India's foreign exchange reserves logged their biggest weekly jump since September 2021 and also rose for the first time in three weeks for the week ended October 28, helped by gains in both foreign currency assets and gold reserves.

The foreign exchange reserves of Asia's third largest economy rose by $6.56 billion to $531.08 billion for the week ending Oct 28, according to data released today by the Reserve Bank of India.

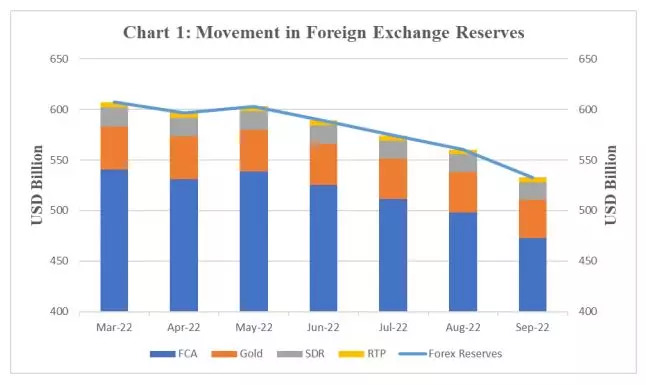

However, the spot forex reserves are still sharply down from $607 billion in end-March and depleted by $111.37 billion from the record high of $642.45 billion seen on September 3 last year.

The forex reserves have depleted for 11 weeks out of 13. The other time it got lucky was for the week ended Oct 7, when gains in gold reserves had lifted the forex reserves by just $204 million.

The foreign exchange reserves had fallen to their lowest level since July 2020 to $524.52 billion for the week ending Oct 21.

The gain in the foreign exchange reserves can be attributed to a rise in the Foreign Currency Assets (FCA), which is a major component of the overall reserves, according to the Weekly Statistical Supplement released by RBI.

Foreign currency assets rose $5.77 billion to $470.85 billion for the week ending Oct 28. Gold reserves rose by $556 million to $37.762 billion.

Expressed in dollar terms, FCA consists of the effect of appreciation or depreciation of non-US units like the euro, pound and yen held in the foreign exchange reserves.

Rupee Movement

For the week ended October 28, the rupee closed with its first weekly gain in seven weeks after carving out a 0.25% gain. The local currency, along with most other Asian peers, gained on bets that the Federal Reserve may not opt for another 75 basis points hike in its December December policy meeting.

The Indian rupee today gained 0.36% to settle at 82.44 per dollar, thanks to the Chinese yuan's rally that helped it erode losses accumulated through the week.

To help arrest rupee's record fall, the Reserve Bank of India has now burned $111.37 billion from its forex coffer, triggering concerns on this front as well. The central bank has however attributed about two-thirds of the decline to valuation effects.

The soaring dollar, accelerating US interest rates, stalling global economy and alarming geopolitics have whipsawed global currencies, sending them to record lows against the greenback. On the other hand, interventions by central banks across the globe to support their local units have eroded global foreign-currency reserves by about $1 trillion, or 7.8%, this year to $12 trillion, the largest drop since Bloomberg started to compile the data in 2003.

FX Reserves Half Yearly Report

The RBI today also released Half Yearly Report on Management of Foreign Exchange Reserves for April to September of this year. During the half-year period under review, reserves decreased from $607.31 billion as at end March 2022 to $532.66 billion as at end-September 2022, it said.

On a balance of payments basis (i.e., excluding valuation effects), foreign exchange reserves increased by a meager $4.6 billion during April-June 2022 as compared with increase of US$ 31.9 billion during April-June 2021, the RBI said. Foreign exchange reserves in nominal terms (including valuation effects) decreased by $18.2 billion during April-June 2022 as compared with increase of $34.1 billion in the corresponding period of the preceding year.

As of September-end, out of the total FCA of $472.81 billion, $361.84 billion was invested in securities, $81.64 billion was deposited with other central banks and the Bank of International Settlements and the balance $29.33 billion comprised deposits with commercial banks overseas. With the objective of exploring new strategies and products in reserve management while diversifying the portfolio, a small portion of the reserves is being managed by external asset managers, the RBI said. The investments made by the external asset managers are governed by the permissible activities as per the RBI Act, 1934.

Strong Forex Umbrella

Reserve Bank of India Governor Shaktikanta Das last month said the central bank's forex reserves umbrella has continued to remain strong despite uncertainty in markets. He said the RBI has been intervening in the forex market based on continuous assessment of the prevailing and evolving situations.

Das said about 67 per cent of the decline in reserves during this financial year that started Apr. 1 is due to valuation changes arising from an appreciating US dollar and higher US bond yields. The governor said that there was an accretion of US$ 4.6 billion to the foreign exchange reserves on balance of payments (BOP) basis during Q1:2022-23.

Fitch Ratings said last week that the reserve cover remains strong at about 8.9 months of imports in September. This is higher than during the “taper tantrum” in 2013, when it stood at about 6.5 months, and offers the authorities scope to utilise reserves to smooth periods of external stress.

Foreign exchange reserves could fall to $510 billion even in a worst case scenario if the current account deficit widens to 4 percent during FY'23 estimates IDFC First Bank. Still we would be better off than the Taper Tantrum period of May 2013 when reserves were less than $300 billion.

No comments:

Post a Comment