By Narendra Nathan ET-Sep 16,2017.

Even though the stock market has been rising and the benchmark indices, Sensex and Nifty, are close to all-time highs, the valuations of holding companies are not in sync with that of their subsidiaries. In fact, the discounts at which parent companies are trading, compared to the valuations of their holdings, have widened further.

This phenomenon usually happens when the market is hot. “Typically holding companies quote at a discount. Since the holding companies don’t move up in line with underlying companies in a rising market, the discount usually widen,” says Ravi Gopalakrishnan, Head, Equities, Canara Robeco Mutual Fund. He advises that investors should look beyond just the discount when making an investment decision.

A big reason for the valuation discount is the diversified portfolio of a holding company. Not all the subsidiaries of a holding company fare equally well and the poor performers pull down the valuations of holding companies. “So, if you are bullish on one particular company, buy that company—not its parent,” says Gopalakrishnan.

Interested in holding companies?

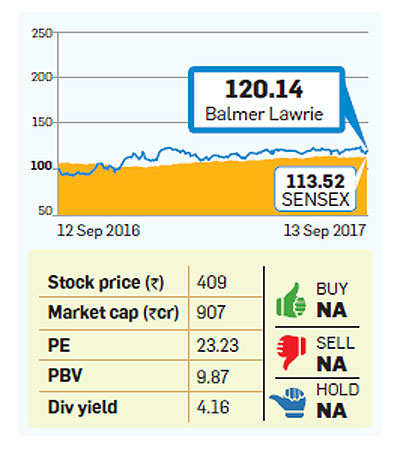

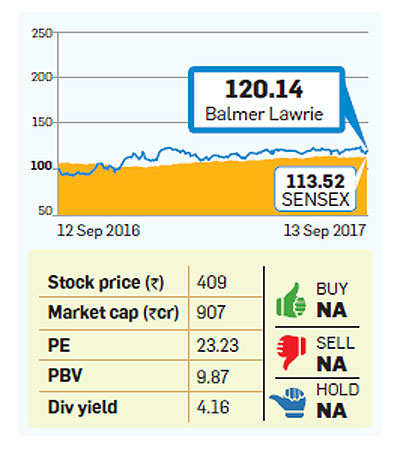

Investors can bet on holding companies with only limited subsidiaries in their kitty. Balmer Lawrie Investments is one such company. “Since a major portion of the dividend received from Balmer Lawrie & Company is distributed as dividends, the dividend yield at Balmer Lawrie Investments is high,” says Rajesh Agarwal, Head of Research, AUM Capital.

Balmer Lawrie Investments

Has consistently offered high dividend yield

Besides limited number of subsidiaries, investors also need to take into account the quality of holding companies’ management. “Sometimes promoters get greedy and decide the swap ratio (the ratio in which a company offers its shares in exchange for the shares of the company it is acquiring) in their favour,” warns Daljeet S. Kohli, an independent market analyst.

Due to a lack of liquidity and low institutional participation in Indian holding companies, buying holding company shares also poses a problem. “Due to low liquidity, the bid-ask spread will be high and some discount will go in that,” says Gopalakrishnan. However, this should not be a big issue for long-term investors. “While short-term investors should avoid this segment (holding companies), long-term investors with 3-5 year holding period can consider them,” says Agarwal.

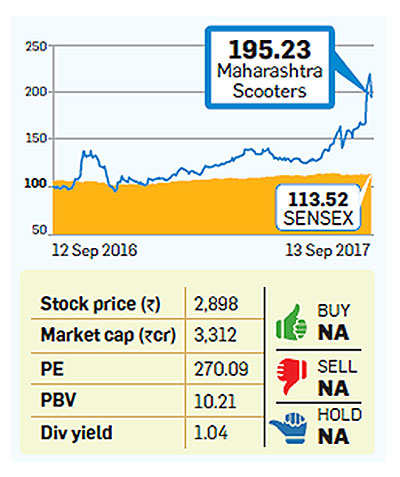

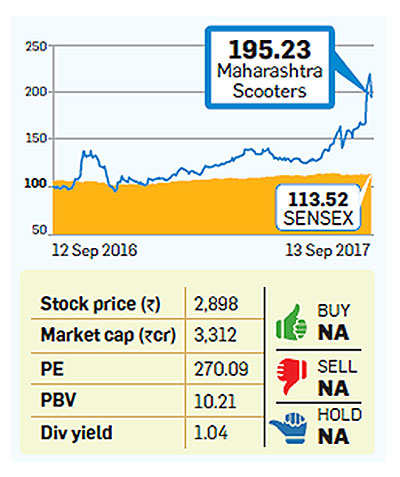

Holding companies’ stocks are usually less volatile because of their high promoter holding— and limited trading in the market. This also means that they may not see a sustained rally. However, there are exceptions. For instance, Maharashtra Scooters’ stock price has almost doubled in the past one year. Experts are still bullish on this company whose holdings include Bajaj Auto, Bajaj Finance, Bajaj Finserv, Bajaj Holdings, Bajaj Hindustan, among other. “Despite the recent rally, Maharashtra Scooter is worth investing because all the companies it holds are doing well,” says Agarwal.

Maharashtra Scooters

Focused holdings to boost stock further

New developments

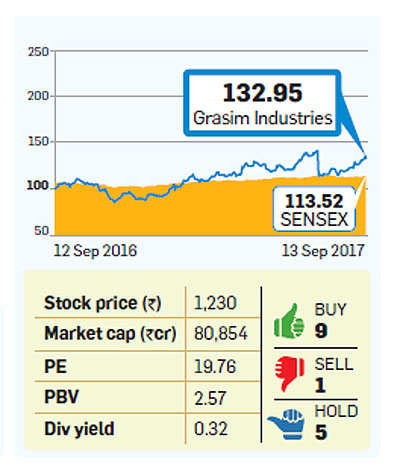

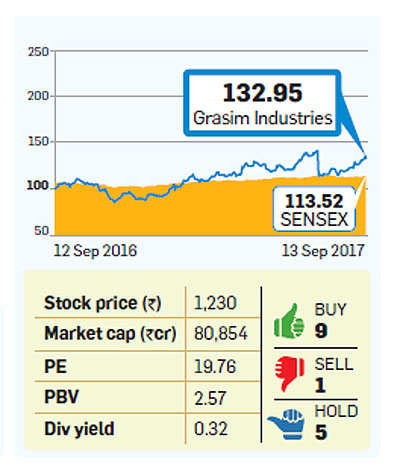

The merger between Grasim Industries with Aditya Birla Nuvo has created a mega-holding company which has stakes in companies across industries—cement, textiles, chemicals, insulators, solar, retail, telecom and financial services.

Will this massive merger help reduce the holding company’s discount? Experts do not think so. “The new exercise is likely to attract a higher discount than earlier. We thus value its stake in Ultratech Cement and Aditya Birla Capital at a 45% discount,” says a recent Motilal Oswal report.

Grasim Industries

Merger with Birla Nuvo will widen the discount

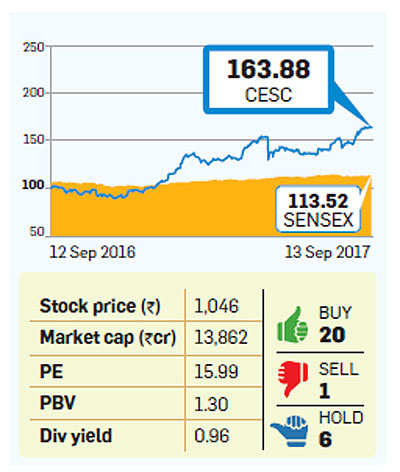

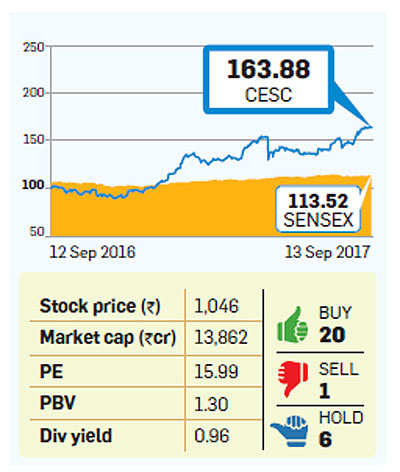

However, analysts are bullish on CESC because the company is looking to undergo a demerger. “The proposed demerger and restructuring would create four distinct entities and unlock substantial value for investors,” says a recent HDFC Sec report. Its subsidiaries include First Source Solutions (55% holding), a profit-making business process outsourcing firm with several Fortune 500 companies as clients.

CESC

Demerger will help unlock value

Figures in the charts have been normalised to a base of 100. Source: BSE, Bloomberg. Compiled by ETIG Database

No comments:

Post a Comment