Tax experts under income-tax lens for valuation of startups

MUMBAI/AHMEDABAD: Indian tax authorities have begun questioning consultants and accountants on the methodology of their enterprise-value estimates after challenging the valuations of startups. Since August, the authorities have started questioning valuers and tax experts on their valuation assessments, four people with direct knowledge of the matter told ET.

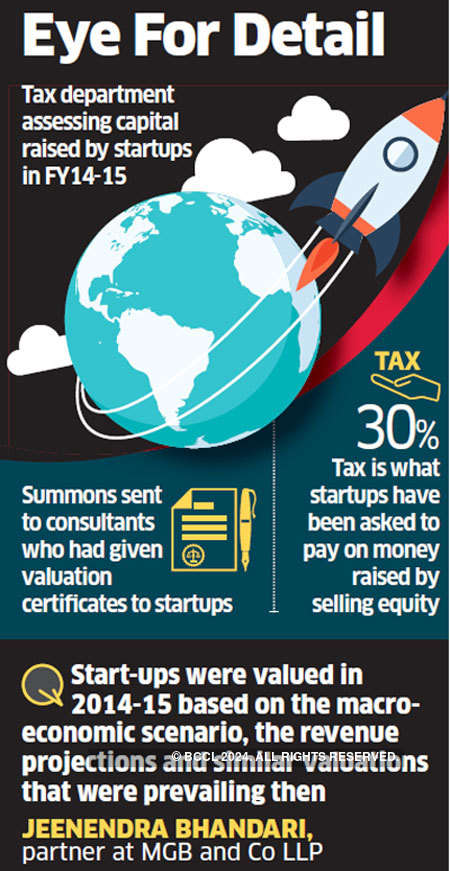

In particular, the taxmen want to know the reason behind high valuations given to several startups in 2014 and 2015. For their part, the financial experts say that their estimates were based on the startups’ projected revenue and growth – something most failed to achieve.

The tax authorities say that the funding received over and above the fair market value of a startup must be considered as its income and not capital.

Many tax officials believe that the relevant section of the Income Tax Act gives them the power to levy tax on the excess consideration.

“Startups were valued in 2014/15 based on the macro economic scenario, the revenue projections and similar valuations that were prevailing then. While it may be true that many startups weren't able to achieve their revenue projections, it may not be fair to question the valuer unless it is glaringly illogical or incorrect,” said Jeenendra Bhandari, partner at MGB and Co LLP.

ET spoke to several valuation experts who have been questioned in the past month. Tax experts say that the valuation of startups was conducted in the macroeconomic situations prevalent in 2014, and to question these valuations in 2017 is unfair.

An income-tax officer based in Mumbai confirmed to ETthat valuation experts were now being questioned. “We are investigating if some of these investments were for converting black money (unaccounted money) to white (legal money). Why would someone pay a high amount in investments when the real value is much less?” he said.

This argument, however, did not cut ice with the experts. “Valuation is an art and there are many factors that determine valuation at a given point in time. While the department may want to target the shell companies, questioning valuation experts of startups where genuine investments have been made is quite alarming," said Paras Savla, partner, KPB & Associates.

ET had on September 7 reported that startups received tax demands on amount paid over the fair value of compulsorily convertible preference shares.

Amit Singhal, CA and co-founder of Start-up Buddy, said: “A reading of the Section 56(2)(vii)(b) clarifies that the provision is applicable to resident investors if securities premium is charged on shares. It is a commonly accepted practice among startups to calculate fair market value of shares based on the discounted cash flow (DCF) method, which is based on the present value of cash flow expected to be earned by the business in the future.”

Fair market value is assessed by the tax department based on past transactions and the record of similar, comparable companies. The Section is often applied when it’s suspected that companies may be issuing shares at a premium over the fair value for laundering unaccounted cash.

Many startup owners are worried about the fresh set of tax notices in last couple of months. Sourabh Deora ..

No comments:

Post a Comment