ET CONTRIBUTORS|

Updated: Sep 04, 2017, 11.29 AM IST

By Tejas Goenka

With the filing of the first set of GSTR-3B done and dusted, it is time now to get GSTR-1 filed. While GSTR-3B was an interim return and was a simple two-page document, GSTR-1 is much more complex. Businesses now have to file GSTR-1, GSTR-2 and GSTR-3 according to the below mentioned revised dates:

The above dates are only for July and August, 2017 returns. The dates for subsequent month's returns (from September onwards) will remain as per the return provisions, that is, File GSTR-1 by 10th, GSTR-2 by 15th and GSTR-3 by 20th of the subsequent month.

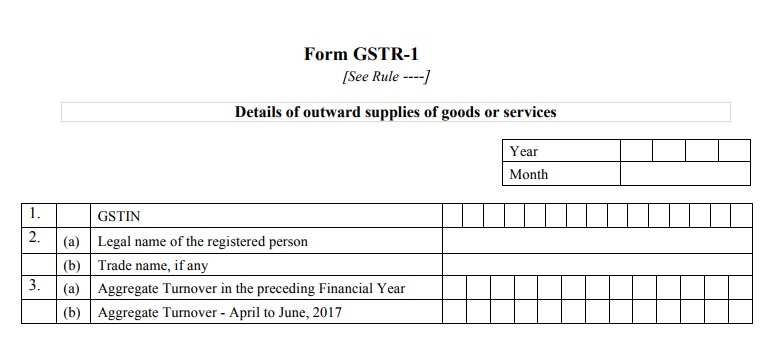

Before we start discussing on how to file GSTR-1, let us understand what is Form GSTR-1 is all about.

What is GSTR-1

Form GSTR-1 is a statement in which a regular dealer needs to capture all the outward supplies made during the month. Broadly, all the outward supplies made to registered businesses (B2B) are required to be captured at invoice level, and supplies made to unregistered business or end consumers are required to be captured at rate-wise.

However, in certain exceptional scenario, even B2C transactions are required to be captured at invoice level.

How to file GSTR-1?

GSTR-1 format contains 13 tables in which the outward supplies details needs to be captured. You need not worry since all tables are not applicable for every business. Based on the nature of business and the nature of supplies made during the month, only the relevant components of GSTR-1 are applicable, not all. Let us discuss on components of GSTR-1 format in detailed.

1. Details of GSTIN and aggregate turnover in preceding year.

In the above table 1, you need to capture the GSTIN allotted to you. Based on the GSTIN, table 2(a) and 2(b) would be auto-populated with details furnished during registration or enrollment. In table 3(a), you need to capture the aggregate turnover of previous financial year, and in 3(b), aggregate turnover of the last quarter (April to June, 2017) needs to be captured manually.

The quarterly turnover information is not to be captured in subsequent returns, and the aggregate turnover of previous financial year would be required to be submitted by the taxpayers only in the first year. From subsequent years, it will be auto-populated.

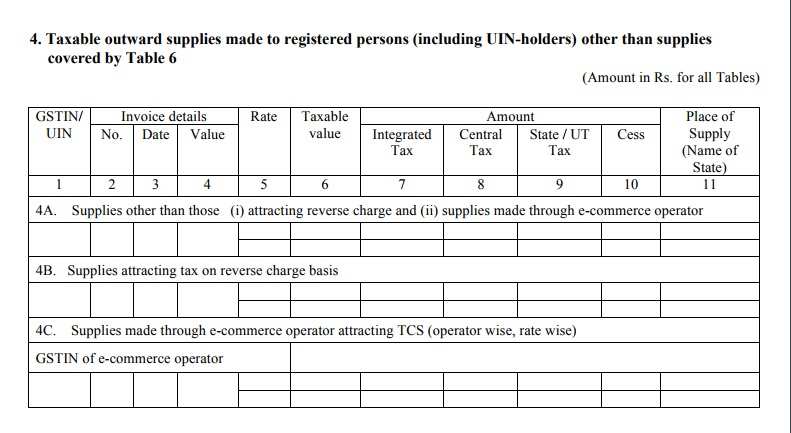

2. Taxable outward supplies made to registered persons (including UIN-holders) other than Zero Rated supplies and Deemed Exports

In the above table, all B2B supplies (outward supplies made to a registered person) both inter-State and intra-State outward supplies should be captured at invoice level rate-wise details.

This table has 3 sections: 4A, all the outward supplies except those attracting reverse charge and supplies made through e-commerce operator; supplies attracting reverse charge should be captured rate-wise in 4B, and those effected through e-commerce operator attracting collection of tax at source should be captured operator wise and rate-wise in 4C respectively.

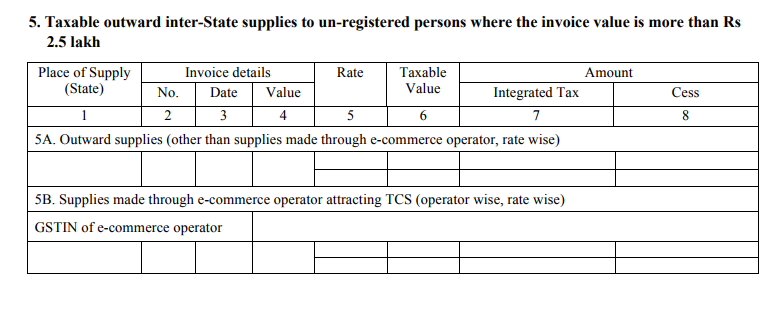

3. Taxable outward inter-state supplies to un-registered persons where the invoice value is more than Rs 2.5 Lakh.

In above table, all inter-State B2C supplies (supplies made to unregistered dealer or end consumer), where invoice value is more than Rs. 2,50,000, you need to upload the invoice-wise and rate-wise details. Similar to table 4, you need to capture the supplies effected through e-commerce operator separately in 5B and all other interstate supplies having invoice value more than Rs. 2,50,000 to be captured in 5A. These types of supplies are referred as B2C Large.

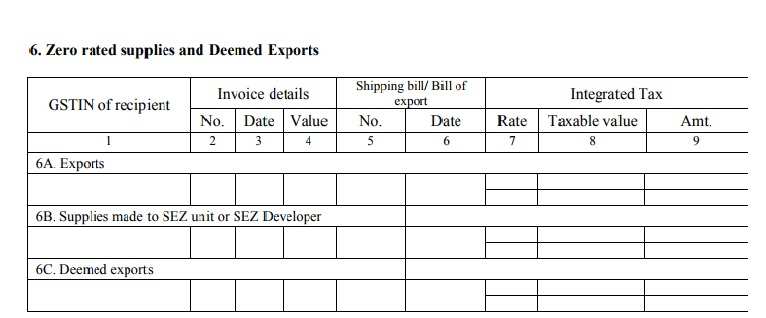

4. Details of Zero Rate supplies and Deemed Exports

In the above table 6, the information related to exports out of India to be captured in 6A, supplies to SEZ unit or SEZ developer in 6 B, and deemed exports in 6C.

The details of these supplies need to be captured at invoice-wise and rate-wise. In declaring these details, the following points needs to be taken care of:

1. Shipping bill and its date. The details of Shipping Bill shall be furnished in 13 digits capturing port code (six digits) followed by unique reference number of shipping bill and its date. If the shipping bill details are not available at the time of filing GSTR-1, the same can be left blank and can be updated as amendment in Table 9 in the next tax period in which the details are available but before claiming any refund/rebate related to the said invoice.

2. Any supply made by SEZ to Domestic Tariff Area (DTA), without the cover of a Bill of Entry is required to be reported by SEZ unit in GSTR-1. The supplies made by SEZ on cover of a Bill of Entry shall be reported by DTA unit in its GSTR-2 as Imports in GSTR- 2.

3. In case of export transactions, GSTIN of recipient will not be applicable and it needs to be left blank.

4. Export transactions effected without payment of IGST (under Bond/Letter of Undertaking (LUT)) needs to be reported as "0" under tax amount heading in Table 6A and 6B.

5. Details of taxable supplies (Net of debit notes and credit notes) to unregistered persons other than the supplies covered in table 5

In the earlier table, that is, no. 5, the taxable person had declared only the interstate outward supplies made to unregistered person (B2C Large) having invoice value more than Rs. 2.5 lakh.

In the this table, that is, Table 7, you need to capture all other supplies made to unregistered person, that is, all intra-state supplies in 7A and inter-state supplies having invoice value up to Rs. 2.5 lakh made to unregistered dealer in 7B.

In Table 7A(1), you need to capture consolidated rate-wise details of all intrastate outward supplies made to unregistered persons, including the supplies made through e-commerce operator. In 7A (2), you need to show separately the details of supplies made through e-commerce operator attracting collection of tax-at-source out of gross supplies reported in 7A (1).

Similarly, the details of inter-state outward supplies having invoice value up to Rs 2.5 lakh need to be captured state-wise and rate-wise in 7B (1). In 7B (2), you need to separately show the details of supplies made through e-commerce operator attracting collection of tax-at-source out of gross supplies reported in 7B (1).

Please note, all the above values should be net of debit note and credit note. If there are any debit note or credit note pertaining to above mentioned supplies, ensure to adjust such values and declare only the net taxable value and corresponding tax.

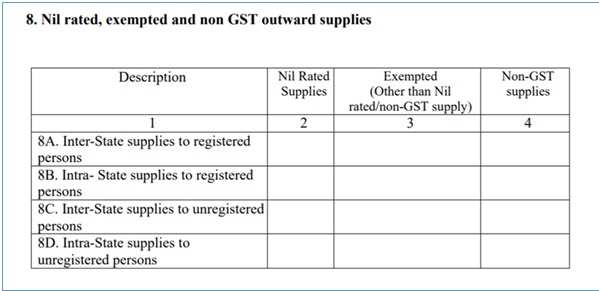

6. Details of nil rated, exempted and non GST outward supplies

In the above Table 8, you need to capture the nil rated, exempted and Non GST outward supplies made during the period. These details needs to be categorized as intra-State supplies to registered person, and inter-State supplies to unregistered person in 8A to 8D as shown in the above table.

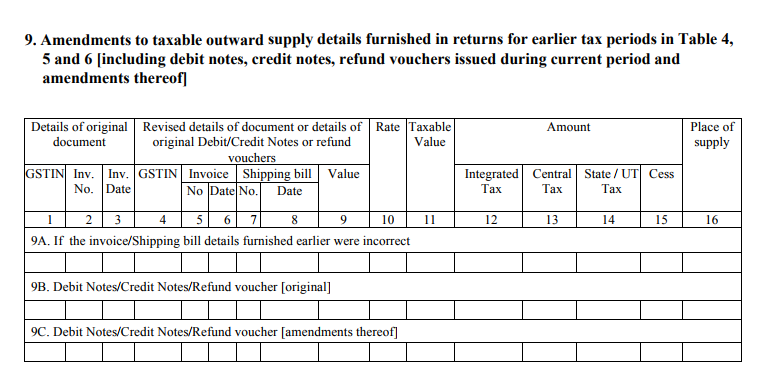

7. Details of debit notes, credit notes, refund vouchers issued during current period and any amendment to GSTR-1 filed for earlier tax periods in Table 4, 5 and 6.

In the above table, you need to capture the details of debit note, credit note and refund voucher (return of advance received) issued against the supplies already reported in:

1. B2B supplies reported in Table 4,

2. B2C Large supplies reported in Table 5,

3. Supplies involving exports/SEZ unit or SEZ developer/deemed exports reported in Table 6.

These details needs to be capture rate-wise along with the original invoice number against the debit note or credit note/debit note/refund voucher issued during the return period.

In table 9A, if shipping bill number and date was not declared in your earlier returns due to non-availability, you can furnish such details pertaining to export transactions effected during earlier return as amendments. If the export transactions are related to current month, the shipping details should be entered in Table 6.

In Table 9B, rate-wise details of credit note/debit note/refund voucher issued during the return period.

In table 9A, if shipping bill number and date was not declared in your earlier returns due to non-availability, you can furnish such details pertaining to export transactions effected during earlier return as amendments. If the export transactions are related to current month, the shipping details should be entered in Table 6.

In Table 9B, rate-wise details of credit note/debit note/refund voucher issued during the return period need to be captured and in table 9C, the details of amendments made through credit note/debit note/refund voucher against the invoice/advance receipt pertaining to pervious return period.

Also, any debit/credit note pertaining to invoices issued before the appointed day must also to be reported in this table.

8. Details of debit note and credit note issued to unregistered person

In the above table, you need to capture the consolidated rate-wise details of debit note/credit note issued against the intra-State supplies made to unregistered person and inter-State supplies having invoice value less than Rs. 2.5 Lakhs made to unregistered person in previous return period. This is an amendment to the details declared in Table 7 of earlier return. In Table 10A and 10B, you need to capture the rate-wise details of intra-State supplies and inter-State supplies respectively.

Out of the value captured in table 10A and 10B, you need to separately capture the details of supplies made through e-commerce operator in 10A (1) for intra-State and 10B (1) for inter-State supplies.

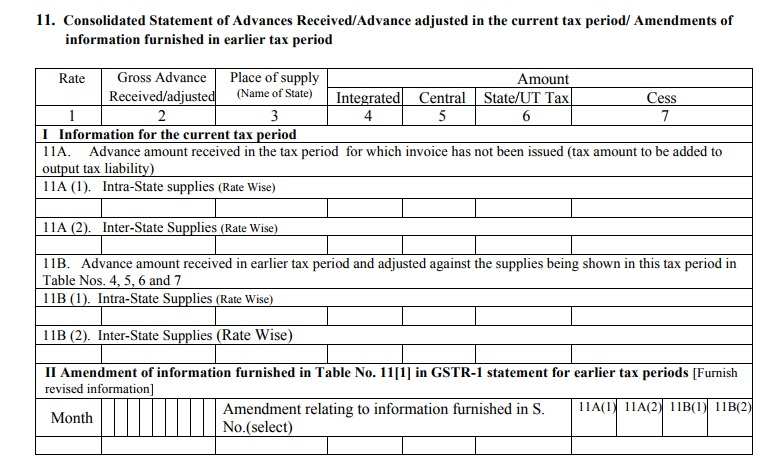

9. Details of Advances Received/Advance adjusted in the current tax period or Amendment to GSTR-1 furnished in earlier tax period

In the above table 11, you need to provide consolidated state-wise and rate-wise details related to advances received in the current period, and also the details of advances received in earlier period but adjusted in the current period. In Table 11A, capture the details of advance received for which the invoice has not been be issued. These details are need to be categorised into intra-State supplies in table 11A (1) and inter-State supplies in table 11A (2).

You also need to include information in table 11B related to adjustment of tax paid on advance received and reported in earlier tax periods against invoices issued in the current tax period. Similar to 11A, these details are also required to be categorised into intra-State supplies in Table 11B (1) and inter-State supplies in table 11B (2).

If there are any changes pertaining to details declared in table 11A to 11B in earlier return, it can be amended by furnishing the changes in Part II of Table 11 ..

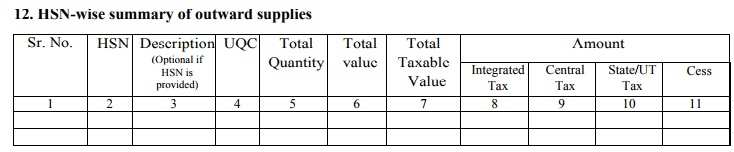

10. HSN-wise summary of outward supplies

HSN code must be reported. It will be optional for taxpayers having annual turnover up to Rs. 1.50 Crore. However, description of goods is mandatory.

HSN code at two-digit level for taxpayers having annual turnover in the preceding year above Rs. 1.5 Cr. but up to Rs. 5 Cr., and at four-digit level for taxpayers having annual turnover above Rs. 5 Cr.

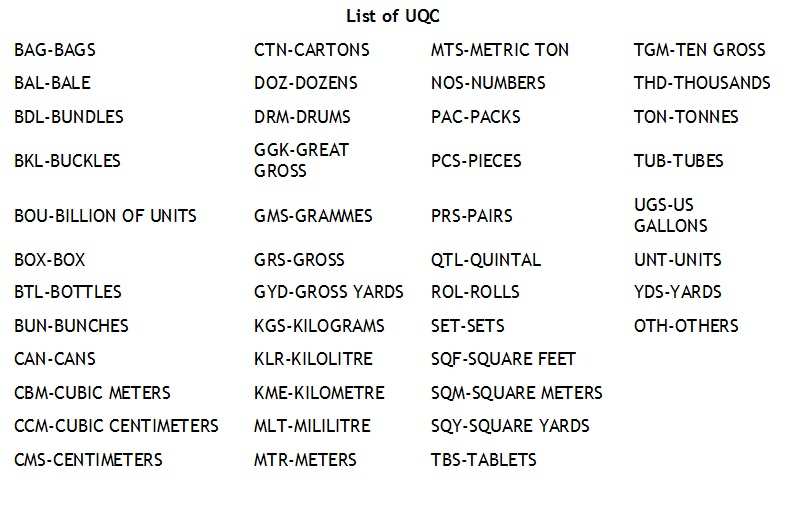

The fourth column UQC refers to unit quantity code and only the prescribed unit of measure (UOM) will be accepted by the portal.

Therefore, irrespective of the UOM maintained by the tax payer, the quantity details need to be furnished using the prescribed UQC listed below:

11. Documents issued during the tax period

In the above table, you need to capture the details of documents issued during the return, along with the starting and ending number of the document, cancelled document and net issued.

Conclusion

Broadly, details required to be captured in GSTR-1 are either invoice-wise, rate-wise, or state-wise details of outward supplies made during the month. By now, you must have got some insight about the amount of information one has to furnish in filing GSTR-1, and and also would have measured the effort and time required in doing so.

For some reason, if the returns are not filed on-time, it will have an impact on the creditability of your business. Subsequently, it will also impact your customers since ITC depends on supplier compliance. It is high time to look for a software which will ease the businesses in meeting the compliance needs.

The writer is Executive Director, Tally Solutions.

No comments:

Post a Comment