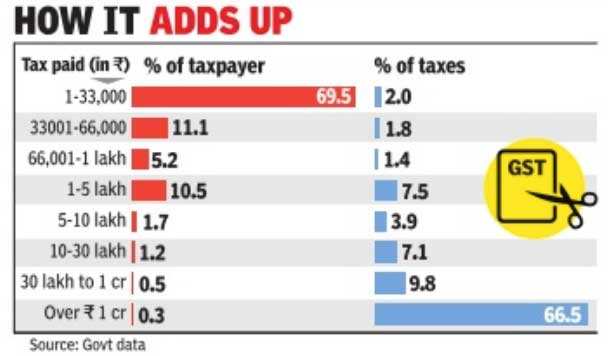

Data available with the government showed that apart from those with "nil" returns, close to 70% of the 32 lakh businesses which had a tax liability paid anywhere between Re 1 and Rs 33,000 in taxes. In contrast, just around 0.3%, which is a little over 10,000 companies accounted for almost two-thirds of the GST mopped up by the government in July. The government had said that it had mopped up around Rs 94,000 crore during July.

Currently close to 1 crore businesses and service providers are registered with GSTN, of which 72 lakh had migrated from excise, VAT and service tax, while 25-26 lakh new taxpayers have been added, finance minister Arun Jaitley said on Friday. He also said that around 9495% of the collection is from large assessees or those with a turnover of over Rs 1.5 crore, who make up around 10% of the registered base of taxpayers.

“Everyone is simply seeking exemptions but most are not paying taxes,“ said an official. The government's move to usher in GST has faced criticism with political parties blaming poor implementation for the problems being faced by businesses. The government, while fixing the problems has said that a part of the reason for the criticism is due to the fact that many entities which were earlier out of the net or evading taxes are now being forced to pay up.

Although tax collections are lower from a majority of the taxpayers, the government is hoping that GST will help widen the base and create space in the future to reduce tax rate. Jaitley said at Friday's meeting that GST Council also decided on how rates will be tweaked in the future. “ As revenue increases, and depending on the revenue neutrality situation in the future, rates will be tailored according to the concept paper (that was cleared),“ he said.

(This article was originally published in The Times of India)

Read more at:

No comments:

Post a Comment