In a ruling that will potentially bring additional tax liabilities of about $1 billion on the telecom sector this fiscal year alone, impacting operator cash flows, the Supreme Court on Monday held that licence fees payable by the telcos will be treated as entirely “capital in nature”.

It set aside a Delhi HC order that categorised licence fees before and after July 31, 1999, differently, as capital expense and revenue expense, respectively.

Rejecting this recharacterisation, a top court bench comprising Justices B V Nagarathna and Ujjal Bhuyan said the licence fees remain capital regardless of instalment payments after the New Telecom Policy 1999 came into effect.

Big Setback for Older Telcos

The order is a setback for older telecom companies Bharti Airtel and Vodafone Idea, and, to a lesser extent, even for Reliance Jio, as they will need to reassess their financial structures and potentially face increased tax liabilities.

“Variable licence fees will be treated as a capital expenditure and, as a corollary, the deduction will not be allowed in the year of the expenditure now,” said taxation lawyer Abhishek A Rastogi, founder of Rastogi Chambers. “This means that higher income will be subject to tax in the year of the expenditure, thereby leading to higher tax-to-net-profit

Experts said the tax implications would be on calculations since 1999.

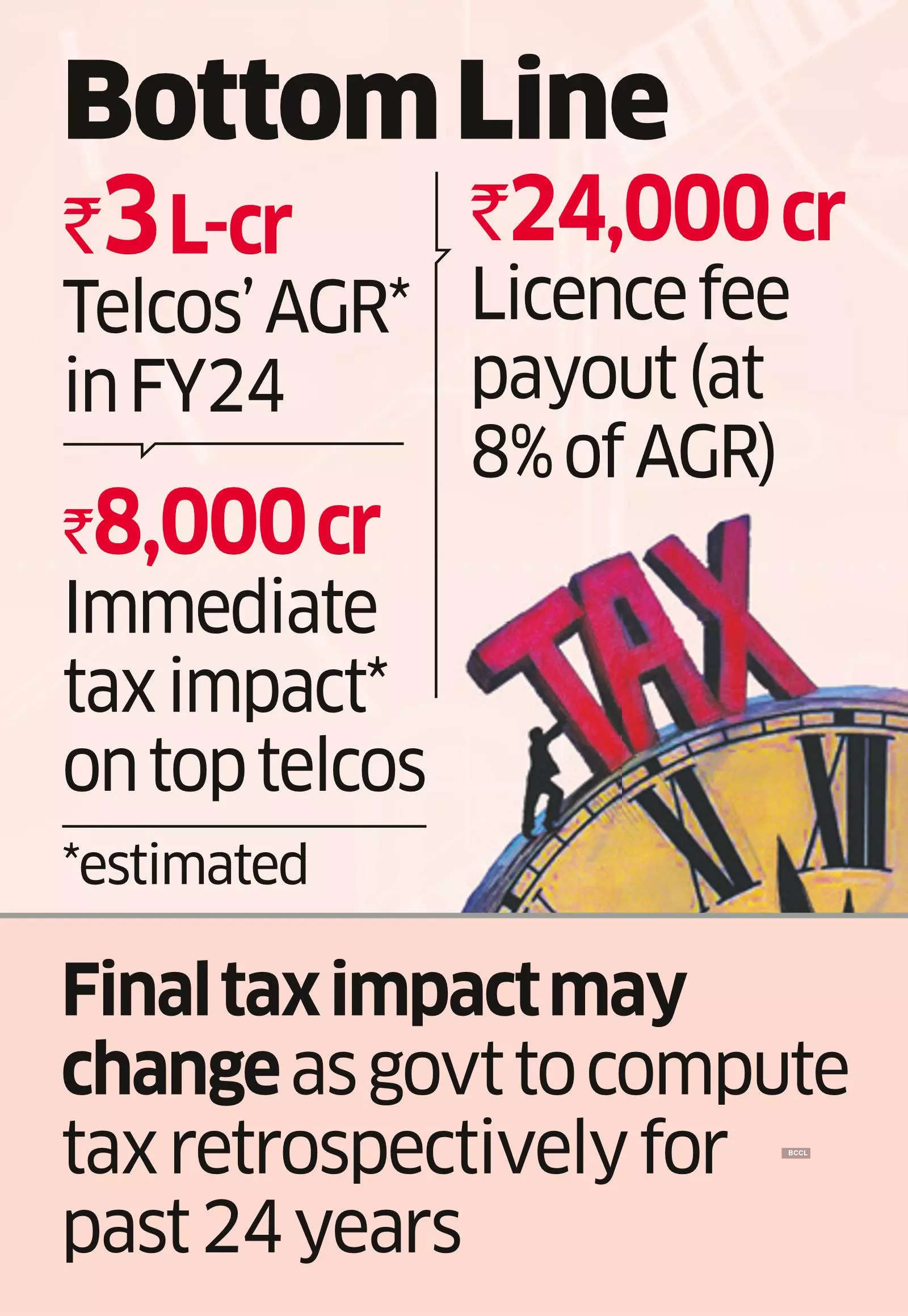

Peeyush Vaish, partner and TMT industry leader at Deloitte India, said back-of-the-envelope calculations suggest that in the immediate term, the top telcos could collectively face around a $1 billion, or about Rs 8,000 crore, of additional tax liabilities, given that the sector’s adjusted gross revenue (AGR) in FY24 is estimated at Rs 3 lakh crore which, in turn, would peg the sectoral licence fee payout at Rs 24,000 crore.

“Till date, telcos have claimed deductions on account of variable licence fee on a year-to-year basis for computing their tax liability…but since the Supreme Court is now treating licence fee as a capex (and not a revenue expenditure), telcos will only be able to amortise it over the remaining tenure of their licences, which will automatically increase net income, in turn, resulting in a higher tax payout, impacting telco cash flows,” Vaish told ET.

He, however, said the final tax liabilities of the operators could see some adjustments as the government is likely to undertake retrospective tax computation for the past 24 years as licence fee payouts based on AGR will be treated as capex from 1999 onwards, and consider the accumulated tax losses of the operators.

Amortisation allows companies to spread the expenditure on an asset that has a long shelf life into several years in their books whereby the benefit of claiming deduction is also spread.

Airtel, Jio and Vodafone Idea did not respond to ET’s emailed queries as of press time Monday. Industry executives said they will study the order before deciding on the next course of action.

Legal and tax experts said the ruling is poised to have far-reaching implications for the financial strategies and tax planning of not only telecom companies but also other industries across India.

“The various telecom operators who have incurred substantial expenses to obtain licence will have to revisit the position taken with respect to the deductibility of the expense,” said Mihir Gandhi, partner, tax & regulatory services, at BDO India. “The disallowance of the expenses would adversely impact the companies which are already suffering huge loss.”

The Delhi HC had in December 2013 held that the licence fee payable up to July 31, 1999, was to be treated as capital expenditure, thus would qualify for deduction under Section 35ABB. The licence fee on revenue sharing basis from August 1, 1999, was to be treated as revenue expenditure.The Delhi HC’s decision was then followed by various other high courts across the country, including Bombay and Karnataka.

No comments:

Post a Comment